Stocks Make Record Highs: 3 Top Buys For The Next Bull Run

Image: Bigstock

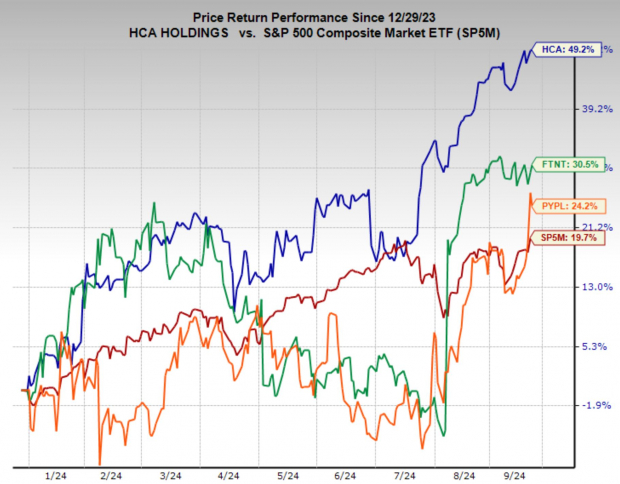

As the stock market reaches new record highs, investors are searching for the next set of winners to ride the wave of momentum into the next bull run. With a combination of strong fundamentals, top Zacks Ranks, and solid growth potential, a few stocks stand out from the crowd.

Among them are HCA Healthcare (HCA - Free Report), Fortinet (FTNT - Free Report), and PayPal (PYPL - Free Report)—with each offering investors impressive momentum and high forecasted earnings growth. In this article, we’ll explore why these three top-rated stocks are positioned to continue outperforming as the market marches higher.

Image Source: Zacks Investment Research

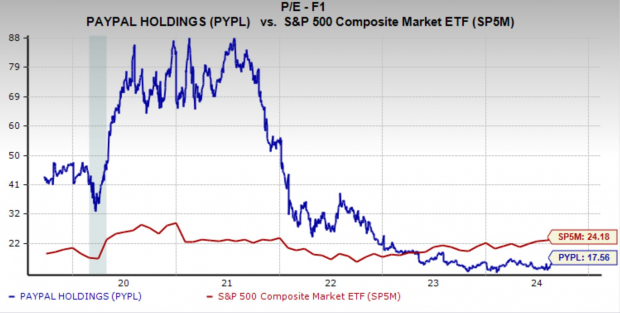

PayPal: Stock Rallies on A Unique Comeback Story

PayPal seems to be setting up for a potentially powerful rebound, offering an especially unique opportunity for investors. After being battered over the past few years—recently down 75% from its all-time high in 2021—the stock appears to have finally turned a corner. It recently broke out from a massive technical base, surging to new year-to-date and one-year highs, signaling a renewed uptrend.

Image Source: TradingView

What makes PayPal even more compelling is its top Zacks Rank #1 (Strong Buy) rating, driven by a series of upward earnings revisions. Analysts are forecasting robust earnings growth of 16% annually over the next three to five years, reflecting the company's ability to recover and expand.

Yet, despite this growth potential, PayPal was still recently seen trading at a highly attractive valuation, with a forward earnings multiple of 17.6x—well below the broader market average and significantly under its five-year median of 33.7x. This creates a rare combination of value and growth, making PayPal an enticing pick as it re-emerges as a top performer in the next bull run.

Image Source: Zacks Investment Research

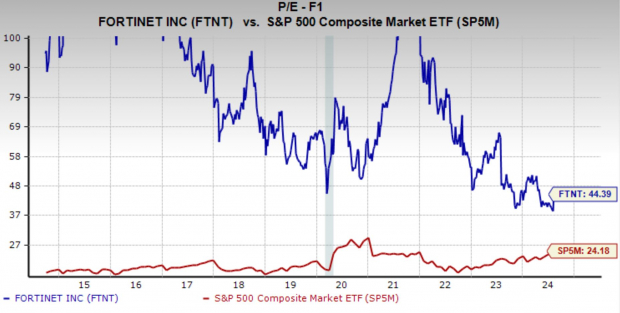

Fortinet: A Cybersecurity Stock with a Bullish Setup

Fortinet is a global leader in cybersecurity solutions, providing advanced threat protection and network security across enterprises, service providers, and government organizations.

The company’s flagship product, the FortiGate firewall, is widely recognized for its high performance and integrated approach to network security, making Fortinet a key player in defending against the increasingly complex world of cyber threats. As businesses continue to prioritize digital transformation and cloud-based services, Fortinet is positioned for long-term growth.

