Starfighters Space Is Taking Off

Image Souce: Starfighters Space

Starfighters Space (FJET) is a high-growth aerospace company based at NASA's Kennedy Space Center. The company is unique because it operates the world's only commercial fleet of F-104 Starfighter supersonic jets.

(Click on image to enlarge)

On December 18, 2025, the company recently transitioned from a private, crowd-funded entity to a publicly traded company on the NYSE American exchange.

The company trades under the ticker FJET. The initial offering price was $3.59 per share, with the IPO raising $40M. The IPO was very successful, with the shares popping to $10+ just after opening and running to $14+ late December.

Core Capabilities

Starfighters Space uses modified Cold War-era F-104 jets to provide a "reusable first stage" for space launches. They are the only commercial entity capable of sustained flight at twice the speed of sound.

The company has a fleet of seven F-104 fighter jets, the only commercial fleet in the world capable of launching payloads through Starfighters STARLAUNCH program.

This program involves jets carrying small satellites to 45K feet and launching them from under the wing, which is significantly more cost-effective than traditional vertical rocket launches.

Beyond satellite delivery, they provide a platform for hypersonic research and pilot training for both government and private aerospace partners.

STARLAUNCH Program

Unlike traditional rockets that launch from the ground, the STARLAUNCH system uses a horizontal launch method. One of its F-104 jet carries a rocket-powered vehicle under its wing to an altitude of approximately 45K to 50K feet.

At supersonic speeds (Mach 2+), the jet releases the launch vehicle. By starting at this altitude and speed, the rocket avoids the densest part of the atmosphere and doesn't need to fight gravity as hard during the initial phase of flight.

The launch vehicle’s engines then ignite to carry the payload (usually small satellites) into Low Earth Orbit.

The program is being developed in two distinct phases to scale capabilities:

STARLAUNCH I involves technology demonstration and suborbital payloads. It is designed to prove the release mechanism and the integration between the F-104 and the launch vehicle. It's primarily aimed at hypersonic research, microgravity experiments, and "point-to-point" atmospheric testing for the Department of Defense (DoD).

STARLAUNCH II involves a full commercial orbital delivery through a larger, more powerful vehicle (likely to be the F-4 Phantom) designed to place SmallSats (up to 200kg) into specific orbits.

This stage is designed for launch on demand, allowing customers to put a satellite in space within days rather than the months or years typically required for rideshare missions on larger rockets like SpaceX's Falcon.

The choice of the F-4 isn't just about nostalgia; it’s a strategic technical move for the STARLAUNCH program:

- The F-4 was designed to carry over 18K lbs of weapons. This is significantly more than the F-104 Starfighter.

- These Phantoms will likely be the primary carriers for STARLAUNCH II (the orbital vehicle). The F-104 will remain the speedster for hypersonic tests, while the F-4 becomes the heavy lifter for satellites.

Advantages

The STARLAUNCH program is designed to solve three major pain points in the current space industry:

- Because the jets can take off from standard runways and fly above most weather systems before launching, they are far less likely to face weather-related delays than ground-launched rockets.

- The F-104s can operate from almost any runway with sufficient length. This allows them to launch from various locations (like Kennedy Space Center in Florida or Midland in Texas) to reach different orbtal inclinations easily.

- By reusing the F-104 as the first stage, the per-launch cost is significantly lower than expendable rocket systems.

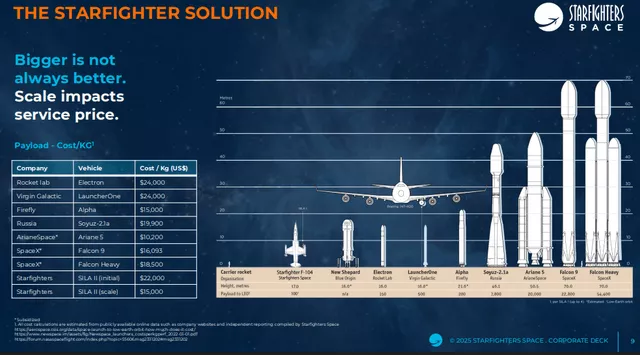

Competition

Virgin Orbit

The collapse of Virgin Orbit left a massive gap in the market for Dedicated SmallSat Launch. Most customers are now forced to "rideshare" with SpaceX, which is like taking a bus—it’s cheap, but it doesn't drop you off at your front door.

