Spring 2022 Snapshot Of Expected Future S&P 500 Earnings

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

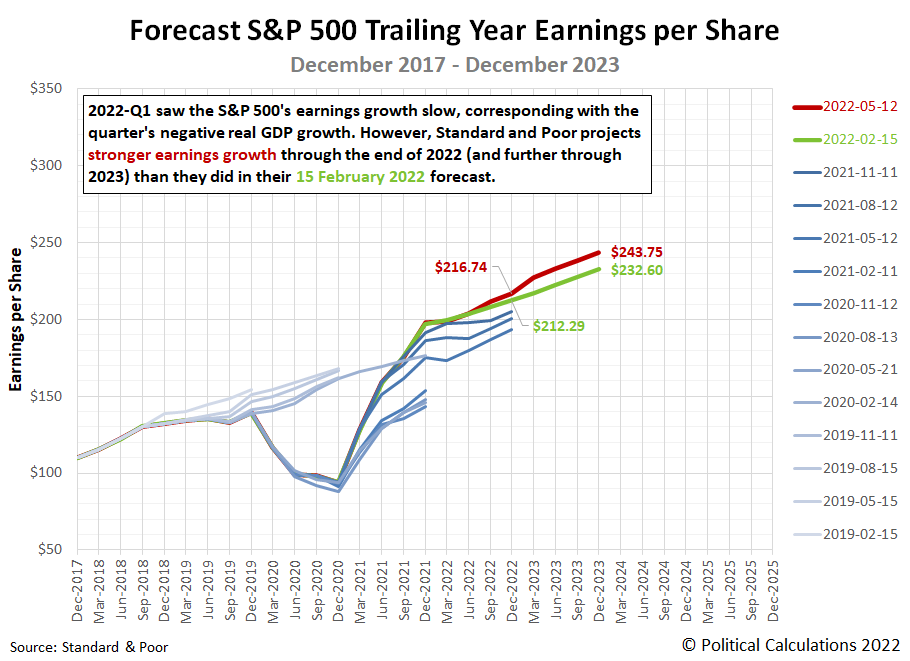

Since our last update three months ago, Standard and Poor's projections have strengthened, indicating expectations of stronger growth through 2022 and 2023. The following chart illustrates how the earnings outlook has changed with respect to previous snapshots:

The improved outlook for S&P 500 earnings has developed even though the Federal Reserve has begun raising interest rates and is signaling larger rate hikes to squelch excess inflation generated by the Biden-Harris administration's fiscal policies. Since those policies represent a growing headwind for the U.S. economy, it raises the question of how much more improvement would have been seen had the Fed chosen to continue holding the Federal Funds Rate at the zero bound.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 12 May 2022. Accessed 13 May 2022.

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more