Stocks Lower Ahead Of Fed Rate Decision

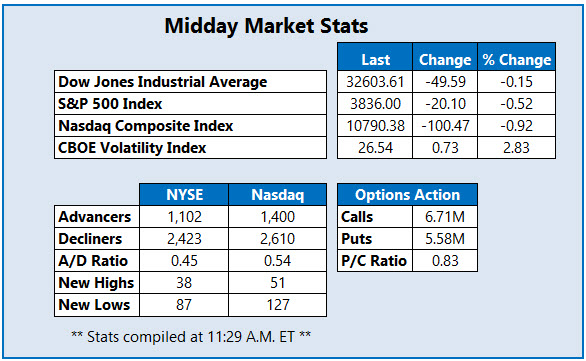

Stocks are lower midday, as Wall Street prepares for the conclusion of the U.S. Federal Reserve's policy meeting, in which a 0.75 percentage point rate increase is expected. The Nasdaq Composite (IXIC) is down triple digits, while the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are more modestly in the red. Meanwhile, today's ADP employment data is solidifying the labor market's strength, following yesterday's strong job openings data.

Airbnb Inc (Nasdaq: ABNB) is seeing a surge of volume in the options pits today. Despite upbeat third-quarter results, the stock's lowered current-quarter forecast is weighing on the shares, and ABNB is down 9% at $99.20 at last look. So far, 72,000 calls and 74,000 puts have crossed the tape. The weekly 11/4 115-strike call is the most active, with new positions being opened there. Analysts are chiming in as well, with no fewer than nine price-target cuts after the event. On the charts, ABNB's 150-day moving average has been keeping a lid on rallies.

Benefitfocus Inc (Nasdaq: BNFT) is at the top of the Nasdaq today, up 47.7% at $10.32 at last glance, following news that Voya Financial (VOYA) will buy the company for an all-cash deal valued at roughly $570 million, or $10.50 per share. In response, Piper Sandler raised its price target to $10.50 from $6. Year-to-date, the equity is still currently down 3.1%.

Conversely, Rogers Corp (Nasdaq: ROG) is at the bottom of the Nasdaq after a scrapped buyout deal. DuPont De Nemours Inc (DD) pulled out of its $5.2 billion buyout of the semiconductor name, citing regulatory hurdles in China. ROG is down 44.6% at $127.01 at last check, and sports a 53.3% year-to-date deficit.

More By This Author:

Fed Fatigue Wears On Stocks To Start November

Investors Wary Of Potential Fed Response To Resilient Labor Market

Dow Marks Best Month In Over 45 Years