Spotlight: Bank Of Hawaii

Bank of Hawaii Corporation (BOH) is a 123-year-old regional financial services company with $19.8 billion in assets. Through its subsidiaries, the company provides a broad range of financial products and services to businesses, consumers and governments in Hawaii, Guam and other Pacific Islands. The company’s principal subsidiary, Bank of Hawaii, provides banking and investment services through its 67 branch locations, 367 ATMs, online and mobile banking services.

EFFICIENT BANK

In 1893, Peter Cushman Jones, a 60- year-old businessman, persuaded his two close friends to join him in organizing a new bank in the Islands. Four years later, with $400,000 in capital, Bank of Hawaii became the first chartered and incorporated bank to do business in the Republic of Hawaii, operating from a two-story wooden building in downtown Honolulu. Today, Bank of Hawaii is the second largest bank in the state with nearly $20 billion in assets offering a broad range of financial products and services through four business segments: Retail Banking, Commercial Banking, Investment Services & Private Banking and Treasury and Other. Bank of Hawaii operates in a unique competitive landscape where the top four banks control more than 80% of the regional market, providing the bank with a sticky, low-cost deposit base that reduces its sensitivity to pricing pressure. In addition to its lowcost deposit base, Bank of Hawaii is a low-cost operator, evidenced by its 2019 efficiency ratio (non-interest expense divided by total revenues) of 55.7%, which places it among the country’s most efficiently run banks. The conservatively-managed bank maintains a pristine balance sheet with solid asset quality and robust liquidity and capital levels, far exceeding regulators’ requirements.

PROFITABLE GROWTH

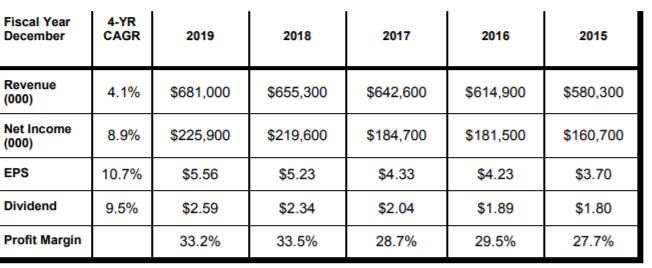

During the past five years, Bank of Hawaii has banked profitable growth with revenues compounding 4% annually, net income growing by 9% annually and EPS increasing at an 11% annual pace. During the period, average loans and leases have increased at a 9% annual clip to $10.7 billion while average deposits have grown by 4% annually to $15.2 billion. Return on average equity averaged a profitable 16.2% over the last five years.

GROWING DIVIDENDS

Since becoming a public company in 1972, Bank of Hawaii has paid uninterrupted quarterly dividends to shareholders, which have increased at a 10% annual pace during the past five years. While the bank has suspended share repurchases, it is still paying a substantial dividend as the bank generates significant capital in excess of well-capitalized minimums. Bank of Hawaii increased its dividend 3% to an annualized $2.68 per share with the dividend currently yielding 4.8%.

SECOND QUARTER 2020

Bank of Hawaii reported net interest income rose 5% during the second quarter to $178 million with EPS down 30% to $.98. Results for the second quarter included a provision for credit losses of $40.4 million compared to $4.0 million in the prior year period, reflecting the uncertainty caused by the coronavirus on loan repayments. Loan and lease balances increased 10% during the quarter to $11.8 billion with total deposits up 12.5% to a record high of $17.4 billion. The bank performed well in a challenging environment with tourism halted due to the virus yet the balance sheet continued to grow while maintaining strong levels of capital and liquidity. The efficiency ratio for the second quarter improved to 50% from 55% in the prior year quarter. Total shareholders’ equity increased to $1.4 billion with book value equal to $33.76 per share at quarter end.

Investors banking on attractive long-term returns should consider Bank of Hawaii, a high quality market leader with an efficient cost structure, profitable growth and an attractive 4.8% dividend yield. Buy.

Quite an interesting history lesson here. Perhaps others should try to copy the principles and motivations of this bank. Clearly it makes sense to follow the path of a consistent winner. Am I the only one to see this??

Sometimes it seems that risks taken with other people's money, done in the chase for sort term benefits, are rather devoid of rational thinking, as the disaster of 2008 shows so very clearly. It appears that The Bank Of Hawaii avoided that path. How is it that they are so much smarter??