Stocks Eye Daily, Weekly Drops As Omicron Variant Spreads

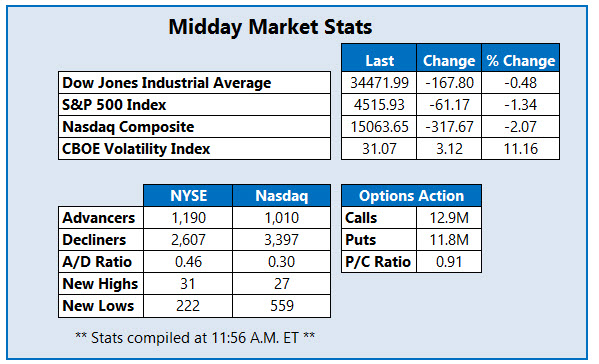

This morning's rally was short-lived. The major indexes are headed toward both daily and weekly losses at midday, as new cases of the Covid-19 omicron variant continue to pop up across the globe. The Dow Jones Industrial Average (DJI) is down 167 points, while the S&P 500 (SPX) and Nasdaq Composite (IXIC) are both swimming in red ink as well.

It's been a volatile week for reopening stocks, which are struggling once again today. News that Chinese ride-sharing giant Didi Global (DIDI) will be delisting from the New York Stock Exchange (NYSE) is also weighing on the market. In terms of economic indicators, nonfarm payrolls showed a worse-than-expected 210,000 jobs added in November, while the unemployment rate fell below analysts' estimates to 4.2%.

Upstart Holdings Inc (Nasdaq: UPST) is seeing an uptick in bullish options activity today, with volume running at nearly double the intraday average. So far, 35,000 calls have exchanged hands, compared to 16,000 puts. Most popular is the weekly 12/3 190-strike call, which expires later today, followed by the 200-strike call in that same series, with new positions being opened at both. UPST is down 2.4% at $172.80 at last check, struggling to find its footing at the newly formed 200-day moving average. The stock is up 324.2% in 2021.

One of the best stocks on the Nasdaq today is Celyad Oncology ADR (Nasdaq: CYAD), last seen up 44.6% at $5.15 after the company signed an agreement with Fortress Investment Group for a private placement worth $32.5 million, or 6.5 million ordinary shares at $5 each. CYAD hit a five-month high earlier today and is now pacing for its best day in roughly three years, though it still sports a 32.7% year-to-date deficit.

Creative Medical Technology Holdings Inc (Nasdaq: CELZ) is one of the worst-performing stocks on the Nasdaq, down 28.1% at $2.30 at last glace. Weighing on the security is news that the firm announced an underwritten public offering of 3.87 million shares priced at $4.13 per share. CELZ is down 83.4% year-to-date, and is eyeing its lowest close in nearly one year.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more