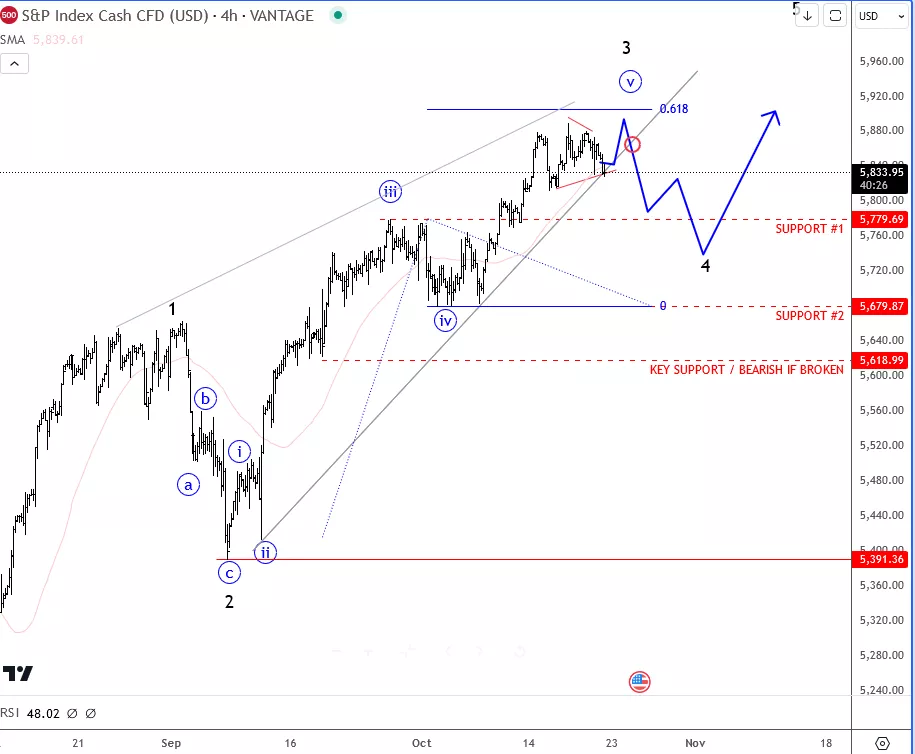

SP500 Looking For Resistance At The End Of Wave 3

Image Source: Pexels

The SP 500 has been bullish for some time, but we are now seeing the index approaching key resistance levels near 5,900. This could slow down the bulls and potentially lead to a deeper fourth-wave retracement, especially considering that the Dollar has shown a strong rebound in recent weeks. Dollar strength could then increase risk-off sentiment, which might trigger a pullback in the SP 500.

(Click on image to enlarge)

SP500 4H Chart

From an Elliott wave perspective, this pullback is expected, as we are likely in the late stages of an extended wave three. So if the trendline support, connected from mid-September, is broken, we should be aware of a deeper ABC retracement within this wave four. In that case, detailed support would be around 5,750, which is the pivot zone from wave four of one lesser degree.

If someone is looking to join the trend, it’s certainly more appropriate to wait for a pullback rather than chase the market at these higher levels.

If something significant happens and the S&P 500 breaks below the key 5,600 support, it could signal a major top, potentially confirmed by the wedge shape outlined by the gray trendlines.

More By This Author:

EUR/AUD And EUR/NZD Pairs Show Short-Term Bull Setup

Crypto Market Shows Bullish Pattern

Dollar Index Is Looking For A Bigger Recovery After A Pullback

For more analysis check our Elliott Wave video, or visit us at more