S&P Challenges All-Time Highs

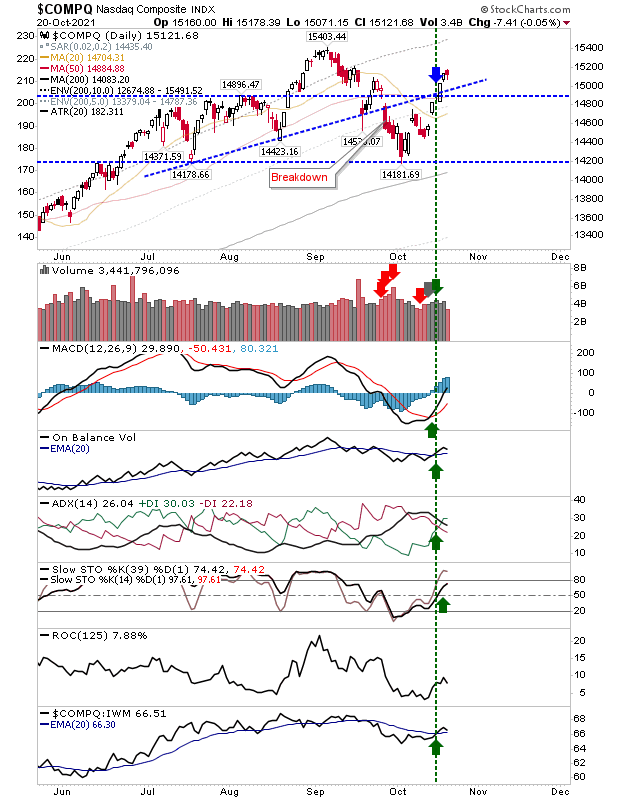

Once the Nasdaq broke through resistance (former support) defined by the July and August swing lows it has managed to hang on to regained support. Technicals are net positive and the index is again outperforming the Russell 2000. It still has some way to go before it challenges the September high and finished today with a small bearish candlestick.

The S&P has managed to reach a point to challenge the August high. It managed to do so on higher volume accumulation, although following the sequence of bullish white candlesticks I would expect it to now consolidate - perhaps forming a 'bull flag' before forming new highs.

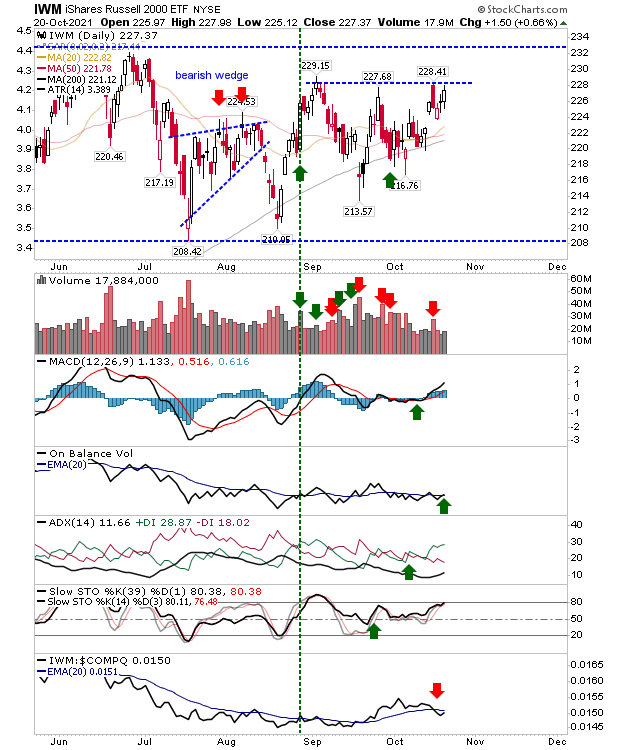

The Russell 2000 retains its range-bound action, although I have drawn in a second resistance level which may be enough to qualify it for a breakout if it can get past this level. Remember, triple tops are rare, and here we are looking at a triple top - which means the chance for a breakout is high.

First, we had the Nasdaq recovering from its breakdown, now we have the S&P challenging all-time highs and soon we could see the Russell 2000 clear its 2021 trading range. All of these point to a return to a bull market and with the end of the pandemic not likely until sometime next year, we are unlikely to see a 'sell the news event' before then.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more