Stocks Extend Gains, Weekly Wins In Sight

Stocks are extending this morning's gains, with the Dow Jones Industrial Average (DJI) last seen up 317 points. Both the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are firmly in the black as well, as all three major benchmarks look to string together a third-straight win and snap three-week losing streaks. Investors appear to be brushing off Federal Reserve Chairman Jerome Powell's promise to fight inflation “until the job is done", with the Cboe Volatility Index (VIX) earlier slipping to its lowest level in two weeks.

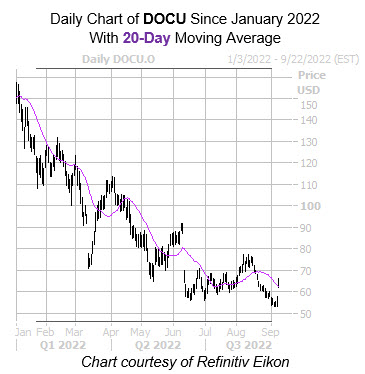

DocuSign Inc (Nasdaq: LYFT) is up 8.4% to trade at $62.83 at last check, while also getting blasted in the options pits. So far, 60,000 calls and 63,000 puts have crossed the tape, volume that's eight times the average intraday amount. Most popular is the 9/9 65-strike call, followed by the 66-strike call in the same weekly series, with new positions being opened at both. The software company posted a second-quarter earnings and revenue beat last night, and this morning received two price-target hikes and fresh coverage from J.P. Morgan Securities, which assumed a "neutral" rating and $65 price target. DOCU is set to topple overhead pressure at the 20-day moving average for the first time since mid-August.

Among the top gainers on the Nasdaq today is Zscaler Inc (Nasdaq: ZS), last seen up 18% to trade at $182. Tailwinds are blowing for the cloud company after a fourth-quarter earnings and revenue beat, accompanied by a strong fiscal 2023 outlook. In response, no fewer than 10 issued price-target hikes, with a lofty one coming from Needham to $210 from $185. Meanwhile, Credit Suisse cut its price objective to $275 from $310. ZS is still down 42.5% in 2022.

Towards the opposite of the Nasdaq is Immunocore Holdings PLC (Nasdaq: IMCR), last seen down 13.8% at $49.51. Today's bear gap comes after the company's Phase 1 data for its T cell receptor immunotherapy IMC-F106C to treat solid tumors was linked to cytokine release syndrome (CRS). The shares earlier fell to their lowest level since July, after nearly scoring a fresh record high yesterday. Year-over-year, IMCR still sports a 58.7% lead.

More By This Author:

Stocks Snap Losing Streaks; Log Best Day In Weeks

Dow Up 249 Points, Nasdaq Set To Snap Skid

Nasdaq Marks Longest Losing Streak Since 2016