Starbucks Stock Plummets On Day After Institution Loads Shares

Starbucks Corporation (NASDAQ: SBUX) began accepting Bitcoin as payment in its El Salvador locations last week along with McDonald’s Corp (NYSE: MCD) after the country adopted the cryptocurrency as legal tender.

Starbucks has shown individual strength recently amid general market weakness but on Wednesday gapped down and fell lower.

On Tuesday in the after-hours session, an institution placed a massive block trade of Starbucks shares. The trader purchased 659,841 shares of Starbucks above the ask at $118.86. The total cost of the shares was a whopping $78.42 million.

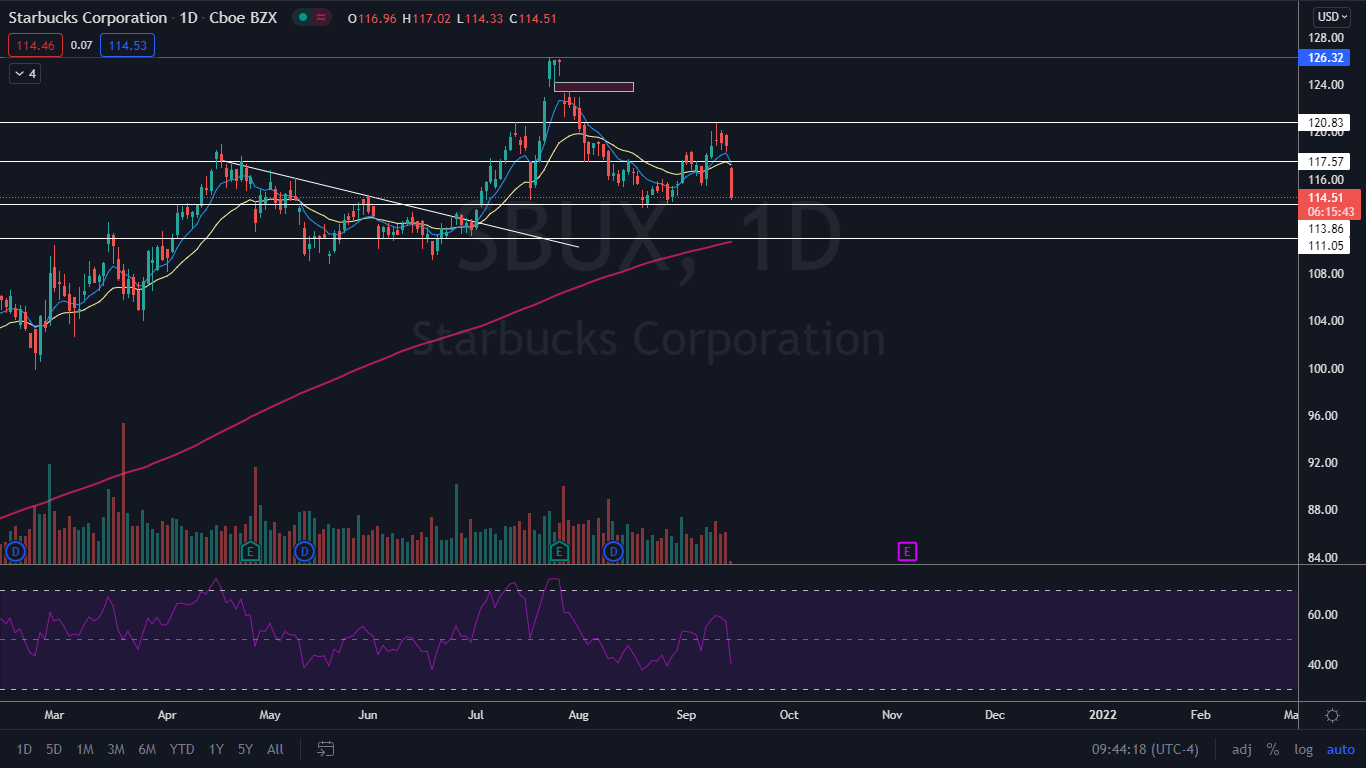

The Starbucks Chart: After reaching an all-time high of $126.32 on July 23, Starbucks entered a downtrend. The stock then completed a bullish triple bottom pattern near the $113 level and on Aug. 26 reversed course into an uptrend, making higher highs and higher lows.

On Wednesday, the stock gapped down and dumped over 3% lower. The support zone at $113 may provide an area for Starbucks to bounce from again if the stock reached the level.

There are now two gaps above on Starbucks’ chart. The first gap which was created on Wednesday is between $116 and $118 and the second higher gap exists between the $123 and $124 levels. Gaps fill 90% of the time so it is likely Starbucks will trade back up into the range in the future.

Starbucks has support below at $113 and $111 and resistance above at $117 and $120.

Photo: Courtesy Starbucks

Disclaimer: © 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Interesting, but no clues as to the reason for the actions. No analysis, really.