Stocks Mixed As Economic Data Floods In

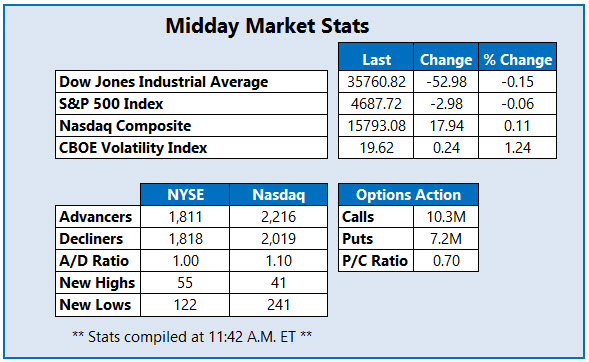

The Dow Jones Industrial Average (DJI) is down 53 points midday but has pared its triple-digit losses from the morning, as investors unpack another round of retail earnings. Also reversing their early morning deficits, the S&P 500 (SPX) is just below breakeven, while the Nasdaq Composite (IXIC) sits comfortably in the black, despite rising bond yields continuing to weigh on the tech sector.

There is a deluge of economic data to sift through today. Initial jobless claims came in at 199,000 for last week, its lowest level in over 50 years. Elsewhere, new home sales rose 0.4%, consumer spending jumped a higher-than-expected 1.3%, and U.S. personal incomes rose 0.5%.

Deere & Co (NYSE: DE) is seeing notable options activity today. The stock is jumping -- up 6.5% to trade at $371.86 at last check-- after the machinery giant scored fiscal fourth-quarter earnings beat, despite lower-than-expected revenue. So far, 22,000 calls and 9,956 puts have crossed the tape, with options volume running at six times what's typically seen at this point. The weekly 11/26 370-strike call is the most popular, with new positions being opened.

Climbing higher on the New York Stock Exchange (NYSE) today is Guess? Inc (NYSE: GES), up 13.6% to trade at $24.20 at last check. The retailer beat third-quarter earnings and revenue estimates and raised its full-year forecast, as well as doubled its quarterly dividend. Now rising to its highest level since early September, the stock is grappling with its180-day moving average.

Meanwhile, Nordstrom Inc (NYSE: JWN) is on the other end of the spectrum, down 28.2% to trade at $22.94 at last check, and earlier hit an annual low of $22.50. The retail chain reported worse-than-expected third-quarter earnings and revenue, and warned of supply shortages ahead of the holiday season. In response, Jefferies downgraded the stock to "hold" from "buy", with a price-target cut to $30 from $48, while no fewer than five other analysts slashed their price targets as well.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more