Stock Profile - Texas Instruments (TXN)

Texas Instruments is the world's largest analog chipmaker and a key supplier of embedded chips for a wide range of industrial, automotive, personal electronics, communications, and enterprise systems applications. Its 80,000 products are integral to almost every type of electronic equipment manufactured by more than 100,000 customers. With 15 manufacturing sites worldwide, Texas Instruments produces tens of billions of chips annually generating $18.34 billion in revenues in 2021.

Global Leader

Texas Instruments (TXN) traces its roots to Geophysical Service, Inc., a petroleum exploration firm founded in 1930. Headquartered in Dallas, Geophysical Service developed an innovative technique for oil exploration which used underground sound waves to find and map areas most likely to yield oil. During WW II, the company pivoted to military electronics which sparked its pioneering position in transitioning the world from vacuum tubes to transistors and then to integrated circuits. Today, Texas Instruments (TI) boasts a diverse product portfolio of semiconductors used in almost every type of electronic equipment to convert and amplify signals, manage power, process data, connect wirelessly, cancel noise and improve signal resolution.

The company operates through two segments, Analog and Embedded Processing. TI’s Analog semiconductors (77% of 2021 revenue) convert real world signals like sound, temperature, pressure and images into digital data. Embedded Processors (17% of 2021 revenue), dubbed the “digital brains” for many types of electronic equipment, are optimized for a range of products of varying complexity from simple low-cost microcontrollers used in the likes of electronic toothbrushes to highly specialized, complex devices such as motor control. In 2021, 41% of TI’s sales came from industrial markets, 21% from automotive, 24% from personal electronics, 6% each from communications equipment and enterprise systems and 2% from other products.

TI’s business model is built around the following four sustainable competitive advantages: manufacturing and technology capabilities with low costs and supply chain control; a broad product portfolio; a broad reach of markets; and diversity and longevity of products, markets and customer positions. Together, these competitive advantages enable TI to generate and return significant amounts of cash to shareholders. All of the firm’s investments are made to strengthen and leverage these advantages over the long term.

Profitable Growth

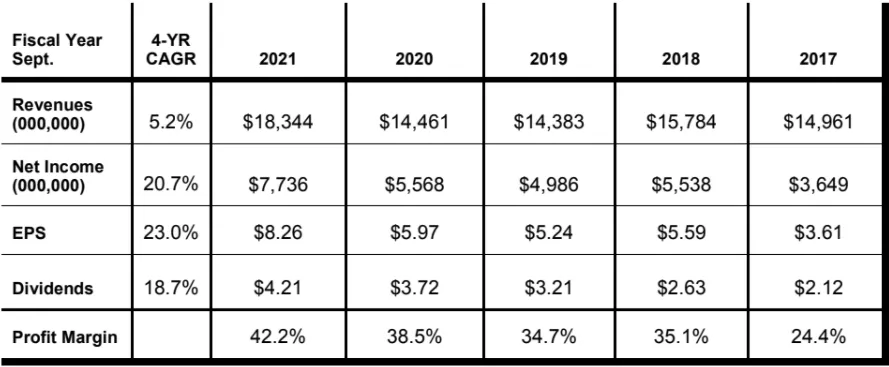

Texas Instruments generated healthy growth during the past five years with revenues compounding at a 5% annual rate as net income grew 21% annually and EPS increased at a 23% rate with fewer shares outstanding. For fiscal 2021, Texas Instruments’ revenue rose 27% to $18.3 billion, driven by broad-based demand with net income jumping 39% to $7.7 billion and EPS up 38% to $8.26. During 2021, TI generated an impressive 58.0% return on shareholders’ equity and ended the year with more than $9.7 billion in cash and investments and $7.2 billion in long-term debt on its sturdy balance sheet.

(Click on image to enlarge)

Robust Cashflows

TI’s leadership team prides itself on acting like long-term owners and believes that growing free cash flow per share is the primary driver of value. During 2021, TI generated $8.8 billion in operating cash flow, up 40% from last year. Capital expenditures jumped from $649 million last year to $2.5 billion, or 13% of revenue, as the company executes a multi-year plan to strengthen its competitive position and support growth for the next 10 to 15 years. To that end, TI expects to invest $3.5 billion annually through 2025 to build three additional U.S. plants to manufacture chips built on 300-millimeter wafers that cost 40% less than 200-millimeter wafers.

During 2021, TI generated free cash flow per share of $6.82, up 14.3% from last year, with free cash flow per share growing at a 12% average annual clip since 2004. With this robust cash flow, TI has rewarded shareholders with 18 consecutive years of dividend increases, including a 13% increase last quarter, which brought the current dividend yield to a generous 2.7%. Since 2004, TI has reduced its share count by 46% through repurchases done only when shares sell at a discount to intrinsic value. At year end, $10.1 billion remained authorized for future share repurchases after TI spent $527 million on buybacks in 2021. In total, TI returned 70% of free cash flow to investors in 2021. Long term investors should consider chipping Texas Instruments into their portfolios, a high-quality global leader with profitable growth and robust free cash flows. Buy.

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more