Staying Cautious On Corvus Pharma IPO

Corvus Pharmaceuticals Inc. (NASDAQ:CRVS) expects to raise $67.8 million in its upcoming IPO. Based in Burlingame, California, Corvus Pharmaceuticals is a clinical stage biopharmaceutical company focused on the development and marketing of immune-based cancer treatments.

We previewed CRVS on our IPO Insights platform.

CRVS will offer 4.7 million shares at an expected price range of $15 to $17.

CRVS filed for the IPO on January 4, 2016.

Lead Underwriters: Cowen & Co., and Credit Suisse Securities

Underwriters: BTIG LLC, Cantor Fitzgerald, and Guggenheim Securities

Business Summary: Biopharmaceutical Company Developing Cancer Treatments

(Click on image to enlarge)

(Source)

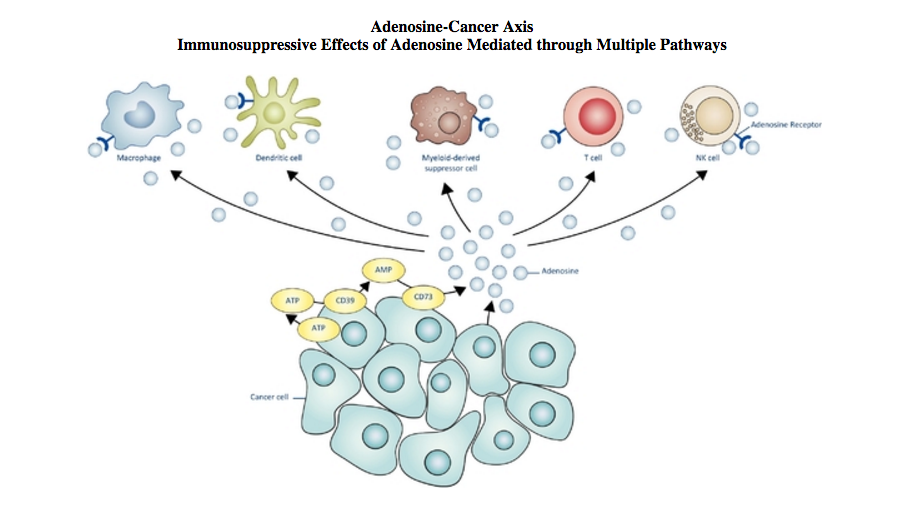

Corvus Pharmaceuticals is a clinical stage biopharmaceutical company that is developing cancer treatments designed to utilize the patient's own immune system to attack cancer cells. Its lead product candied is CPI-444, which is an oral, small molecule antagonist. The candidate is planning to initiate Phase 1/1b clinical trials for adenosine, which is an immune checkpoint.

(Click on image to enlarge)

(Source)

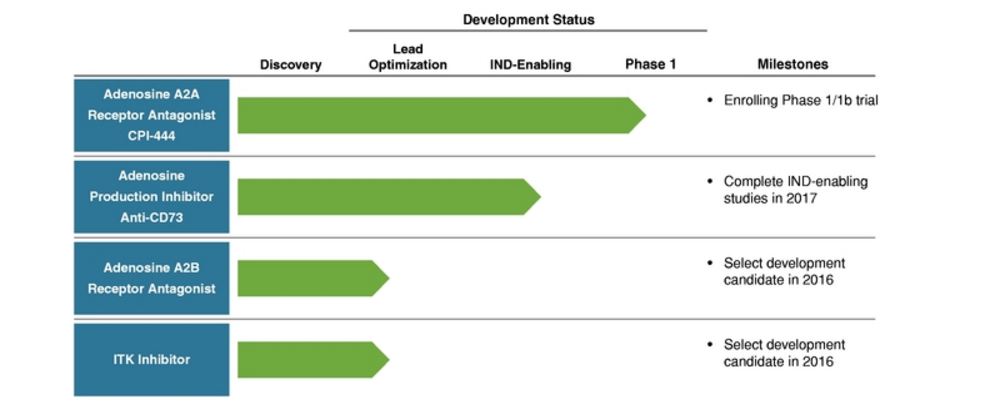

In January 2016, Corvus Pharmaceuticals began enrolling patients in an expansion trial for CPI-444, and this trial will test the safety, tolerability, efficacy and biomarkers in several types of solid tumors. The trial will investigate the drug as a single agent and in combination with an investigational cancer immunotherapy treatment by Genentech.

The company is developing immune-oncology therapies that are aimed at improving upon current immune-oncology treatments. This type of research represents a breakthrough in certain cancer treatments. Immuno-oncology therapies utilize a patient's own immune system to stop the growth of cancer cells. Patients have immune cells called T-cells that fight disease, and these cells generally recognize cancer cells as foreign and attack them. However, some cancer cells have certain capabilities to block the visibility of T-cells. Immuno-oncology therapies seek to address this issue.

Three of Corvus Pharmaceuticals programs are developing methods to disable a cancer's ability to ward off an immune system attack. This is done by inhibiting adenosine in the cancer's surrounding environment or by limiting a tumor's ability to produce adenosine. The fourth program targets the regulation of T-cell differentiation and activation.

Also in the pipeline is adenosine production inhibitor anti-CD73, adenosine A2B receptor antagonist, and ITK inhibitor. Corvus Pharmaceuticals holds worldwide rights to all of its product candidates.

Executive Management Overview

Co-founder, President and CEO Richard A. Miller, M.D. was also the founder and CEO of Pharmacyclics. Prior to that, he was a co-founder, VP and director of IDEC, which later merged with Biogen. Dr. Miller received an M.D. from the State University of New York Medical School and is currently Adjunct Clinical Professor of Medicine (Oncology) at Stanford University Medical Center.

Co-founder and EVP Joseph Buggy, Ph.D. was with Pharmacyclics from 2006 to 2013. He served as director and principal scientist at Celera Genomics from 2001 to 2006. Dr. Buggy holds a Ph.D. in Molecular, Cellular, and Development Biology from Indiana University and a B.S. in Microbiology from the University of Pittsburgh.

Potential Competition: Merck, Novartis and AstraZeneca

There are several enterprise level pharmaceutical companies developing immune-oncology therapies. These include Merck (NYSE:MRK), Kyowa Hakko Kirin Pharma in Japan, AstraZeneca (NYSE:AZN), Bristol-Myers Squibb (NYSE:BMY), Genentech, AbbVie (NYSE:ABBV), Janssen Pharmaceuticals and MedIummune LLC.

Financial Highlights:

Corvus Pharmaceuticals provided the following figures from its financial documents from January 27, 2014 (inception) to December 31, 2014 and the fiscal year ended December 31, 2015:

|

2015 |

2014 |

|

|

Revenue |

N/A |

N/A |

|

Net Income |

($31,355,000) |

($161,000) |

As of Dec. 31, 2015:

|

Assets |

$98,459,000 |

|

Total Liabilities |

$3,780,000 |

|

Stockholders' Equity |

($31,101,000) |

Conclusion: Consider Holding Off

As with many early stage pharma firms, CRVS has incurred significant losses incurred since inception; in addition, the firm relies heavily on its lead product (far from commercialization).

While we do like CRVS' focus on immuno-oncology (Similar IPOs,centered on cancer treatments, were successful in 2015.), we remain cautious overall and suggest investors be so, as well.

This follows a very sluggish IPO market in 2016, marked by the recent postponement of Spring Bank's IPO last week.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.