The technical difficulty of dropping a rocket at Mach 2 is immense. If Starfighters can prove their release mechanism works reliably in the upcoming 2026 tests, they could capture the customers who used to fly with Virgin Orbit but at a significantly lower operational cost.

Following the high-profile bankruptcy of Virgin Orbit in 2023, the sector has branched into two distinct directions: Heavy/Hypersonic testing and Tactical/SmallSat delivery.

Starfighters Space sits in a unique speed-focused niche compared to its primary competitors.

Stratolaunch

Stratolaunch operates the Roc, the world’s largest wingspan aircraft. While originally intended for satellites, they have pivoted almost entirely to hypersonic flight testing with their Talon-A vehicles.

Stratolaunch is like a flying laboratory for the DoD, it's much larger and more expensive to operate than Starfighters. While Starfighters uses speed (Mach 2) to help the rocket, Stratolaunch uses its massive size to carry extremely heavy payloads that FJET simply cannot lift.

Aevum

Aevum’s Ravn X is a fully autonomous, unmanned aircraft designed specifically for launch on demand, focusing on the same tactical market as Starfighters, getting a satellite up in 180 minutes or less.

Because Ravn X is a drone, it removes the risk to a human pilot (unlike the F-104 Starfighter). However, Aevum has faced several development delays, whereas Starfighters already has an active, flight-proven fleet of jets that have been flying for decades.

Dawn Aerospace

Based in New Zealand and the Netherlands, Dawn Aerospace operates the Mk-II Aurora, a rocket-powered drone. They are aiming for rapid reusability, designed to fly to the edge of space multiple times per day.

While FJET uses a jet to drop a rocket, Dawn is the rocket, although its payload capacity is currently much smaller than what STARLAUNCH II aims to achieve, focusing more on atmospheric research than orbital satellite delivery.

Market opportunity

Starfighters defines its TAM across three primary sectors: SmallSat Launch, Hypersonic Testing, and Point-to-Point Defense Logistics.

The Small Satellite Launch Market

This is the main opportunity. The shift from massive, bus-sized satellites to "constellations" of hundreds of small satellites has created a bottleneck in launch availability.

The global small satellite market is estimated to reach approximately $12B to $15B by 2030. Starfighters target the Tactical/Responsive sub-segment.

This is for customers who need to launch now (within 24–72 hours) to replace a satellite or gain immediate intelligence. This premium on-demand niche is estimated at $1B - $2B annually.

This is currently Starfighters' most stable revenue source. The DoD is in an arms race to develop hypersonic missiles and defense systems. The US government alone is spending over $6B annually on hypersonic research.

Testing hypersonic components in a lab is one thing; testing them at Mach 2+ in the actual atmosphere is another. Because they can fly sustained supersonic missions, they are one of the few commercial entities that can help the DoD fail fast and iterate on designs.

Commercial Pilot Training & Film

While smaller, this is a high-margin niche market. With the rise of private spaceflight companies (Blue Origin, SpaceX, Axiom), there is a growing need for Suborbital Pilot Training.

The F-104 is the closest thing a civilian can fly to a spacecraft. They provide high-G training and high-altitude physiological training.

The biggest challenge for FJET isn't the size of the market (which is massive and growing); it's the execution risk.

- Because they already own the jets and have a lease at the Kennedy Space Center, they have a lower cost base than startups building new planes from scratch.

- The TAM is limited by how many F-104s they have. While they have the world's largest fleet, they can only conduct a certain number of launches per year compared to a ground-based pad that can launch much larger rockets.

Starfighters is positioning itself as the Boutique/Express player in a market currently dominated by Cargo Ships (SpaceX) and Delivery Trucks (Rocket Lab).

