SS&C Technologies: A "Strong Buy" In The Business Automation Industry

Image Source: Pixabay

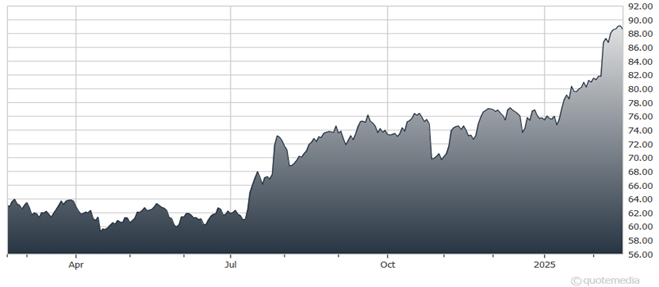

Automating business processes — especially in complex fields like finance or medicine — is a tall order. It also happens to be the exact problem that SS&C Technologies Holdings Inc. (SSNC) decided to tackle. Despite a 41% surge over the last year, the stock has remained significantly undervalued, notes Steve Reitmeister, editor of Zen Investor.

Analysts appear to be unanimously bullish regarding its long-term prospects. Its Zen Rating is “A” (Strong Buy). Its recent price was $88.60. And its maximum one-year forecast price is $105.

Here’s why we’re watching the stock:

- Wall Street equity researchers seem to be overwhelmingly bullish when it comes to SS&C Technologies. Six analysts have recently issued ratings for the stock, with four Strong Buy ratings and 2 Buy ratings.

- Notably, DA Davidson’s Peter Heckmann (a top 3% rated analyst) reiterated an earlier Strong Buy rating after the company reported its Q4 and FY 2024 earnings on Feb. 6. Heckmann also raised his price forecast for the stock from $92 to $102.

SS&C Technologies Holdings Inc. (SSNC) Chart

- Heckmann attributed their price target hike to two factors: The quarter's better-than-expected revenue and EBITDA numbers, as well as the fact that, at recent levels, the stock has been trading at an enterprise value of ~11x the FY 2026 EBITDA forecast, compared to an average multiple of 12x to 12.5x over the last decade.

- Our proprietary quant rating system gave SS&C Technologies stock a Zen Rating of A. Per a holistic overview provided by the 115 unique factors taken into account, SS&C Technologies is in the top 5% of all the stocks we track.

- Relative to its earnings potential, the stock appears to be quite undervalued — netting a Value Rating of A. On top of that, SS&C Technologies also has an A rating when it comes to Sentiment. In both categories, the stock is in the top 5% of equities.

About the Author

Steve Reitmeister brings over 40 years of experience to help individual investors find outperformance. For the better part of the past two decades, he was the editor-in-chief of Zacks.com, where millions of investors enjoyed his timely market insights.

Mr. Reitmeister's commentary has also been featured on other leading investment websites including Yahoo! Finance, Seeking Alpha, CNNMoney, and MarketWatch. The best way to enjoy his insights and stock picks is through his Zen Investor newsletter on WallStreetZen.com.

More By This Author:

The Biggest Investment Opportunity No One’s Talking AboutXLK: What "Hidden" Bullish Breadth Tells Us About Tech

Kinder Morgan: New Pipeline Shows The Attractiveness Of US Midstream Energy Plays

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more