Stock Buybacks Rebound Sharply

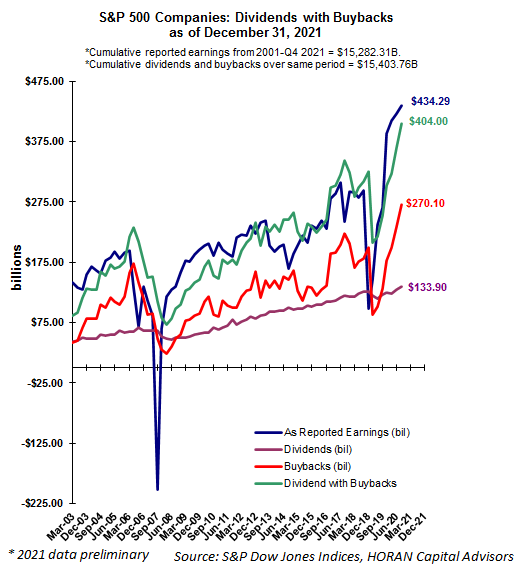

Earlier this past week, S&P Dow Jones Indices reported dividend and buyback activity for the S&P 500 Index through the end of the 2021 calendar year, and what a difference a year makes. For the fourth quarter of 2021, S&P 500 dividend payments increased 10.1% on a year-over-year basis. Buybacks in Q4 2021 more than doubled the amount in Q4 2020, $270.10 billion versus $130.52 billion, an increase of 107%.

Some buyback highlights:

- For all of 2021 Apple (AAPL) was the largest buyback participant at $88.3 billion, followed by Meta Platforms (FB) at $50.1 billion.

- The company with the largest increase in buyback dollars was Meta Platforms, with 2021 buybacks totaling $50.1 billion versus 2020 buybacks totaling just $9.8 billion.

- Berkshire Hathaway (BRK-B) once eschewed buybacks, but they were the largest buyback participant in the financial sector in 2021, buying back $27.1 billion of the company's stock, followed by Wells Fargo (WFC) at $14.7 billion.

- In evaluating the dividend and buyback results on a combined basis, the increase for Q4 2021 versus Q4 2020 was 60.2%. For the entire 2021 calendar year the combined buyback plus dividend amount increased 38.9% versus 2020. The primary driver of this increase was buybacks increasing 69.6% in 2021 versus 2020.

As an observation, investors should place more reliance on the activity around a specific company's dividend practices versus its buyback activity. As the 2020 pandemic year showed, a company facing financial headwinds can quickly stop buybacks.

Just as the pandemic economic shutdown was underway, S&P 500 Index company Q2 2020 buybacks declined by $110 billion while dividend payments were down just under $8 billion. Companies committed to maintaining a dividend that grows annually tend to be higher quality and more able to weather a tougher economic environment, and they can be better investments over the long run.

Disclosure: Firm/family long AAPL, BRK-B.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the ...

more