Stock Pickers: Hope Springs Eternal

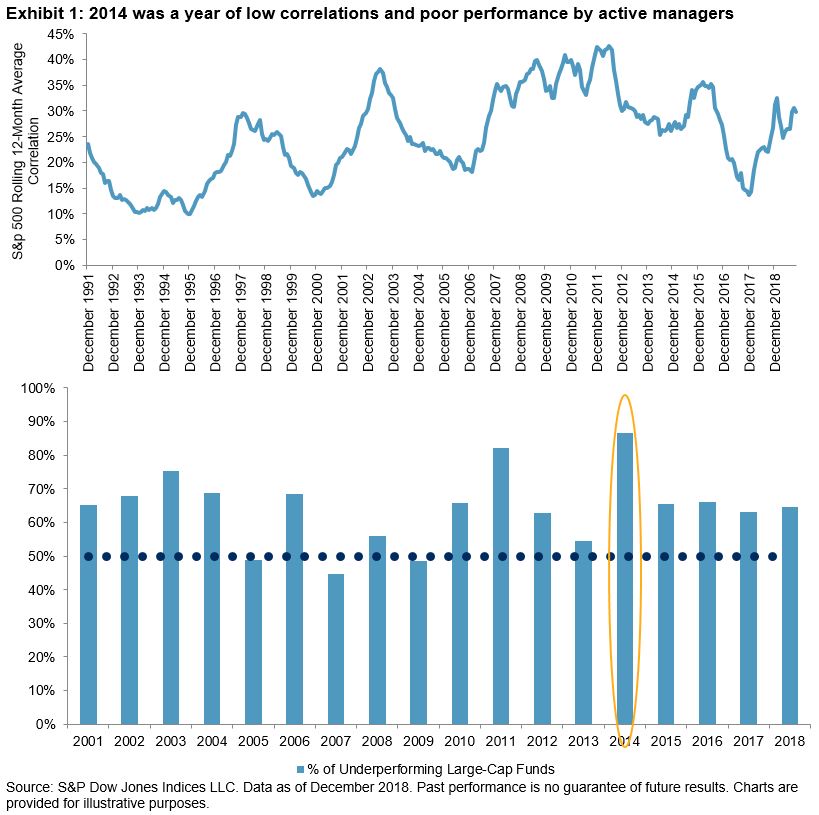

The Wall Street Journal recently quoted several active managers who claim that “conditions for stock picking are improving”. Their rationale is that declining correlations among stocks in the S&P 500 have made it easier for active managers to select stocks based on fundamental analysis.

We have heard this argument before, most notably in 2014 when, as Exhibit 1 demonstrates, correlations had fallen substantially from their financial crisis peak. But 2014 was also a year of record underperformance by active managers, as our SPIVA scorecards demonstrate. As we have argued previously, this is because dispersion, not correlation is the appropriate metric with which to measure the prospective success of stock pickers.

(Click on image to enlarge)

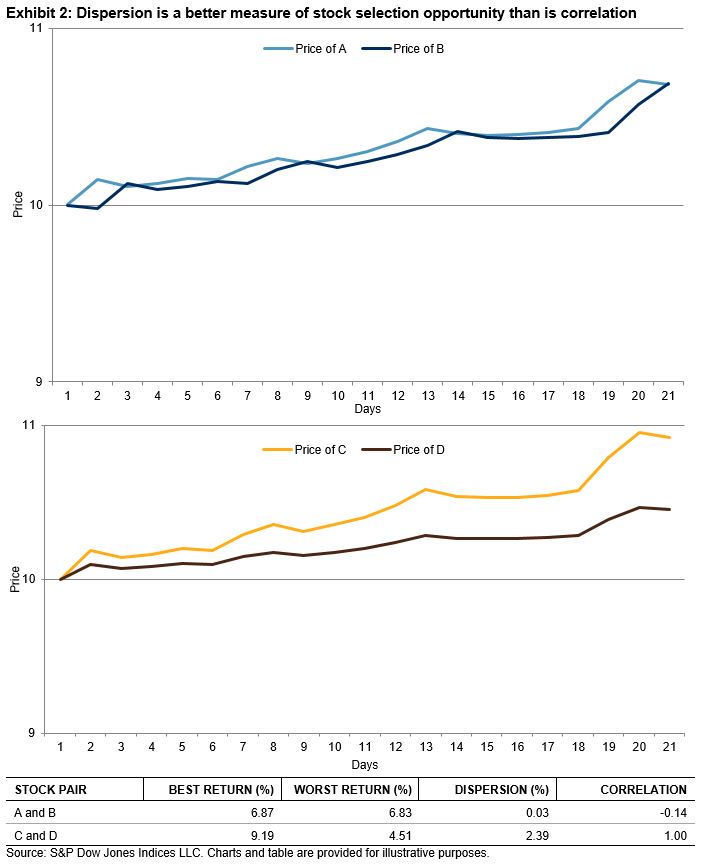

Correlation is a vital tool in analyzing portfolio diversification, but it is dispersion, or cross-sectional portfolio volatility, that offers a more meaningful way to identify opportunities for active management.Exhibit 2 offers a simple illustration that demonstrates this point:

Compare stock pairs A and B versus C and D. Both pairs have an average return of 6.85%, but it’s obvious that an active manager who can choose between C and D can add more value than her competitor who chooses between A and B. And yet – the correlation of A and B is negative, while the correlation of C and D is 1.0. Dispersion, not correlation, determines the value-added potential of active managers.

Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information ...

more