Stocks Keep Falling As VIX Charges Higher

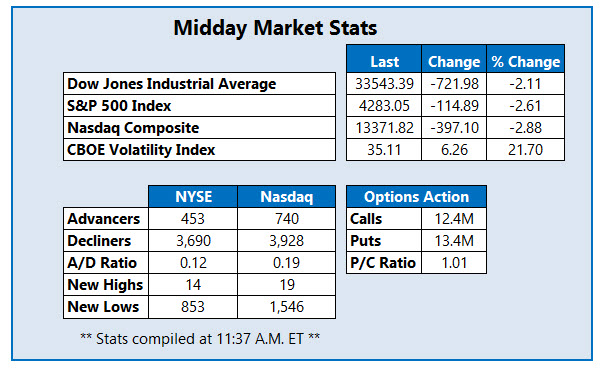

Stocks are crumbling midday, as investors continue to fret over the Federal Reserve's two-day policy meeting that kicks off tomorrow. The Dow Jones Industrial Average (DJI) has shed 722 points at last check, while the S&P 500 Index (SPX) is also firmly in the red as its pullback surpasses 10% and enters the dreaded "correction territory."

The Nasdaq Composite (IXIC) is sinking deeper into correction territory as well, ahead of a slew of Big Tech earnings reports. Meanwhile, Wall Street's fear gauge, the Cboe Volatility Index (VIX), has surged past 30 to its highest level since November 2020.

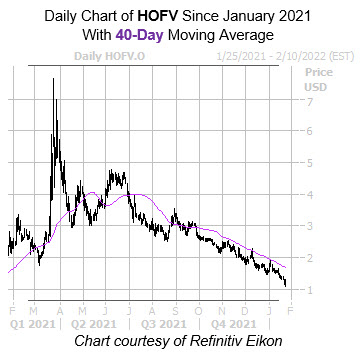

Hall of Fame Resort & Entertainment Co (Nasdaq: HOFV) is seeing an influx of call activity today. So far, 26,000 calls have been exchanged, which is 54 times the average intraday amount. Most popular by far is the February 2.50 call, followed by the March 2.50 call, with new positions being opened at both. HOFV was last seen up 11% to trade at $1.26, after earlier dropping to an annual low of $1.10, though a reason for this price action was not clear. Long-time overhead pressure remains at the 40-day moving average, though.

ShiftPixy Inc (Nasdaq: PIXY) is one of the best stocks on the Nasdaq, last seen up 30.7% to trade at $1.62. Today's bull gap came after the company announced it is now developing a non-fungible token (NFT) gamification loyalty program to be released this year, as it prepares to launch its Ghost Kitchen food brands. PIXY last week surged to its highest trading level since August, bouncing from a Dec. 6, all-time low of 63 cents.

One of the worst stocks on the Nasdaq today, meanwhile, is ReTo Eco-Solutions Inc (Nasdaq: RETO), down 47.5% at 91 cents at last check, though there was no apparent catalyst for this bear gap. RETO has been volatile of late, rallying to the $2.70 level on Friday before plummeting to its lowest trading level since early December today. Quarter-to-date, the security has already shed more than 48%.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more