DoD & Government Contracts

Starfighters is benefiting from the US government's urgent push for Hypersonic and Space Superiority, and it has been increasingly utilized by the AFRL (Air Force Research Laboratory) and the Space Force.

They provide captive carry flights for experimental sensors. Since traditional wind tunnels have limits, the F-104s are used as "flying laboratories" to test how materials react at Mach 2 speeds.

There is an early-stage engagement with the SDA (Space Development Agency). The SDA is building a "Proliferated Warfighter Space Architecture" (thousands of small satellites).

The SDA needs the ability to replace a satellite in 24 hours if one is shot down or fails, exactly what the STARLAUNCH program is designed to do.

Commercial Satellite Partners

While the company hasn't divulged customers (common practice in the industry), several sectors are in active talks for 2026 slots:

- Several university programs that previously used Virgin Orbit have reportedly shifted inquiries to Starfighters due to their lower price point ($2.5M - $3.5M per launch).

- Companies building "LoRaWAN" (Long Range Wide Area Network) constellations for global asset tracking are looking at Starfighters for "inclination-specific" launches. Because the jet can fly to different latitudes, it can drop a satellite into a specific orbit that a SpaceX rideshare might miss.

- Through its partnership with Space Florida (the state’s aerospace economic development agency), Starfighters has a first-look at startups coming out of the Florida tech corridor that need cheap, suborbital testing before going for full orbital missions.

