Stock Momentum Persists Amid Overwhelming Expectations For Fed Rate Cut

Investors remain optimistic that the Fed has wrapped up its rate-hiking regime and that the economy is on track for a soft landing.

If we look at market pricing, investors are expecting a benign set of circumstances in 2024. Both the Fed and the ECB are seen cutting rates in Q2. Bond yields cooled substantially in November.

The 10-year Treasury yield crested above 5% to touch its highest level in 16 years in late October. This week, the benchmark note rate has slipped below 4.3%.

The October data release indicates that inflation, as measured by personal spending, rose as anticipated. The data release suggests that the Federal Reserve might be inclined to keep the existing interest rates unchanged and potentially contemplate lowering them in 2024.

The personal consumption expenditures price index, excluding food and energy prices, rose 0.2% for the month and 3.5% on a year-over-year basis, the Commerce Department reported. Both numbers aligned with the consensus and were down from respective readings of 0.3% and 3.7% in September.

Falling yields have also helped lift equities, but they have been very beneficial to rate-sensitive sectors such as technology and real estate. Indeed, the information technology sector of the S&P 500 is up 12.8% in November, followed closely by real estate, higher by 11.4%. The broad market index is on pace for an 8.5% move higher this month.

Nvidia: Supply constraints continue to make this stock attractive (NVDA)

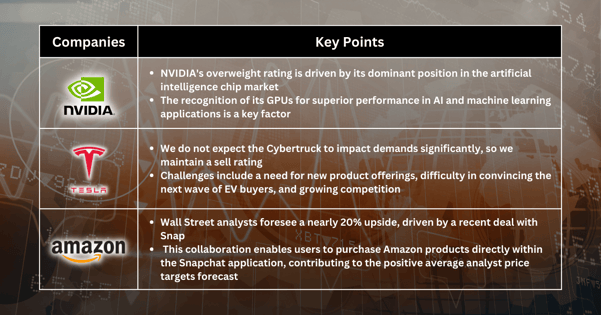

We still give the overweight rating on the dominant artificial intelligence chipmaker. While Nvidia has quickly scaled supply thus far, it remains supply-constrained and will take some time before equilibrium is reached.

Nvidia's dominant position in the artificial intelligence chip market is a key factor supporting the overweight rating. The company's GPUs (Graphics Processing Units) are widely recognized for their superior performance in AI and machine learning applications.

Tesla: Cybertruck is not a game changer (TSLA)

We remain sell-rated as we do not believe the Cybertruck meaningfully changes the demand story over the next several years, which we expect to remain challenged by a lack of new product offerings, difficulty convincing the next wave of EV buyers to drive adoption, and increasing competition.

Amazon: One of the favorite stocks owned by Wall Street (AMZN)

Average analyst price targets forecast in Wall Street nearly 20% upside from current prices. The company recently solidified a deal with Snap that allows users to purchase Amazon products without leaving the Snapchat application.

More By This Author:

Buy, Buy, Buy; Falling Bond Yield Drives Tech Stocks Crazy

Historic Trends Support Ongoing Stock Rally, Indicating Upside Potential

Nvidia Earnings, FOMC Minutes To Provide Further Insights Into The Sustainability Of The Market Rally

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more