Stalwarts Continue To Increase Presence In The S&P 500 Low Volatility Index

If the equity market’s report card so far in 2021 is any indication, it’s on track to be another stellar year. Through Aug. 19, 2021, the S&P 500® is up 17%. The gains were achieved steadily; apart from January, the benchmark has been up every month in 2021. Predictably, in such an environment the S&P 500 Low Volatility Index has lagged, up 14% through the close of Aug. 19, 2021.

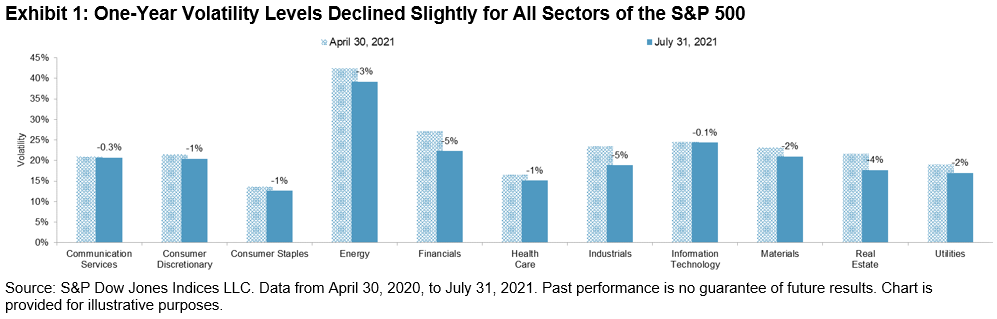

Volatility declined slightly in most sectors of the S&P 500. Even Energy was less volatile compared to three months prior.

(Click on image to enlarge)

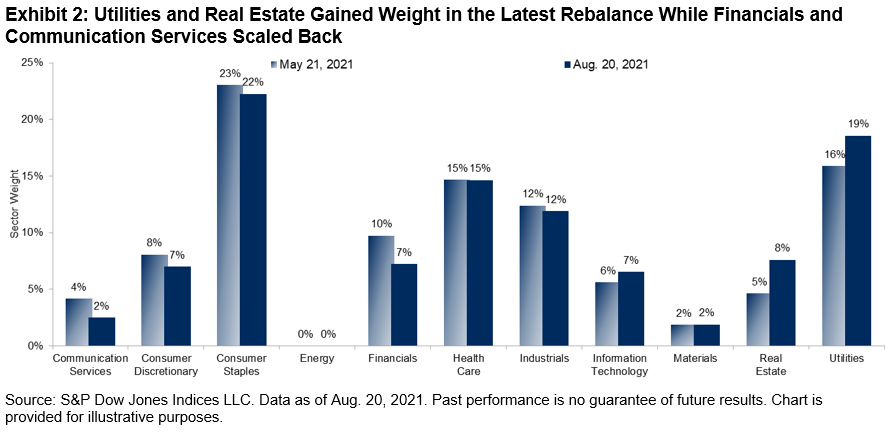

The changes in the latest rebalance for S&P 500 Low Volatility Index, effective after market close Aug. 20, 2021, are subdued compared to the flurry of activity in the previous rebalance.

(Click on image to enlarge)

Real Estate and Utilities continued to increase their weight in the index, with Financials and Communication Services showing the largest declines. The reduction in Financials is somewhat surprising given the sector’s relatively large drop in volatility. Despite this decline, however, Financials remains one of the most volatile sectors in the market, and the S&P 500 Low Volatility Index looks to minimize volatility at the stock level.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more