Financials

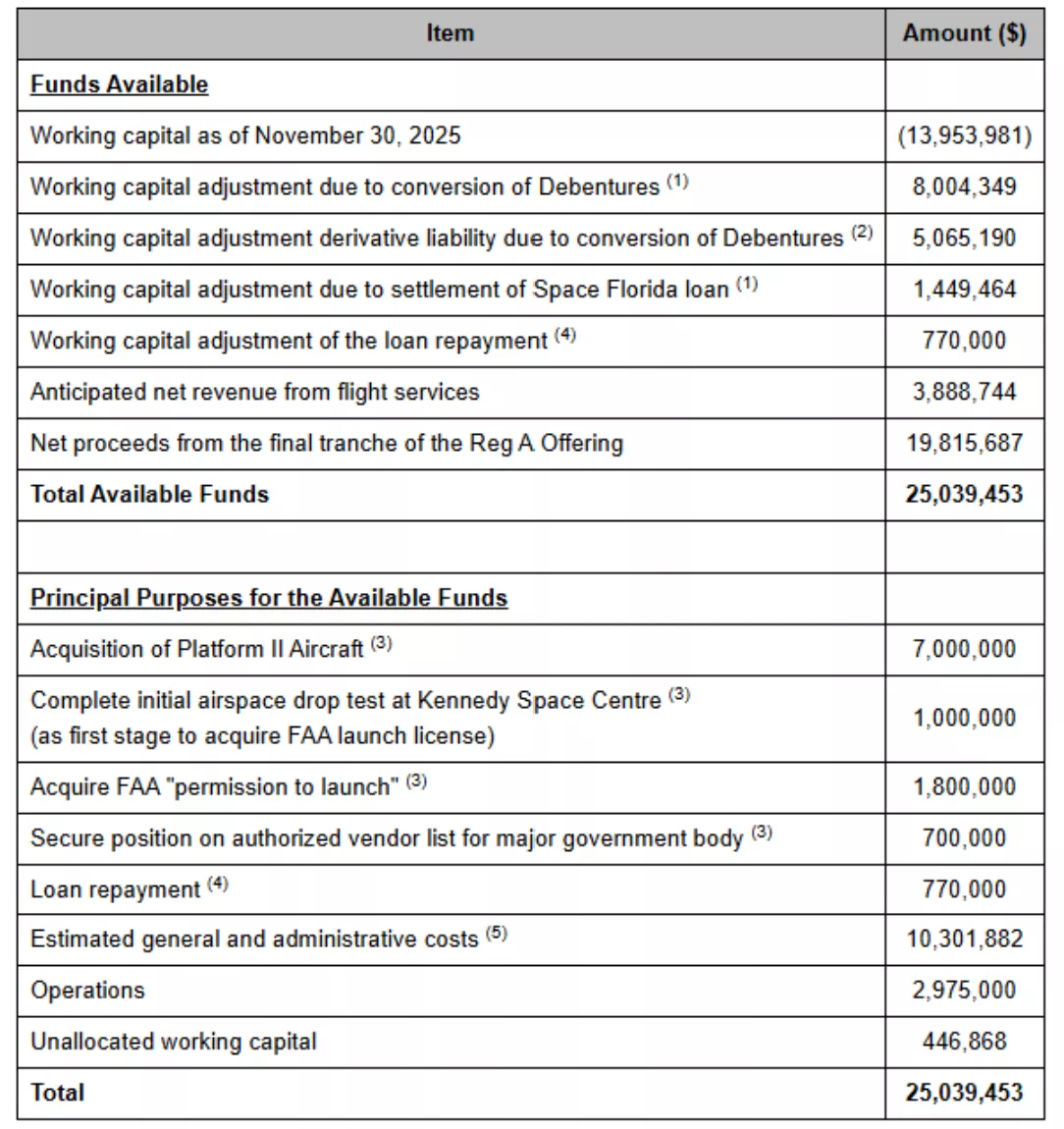

From the December 17, 2025 Prospectus:

As of the date of the prospectus, the company had $21.7M in cash, and add to that the $40M the company collected through its IPO, and they should be good for at least a year with cash, although they are going to buy quite a bit of gear as well (from the prospectus):

- To extend the life of the current fleet, the Corporation has an agreement to purchase 22 J79-19 engines from Hypersonic Group Inc.

- A major acquisition is underway to purchase twelve F-4 Phantom II aircraft, along with one MD-83 and one DC-9, from Aerovision LLC. These are intended to serve as the next generation of test and launch beds.

The sticker price of these aircraft is significantly lower than a new jet because they are being purchased as demilitarized/surplus assets, often for their airframes and specific parts rather than as turn-key combat-ready jets.

In the private/warbird market, an F-4 airframe can range from $500K to $1.5M, depending on its flight hours and engine condition (J79 engines). For 12 units, a bulk price would be in the range of $6M–$9M.

MD-83 and DC-9: These are being acquired to serve as Mother Ships or telemetry/tracking platforms. Older, high-cycle MD-80 series aircraft currently sell for scrap or "part-out" value, typically between $800K and $2M each, so we arrive at a total value in the $8M–$13M range.

That might not be all. The prospectus notes that the company will need to invest in:

- Demilitarization and FAA Certification: Converting these to Experimental/Research status.

- Engine Overhauls: The J79 engines are expensive to maintain and need a lot of fuel to operate.

- Avionics Upgrades: Replacing 1960s/70s dials with modern digital Glass Cockpits for precision launch timing.

The quarterly cash burn pre-IPO was $500K-$1M, but that's likely to jump considerably as a result of:

- The Aerovision Acquisition: As we discussed, they are earmarking ~$12M–$15M for new aircraft. Depending on the payment structure, this could represent a massive one-time cash outflow in early 2026.

- R&D and STARLAUNCH I: Finalizing the rocket integration and paying for FAA/Space Force range fees for the 2026 test flight is capital-intensive.

- Public Company Costs: Now that they are listed on the NYSE American, they will face increased legal, accounting (SOX compliance), and investor relations costs, typically adding $1.5M - $2M annually to the burn.

Still, the $60M+ in cash on the balance sheet should be good for at least a year, probably more.

Backlog

Because the company is in the "pre-revenue" phase for its orbital launch business, the backlog is split between active flight services and Letters of Intent (LOIs) for future launches.

Before the IPO, the company’s revenue had been primarily driven by its NASA Space Act Agreement and DoD testing contracts.

Based on pre-IPO filings, the company has been generating between $3M and $5M annually through hypersonic testing, pilot training, and media production (Top Gun: Maverick type support).