From a technical perspective, Fortinet’s stock recently formed a bullish flag pattern on the chart, indicating potential for a significant upward move. This setup often signals the continuation of a strong trend, and with Fortinet recently trading near breakout levels, it could be primed for further gains. Watch for a breakout above the $77 level.

Image Source: TradingView

On the fundamental side, Fortinet holds a similar Zacks Rank #1 (Strong Buy) rating, fueled by major upward revisions to earnings estimates. Analysts have boosted their projections for the current quarter by 18%, FY24 by 13%, and FY25 by 11%, reflecting growing confidence in the company’s near-term outlook.

Looking ahead, Fortinet’s earnings are expected to grow at an impressive 16.3% annually over the next three to five years, driven by continued demand for cybersecurity solutions.

Despite this growth potential, Fortinet has been trading at a forward earnings multiple of 44.4x, which is well below its 10-year median of 75.2x. This provides a compelling value proposition for a high-growth company in a crucial industry, making Fortinet an attractive buy ahead of the next bull run.

Image Source: Zacks Investment Research

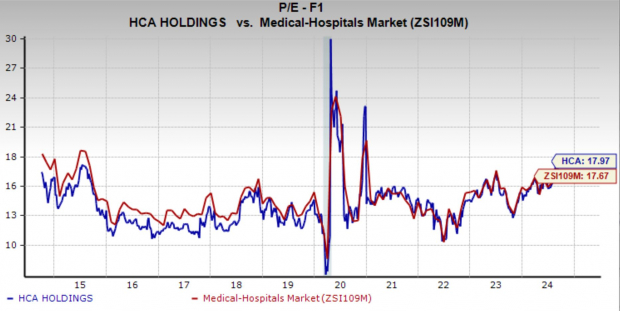

HCA Healthcare: A Healthcare Giant with Strong Momentum

HCA Healthcare is one of the largest healthcare service providers in the U.S., operating over 180 hospitals and more than 2,000 care sites across 20 states. The company plays a critical role in providing healthcare services ranging from acute care hospitals to outpatient surgery centers and urgent care clinics.

HCA’s scale, operational efficiency, and comprehensive care network make it a dominant player in the healthcare industry, well-positioned to benefit from ongoing demographic trends, including an aging population and increased healthcare spending.

HCA Healthcare is the best-performing stock in this group year-to-date, driven by strong earnings growth and robust operational performance. Despite its stellar run, the stock can still offer a reasonable valuation at 18x forward earnings. While this is higher than its 10-year median of 13.5x, it remains in line with the industry average, suggesting there’s still room for the stock to run given its fundamentals.

Image Source: Zacks Investment Research

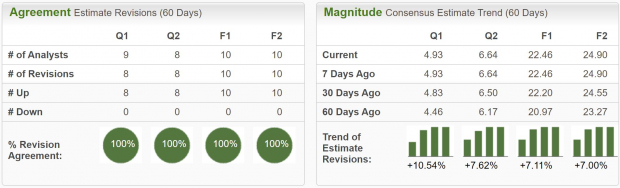

The company’s Zacks Rank #2 (Buy) rating further solidifies its investment case. Analysts have been unanimous in upgrading their earnings estimates across various timeframes, with revisions as high as 10%, reflecting confidence in HCA Healthcare’s ability to continue outperforming. With strong momentum and solid earnings growth, HCA Healthcare remains an attractive option for investors looking to capitalize on the next bull run in the market.

Image Source: Zacks Investment Research

Should Investors Buy PayPal, Fortinet, and HCA Healthcare Shares?

As the stock market continues to hit record highs, finding stocks that not only benefit from the current momentum, but also offer strong growth prospects will become crucial. PayPal, Fortinet, and HCA Healthcare all present compelling cases for investors looking to ride the next bull run.

PayPal stands out as a unique rebound opportunity, having been beaten down significantly but recently showing signs of a powerful recovery with solid growth potential and an attractive valuation. Fortinet offers a combination of strong technical momentum and fundamental growth, underpinned by the rising demand for cybersecurity solutions. Finally, HCA Healthcare remains a top performer with a proven track record and a favorable industry backdrop, presenting a solid investment option in the healthcare space.

With all three stocks carrying favorable Zacks Rank ratings and upward earnings revisions, they are well-positioned to continue outperforming as the market marches higher. Whether you’re looking for value, growth, or a technical breakout, these stocks could provide a strong foundation for participating in the next bull run.

Investors seeking to capitalize on market momentum should consider adding PayPal, Fortinet, and HCA Healthcare to their watchlist.

More By This Author:

Post-Fed Rate Cut: Buy, Hold, Or Sell Nvidia Stock?Buy 3 High Dividend-Paying Stocks With Attractive Short-Term Returns

Solar Stocks Rally After Presidential Debate: Should Investors Give Chase?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more