Still Time To Buy Coca-Cola Stock As A Defensive Hedge?

Image Source: Pixabay

The consumer staples sector typically draws interest during economic downturns as consumers buy these products regardless of economic conditions. Seeing as beverages are one of the most essential consumer items, Coca-Cola (KO - Free Report) stock is historically known to be a pleasant hedge against market volatility when economic uncertainty arises.

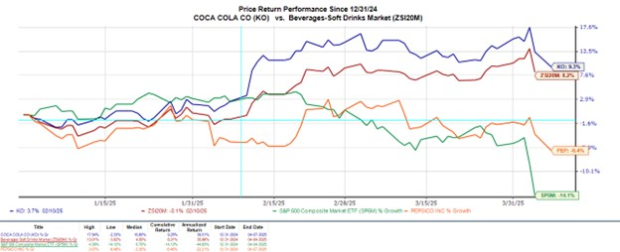

This scenario is playing out with President Trump’s “Liberation Tariffs” rocking markets over the last few trading sessions. Amid the mayhem, Coca-Cola's stock hit a 52-week peak of $73 a share last Thursday and is sitting on +9% gains this year compared to the S&P 500’s 14% decline and rival PepsiCo’s (PEP - Free Report) 6% drop.

Image Source: Zacks Investment Research

Brand Recognition & Institutional Ownership

Thanks to its global presence as one of the most recognized brands in the world, Coca-Cola’s stock has remained a primary holding of many mutual, pension, and hedge funds. Limiting panic selling that may arise from retail investors, 70% of Coca-Cola shares are owned by institutional shareholders including Berkshire Hathaway (BRK-B - Free Report), Blackrock (BLK - Free Report), and Vanguard Group.

What also helps Coca-Cola navigate more sensitive economic fluctuations is the company’s core focus on its flagship soda and other drink products as opposed to Pepsi, which has a diversified portfolio of snack products that can see demand wayward.

Dividend Reliability

While Coca-Cola and Pepsi both share the prestigious Dividend King title, it’s noteworthy that Coca-Cola still has the reliability edge. Having a current annual dividend yield of 2.92%, Coca-Cola has increased its dividend for 64 consecutive years while Pepsi has done so for 53 consecutive years.

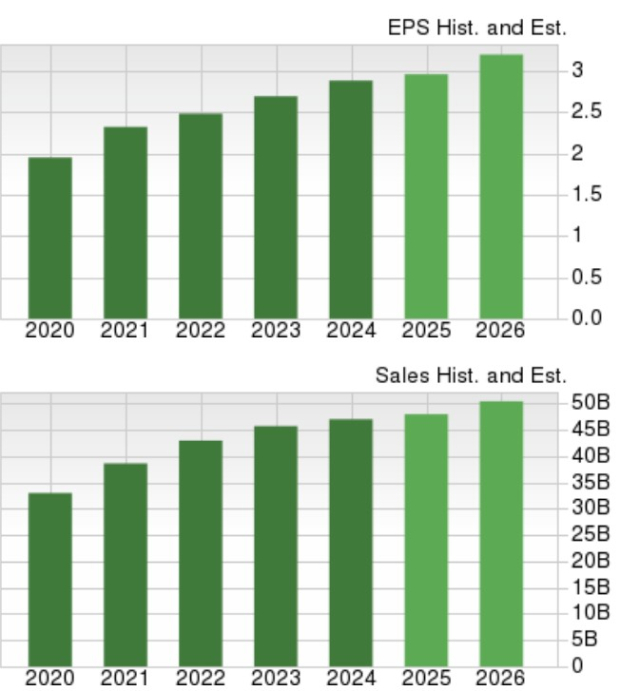

Image Source: Zacks Investment Research

Coca-Cola’s Steady Growth

Coca-Cola is expected to post 2% sales growth in fiscal 2025 with its top line projected to expand another 5% in FY26 to $50.49 billion. Furthermore, annual earnings are slated to increase by 3% this year and are projected to spike another 8% in FY26 to $3.20 per share.

Image Source: Zacks Investment Research

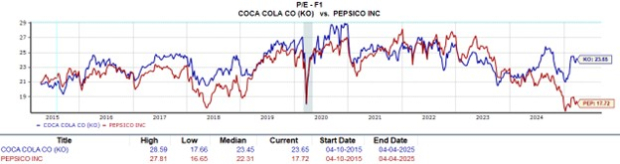

KO Valuation Comparison

Following its most recent rally, Coca-Cola stock trades at a 23.6X forward earnings multiple which is slightly above its Zacks Beverages-Soft drinks Industry average of 19.1X and Pepsi’s 17.7X. However, KO does trade beneath its decade-long high of 28.5X forward earnings and is on par with the median of 23.4X during this period.

Image Source: Zacks Investment Research

Bottom Line

For now, Coca-Cola stock lands a Zacks Rank #3 (Hold). Despite trading at a premium to its peers in terms of P/E valuation, Coca-Cola stock has lived up to the notoriety of being a reliable defensive hedge against economic uncertainty. After recently hitting 52-week peaks there could be better buying opportunities but holding KO shares may be ideal as markets adjust to the implementation of an ongoing trade war.

More By This Author:

3 International E&P Stocks To Watch In An Undervalued Industry2 Furniture Stocks To Watch Defying The Industry Downturn

3 Large-Cap Value Funds To Dodge Trade War Fears Post Trump's Tariffs

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more