While small, this revenue is high-margin because the F-104 airframes are fully owned and depreciated.

The most interesting item for investors is the pipeline for the STARLAUNCH I & II programs.

In their roadshow, management indicated they have signed LOIs with several SmallSat and CubeSat operators. While LOIs are not guaranteed revenue, they represent a potential pipeline exceeding $50M - $70M over the next three years.

The company is also positioning itself for a piece of the $900M Orbital Services Program-4 (OSP-4) from the US Space Force. While they haven't announced a specific task order win yet, being a "qualified" bidder is a major part of their valuation.

It is important to note that, as of their most recent filings:

- The hard backlog (that is, signed, non-cancellable contracts) is likely in the sub-$10M range, consisting mostly of the 2026 flight testing schedule.

- The transition from LOIs ($50M+) to actual revenue depends entirely on the success of the early 2026 STARLAUNCH I test.

Milestones

As of late 2025, the program is moving from the lab to the runway:

- The company has been performing carry flights, flying jets with the weight and aerodynamic profile of the launch vehicle to test handling.

- Starfighters Space is currently working through the FAA Astrolabe and launch licensing process to clear the specific air-launch corridors off the coast of Florida.

- The first full-scale STARLAUNCH I test flight is one of the most anticipated aerospace events scheduled for early 2026.

That test flight is pretty important. If successful, it will prove that the flight control systems can handle the transition from the jet to the rocket at supersonic speeds. A failure would likely necessitate another capital raise, given the current cash runway.

Valuation

There are some 22.5M shares, including the shares held by existing insiders/founders and the new shares issued during the IPO. Then there is an 180K greenshoe option, and 1.4M warrants (with an average execution price of $4.49). At $14 per share, that produces a market cap of $337.1M and an EV of $277.1M.

Conclusion

There is much to like here:

- The company already generates modest, high-margin revenue ($3-$5M/y). Their jets serve as a testing platform before they ever drop a rocket. They can fly experimental sensors or hardware at high speeds and return them to the hangar for inspection. This creates a recurring revenue stream from the DoD that pure launch companies don't have.

- The company already has a fleet of 7 F-104s, and by acquiring F-4 Phantoms, they are scaling their first-stage fleet at a fraction of the cost it would take to develop a new autonomous drone or custom carrier plane, providing a cost advantage.

- The cost advantage is further enhanced as it launches at Mach 2+, requiring less fuel in the rockets, saving cost and weight (compared to competitors using planes).

- FJET is headquartered at NASA’s Kennedy Space Center and has a long-term agreement to use the Shuttle Landing Facility. They are the only commercial supersonic fleet authorized to operate out of this historic NASA site.

- While ground-based rockets have to wait for launch windows and deal with complex pad refurbishments, FJET can take off from a runway. This allows for Responsive Space—the ability to launch a satellite on 24-hour notice, which is a massive requirement for the US Space Force, providing launch time and location flexibility.

- The company already has a pipeline of $50-$70M in revenue.

- The company has $60M+ in cash, providing at least a year's runway.

- With an EV under $300, the shares still have significant upside despite the blistering rally late December 2025, given the size of the market opportunity and the competitive advantage, providing attractive unit economics.

Caveats

- While we surmise the unit economics are highly favorable (as the company has many of the assets already in place), we have little to go on in terms of actual figures.

- The company still has to proceed with its first full-scale STARLAUNCH I test flight, scheduled for early 2026, has to be glitch-free.

Inerested in investing in this space? Though there are few to no direct competitors, other public companies in the broader space industry include Virgin Galactic Holdings, Inc. (SPCE), Lockheed Martin Corporation (LMT), Northrop Grumman Corporation (NOC), and Boeing (BA),

More By This Author:

Aduro Clean Technologies Is Starting To Scale Up

SenesTech Has Built A Better Mouse Trap

Cidara Therapeutics' Unique Cloudbreak Platform And Its Promise In Influenza And Oncology

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more