Double Bottom Déjà vu? Or…Just a Mirage?

Every single person who knows I am a market watcher has asked me the same question for the last two weeks.

This past Monday (September 26th, 2022), I was asked at least three times as often. In fairness, the S&P 500 Index chart that many of them were looking at does beg this question. And on Monday, the market closed with the most crystal clear setup I’ve seen in a long time:

(Click on image to enlarge)

Without any markup from me at all, this chart has the clearest: 1) Start of a Double Bottom setup and 2) Multi-month channel that I have seen on a major index in decades (more on that below).

Just in case you’d like me to mark that up, let’s take a look:

(Click on image to enlarge)

This is the start of the Double Bottom setup. Edwards & Magee or Richard Schabacker would require lots of confirmation to complete the setup. But, for now, that’s just a work of art! And given today’s extreme market volatility, that could be violated in a morning of trading…

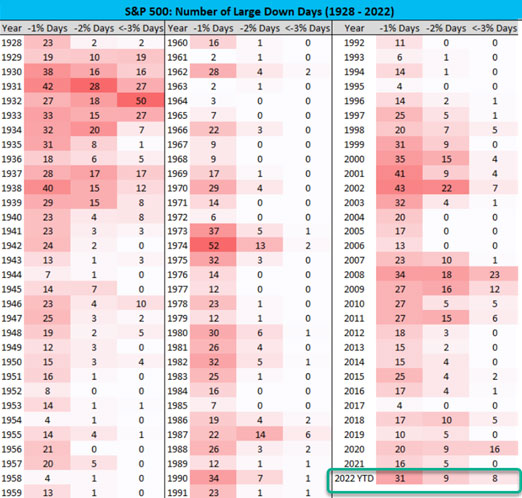

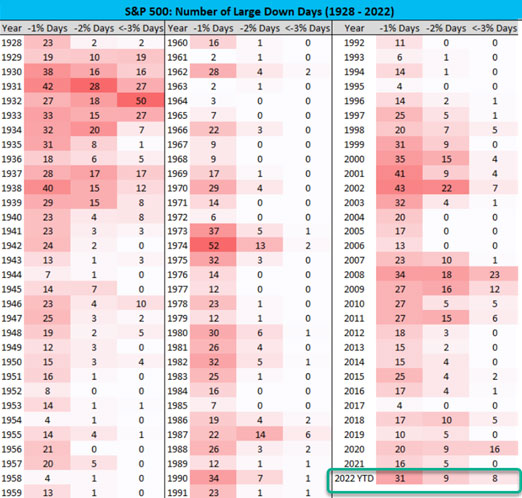

Because, we’ve had an astonishing 31 trading days where the S&P has dropped between -1% and -2%. That’s more in just under nine months than we’ve had in any full year since 2008. We had an additional nine days with drops between -2% and -3% and yet another eight days with drops greater than -3%.

Those numbers, courtesy of Compound Advisors:

(Click on image to enlarge)

Those of you who are market historians will enjoy this chart comparison below because the setup is strangely similar to almost exactly 20 years ago. The top chart is from 2002 and the chart immediately below is the exact same chart from the top of the article:

(Click on image to enlarge)

(Click on image to enlarge)

And here’s what happened back in 2002 after the support level/double was hit:

(Click on image to enlarge)

The recent market action in 2022 and the late stages of the Dot.Com crash have shown some similarities for a few months, but there are few other direct similarities in the macro-economic picture and the Fed action in the two eras. And, remember that the 2002 action came almost two and a half years after the start of the Dot.Com cliff dive. I’m certainly not suggesting a double is starting here but that is certainly one of the technical analysis scenarios that’s in play. In a future article, we’ll look at some signposts that might make for a tradeable Double Bottom. Or, for the possibility that the support level is violated.

More By This Author:

Using Breadth Indicators To Forecast The Markets Dealing with Different Market Forecasts and OpinionsThe Coronavirus and the Shanghai Composite Index Price Forecast

Disclosure: Financial Markets Risk Warning

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large ...

more

Disclosure: Financial Markets Risk Warning

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

All information on this website is for educational purposes. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibility for your actions, trades, profit or loss, and agree to hold Invest2Success and any authorized distributors of this information harmless in any and all ways.

All rights reserved. The use of this website constitutes acceptance of our user agreement.

Financial Products Services Disclosure

Invest2Success is partnered with and advertises promotes other companies finanical products and services, as well as our own. As such, Invest2Success receives advertising promotion compensation from these other companies in doing so. Invest2Success believes the products services of our own and other compaines listed on our site and blog are very unique and can be beneficial to investors traders because they meet our quality guidelines for good investing trading methods which investors traders can use to help improve their financial education knowledge and investing trading results. We do not warrant and are not liable for any claims or testimonies made by these other compaines products and services. Review each product and service carefully before purchasing and using. The purchase, use, and results of any of the products services on our website and blog is sole responsibilty of the user.

less

How did you like this article? Let us know so we can better customize your reading experience.