Stock Profile: Booking Holdings

Booking Holdings (BKNG) is the world leader in online travel and related services provided to customers and partners in over 220 countries through six primary brands - Booking.com, priceline.com, KAYAK, agoda.com, rentalcars.com, and OpenTable. Booking Holdings helps people experience the world by providing consumers, travel service providers, and restaurants with leading travel and restaurant reservation and related services.

Photo by Brands&People on Unsplash

Strong Brands

Booking Holdings was launched in 1998 in the U.S. under the priceline.com brand. Since then, the operations have expanded to include other strong travel-related brands, including Booking.com, agoda.com, rentalcars.com, KAYAK and OpenTable.

Booking.com is available in 40 languages and is the most profitable and largest online accommodation reservation service in the world with more than 2.3 million properties in more than 220 countries, including 432,000 hotels, motels and resorts and 1.9 million homes, apartments and other unique places to stay. Agoda.com is a leading online accommodation reservation service catering primarily to consumers in the Asia-Pacific region.

Rentalcars.com is a multinational car hire service, offering its reservation services in over 54,000 locations, including more than 1,100 airports throughout the world.

Priceline.com offers leisure travelers, primarily in the U.S., multiple ways to save on airline tickets, hotel rooms, car rentals, vacation packages and cruises.

KAYAK, acquired in 2013, is a leading travel research site allowing people to easily compare hundreds of travel sites when searching for flights, hotels and rental cars. OpenTable, acquired in 2014, is a leading brand for booking online restaurant reservations. OpenTable primarily does business in the United States with plans to expand internationally.

Impact Of The Pandemic

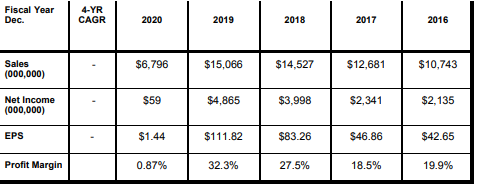

The COVID-19 pandemic, as well as subsequent outbreaks driven by new variants of COVID-19, resulted in a significant decrease in consumer spending and an unprecedented decline in travel and restaurant activities due to government restrictions and economic conditions. This, obviously, had a material adverse impact on Booking’s financial results last year as seen in the table above. Substantial restructuring and impairment charges also negatively impacted results. This prompted us to cancel our reservation and sell our position in Booking last year given all the uncertainty around the pandemic and its impact on the travel business.

We continued to monitor the company’s efforts in navigating through the travel crisis. Booking Holdings reported better than expected booking growth in the 2021 second quarter as there were strong signs of recovery in the travel industry due to increased vaccination rates and the relaxation of many travel restrictions. Revenues in the second quarter increased 243% to $2.2 billion. Second-quarter gross bookings traveled 852% higher over the prior year to $21.9 billion. Room nights booked increased 461% to 157 million although the company still posted a loss related to COVID.

Management is expecting third quarter revenues to be much more aligned with 2019 pre-pandemic levels with the company expected to report an operating profit once again in the third quarter. However, there is still uncertainty for the near-term due to the Delta variant and potential future travel restrictions. However, management is very confident about the return of long-term growth for global travel. We agree and have decided to book an early reservation by re-establishing a position in Booking Holdings with the expectation that the worst of the pandemic’s impact on the company is behind them.

Strong Cash Flow

Booking Holdings’ business is not capital intensive and thus generates very strong free cash flow. During the first half of the year, the company generated $821 million in free cash flow, compared to a negative $408 million in the prior-year period as a result of the pandemic. Thanks to the strong cash flow, the company ended the 6-30-2021 quarter with more than $11.7 billion in cash and investments on its hospitable balance sheet, after spending $150 million on share repurchases during the first half of the year.

During the past five years, Booking Holdings has generated over $17 billion in free cash flow and has returned over $18 billion to shareholders via share repurchases.

Long-term investors should consider booking a reservation with Booking Holdings, a high-quality company with strong brands, strong cash flows and strong future growth. Buy.

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more