Starbucks: The Aroma Of Profit... But Will It Last?

Starbucks Corp. - Coffee Beans Smell Good and so are the Profits - But Serious Caution is Now Warranted

Starbucks is doing exactly what it should be doing - going up. But since the beginning of the year it has had an ominous Pull-Back that Warrants Caution.

When my fundamental valuations are positive for a company, the technical charts always support this kind of price movement - hence my methodology of "Investing Wisely." Starbucks, like very company is vulnerable to Pull-Backs (check-out 2012 - - $61 to $42 that's about 33% and that is unacceptable asset management). As I did then, I am not again suggestion caution.

The current pull-back is ominous. $82 to $68.

My previously written articles on SBUX (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics.

My previously written articles on SBUX (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics.

Look at the Profits for SBUX - Over the Years

It is simple, all companies cycle from "Favorable" to "Unfavorable." In between, they are "Also Rans." This horse-racing metaphor is the best guidance I have to explain how to know the good, the bad and the Ugly for all securities.

Starbux - has: a) gone up in 20 years - - BUT - - (study the peak to peak and trough to trough); b) is up over 100% in favorable time-frames; is down over 50% in Unfavorable time-frames; and c) has spent years as an "also-ran." The company - has: a) gone Up in 20 years (study the peak to peak and trough to trough); b) is up over 100% in favorable time-frames; is down over 50% in unfavorable time-frames; and c) has spent years as an also-ran. What a waste of time and money during unfavorable and also-ran time frames - don't you think?

The company like so many others has taken some big hits over the years! (Click chart to enlarge)

Have a long look at the above chart. It tells you a story about how to make and preserve your profits. It is not hard to understand how Bear Markets can cause financial set-backs for years and in many cases those set-backs are never recovered. I have over 50 years of successfully doing what I call "preventative maintenance."

A Special Note for Seniors & Retired Investors - Dividend Yield:1.42%

I believe you folks deserve much better service and investment direction and guidance that either Wall Street or the Brokerage Community has been providing. Let me know when I can offer you support.

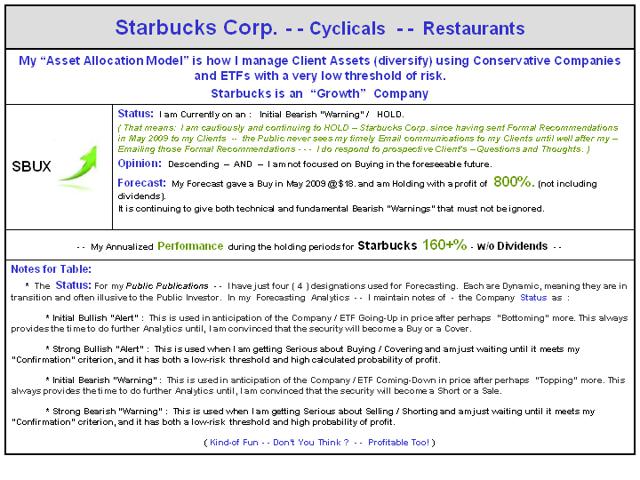

Forecast w/ 5 Year Performance

Starbucks Corp. and other restaurant companies are tracking the marketplace well. Although (SBUX) is currently in a strong rally, it is also an excellent company to forecast for accuracy of future price movements.

Note: The below Table is for your review, questions and perhaps thoughts. If you are seeking to "Invest Wisely" in my "Growth - Asset Allocation Model" - - please email me to open a dialog on how I go about providing super performance with a very low threshold of Risk.

My Current Forecast is quite bright.

If you own or are considering owning restaurant companies, the securities have definitely been positive. Starbucks Corp. currently has strong technicals but I have some reservations about my fundamental valuation, which results in an initial bearish warning.

Therefore my current opinion is to HOLD in anticipation of taking profits - possibly at higher prices. There will be an end but I am not forecasting an "end" at this time.

Therefore my current opinion is to HOLD in anticipation of taking profits - possibly at higher prices. There will be an end but I am not forecasting an "end" at this time.

* Fundamentals - ( weighting - - 40% ): My analytics (weighting 40%) for my fundamental valuation play a vital role in profitable managing money. At this time my valuations of (SBUX) are and remain positive. Plainly stated they are flat but comparatively very positive.

* Technicals ( weighting - - 35% ): Within this outstanding company, my Indicators are not breaking down like with so many others. It recently took a hit off of its highs of $83 to a very recent $69. Now it is back to $73 and that is not positive. It means TOPPING - sooner or later.

* Consensus Opinion - ( weighting - - 25% ): My third pillar of research is one that I believe is distorted to the positive by most all financial analysts. That's because they are afraid of being bearish.

Smile and have fun "Investing Wisely,"

Dr. Steve

Should you have interest in my professional guidance and direction for your Portfolios, please Email Me with your questions or thoughts: senorstevedrmx@yahoo.com.