Stocks Decline, More May Be Coming

We’ve reached a very critical juncture in the markets. Last week, I mentioned how this reminded me of the Q4 2018 pullback (read my story here), and still maintain that there is way too much complacency in this market. Stock markets are risky for a reason, something many Robinhood traders are sure to find out this year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth. Hopefully, you’ll find the below enlightening from my perspective, and I welcome your thoughts and questions.

Stocks closed the week with their first weekly declines in nearly a month.

The pullbacks weren't anything astronomical, but it could potentially be the start of the Q1 declines that I have been predicting.

For one, valuations are insane, and the tech IPO market is looking like clown school. The S&P 500 is trading near its highest forward P/E ratio since 2000, while the Russell 2000 has never traded this high above its 200-day moving average.

Signs are starting to point towards the return of inflation by mid-year as well. As the 10-year yield ticked up to its highest level since March, economist Mohammed El-Erian said “if we were to see another 20 basis point move in yields, that would be bad news.”

Expectations haven’t been this high for inflation in years either. According to Edward Jones, the 10-year breakeven rate hit its highest level since 2018 last week due to rising commodity prices, a weaker dollar, and broad stimulus policy. The 10-year breakeven rate is a market-based measure of inflation expectations.

What’s also concerning is that investors didn’t seem to bat an eye at Joe Biden’s $1.9 trillion stimulus package!

What does this tell me?

That maybe this was anticipated and priced in already. According to Jim Cramer on his Mad Money show on CNBC, “When an event occurs and the market gets exactly what it wants, but nothing more, it’s treated as a reason to sell, not to buy.”

Although this week's decline was moderate, I still feel that a correction between now and the end of Q1 2020 is likely amidst a tug of war between good news and bad news.

Generally, corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). The last time we saw one was in March 2020, so we could be well overdue.

Corrections are healthy market behavior and could be an excellent buying opportunity for what should be a great second half of the year.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

I hope everyone has a great day. Best of luck, and happy trading!

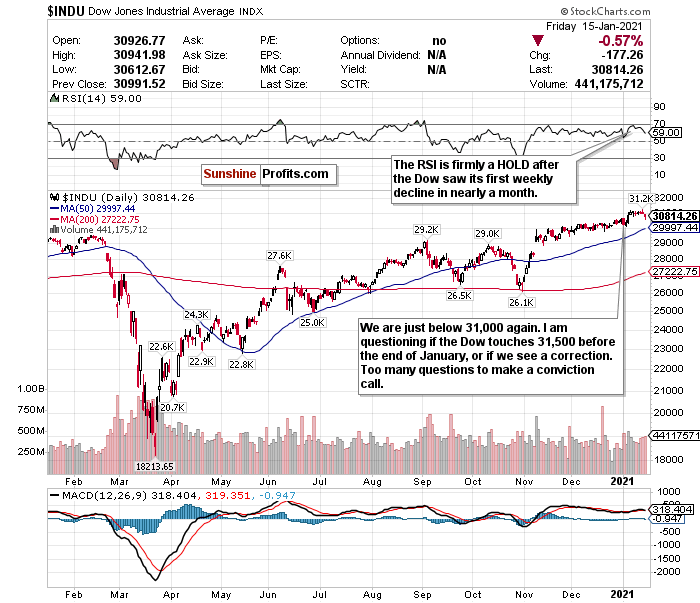

Time to Wager - Is the Dow Over/Under 31,000 Before the End of January?

(Click on image to enlarge)

Figure 1- Dow Jones Industrial Average $INDU

Is it possible to choose "push" on this gamble?

I have too many short-term questions and concerns about the Dow Jones to unequivocally say it's overheated like the Russell or tech IPOs, or if it's at the right buying level.

Although the Dow's RSI is comparable to the Nasdaq's on the surface, it has also not exceeded overbought levels as much.

I do like the Dow's decline this week. But I'd like to see a more profound dip before buying back in.

If someone wanted to make an over/under bet with me on the Dow's 31,000 level by the end of January, the truth is I'd probably choose "push." You'd have better luck betting on the AFC Championship game this year (but only if Mahomes plays).

I don't like how COVID-19 is trending (who does?), I am disappointed in the vaccine roll-out (although it's improving), and I am concerned about short-term economic and political headwinds. But I think it's more likely than not that the Dow hovers around 31,000 by month's end rather than make any significant move upwards or downwards. It is very hard right now to make a conviction call on this index.

If and when there is a drop in the index, it probably won't be anything like we saw back in March 2020.

While a 35,000 call to close out 2021 is a bit aggressive, the second half of 2021 could show robust gains for the index once vaccines are available to the general public.

With so much uncertainty, the call on the Dow stays a HOLD. I am closely monitoring the RSI if it exceeds 70.

For an ETF that looks to directly correlate with the Dow's performance, the SPDR Dow Jones ETF (DIA) is a strong option.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more

Enjoyed this, thanks. Added you to my authors to follow list.

@[Kurt Benson](user:5050) thank you sir!

Thanks Matthew!

@[Adam Sundler](user:121109) You got it