S&P 500 Sold Off Again - Is This Still Just A Correction?

Stock prices suffered another sharp decline yesterday – is this a change of trend?

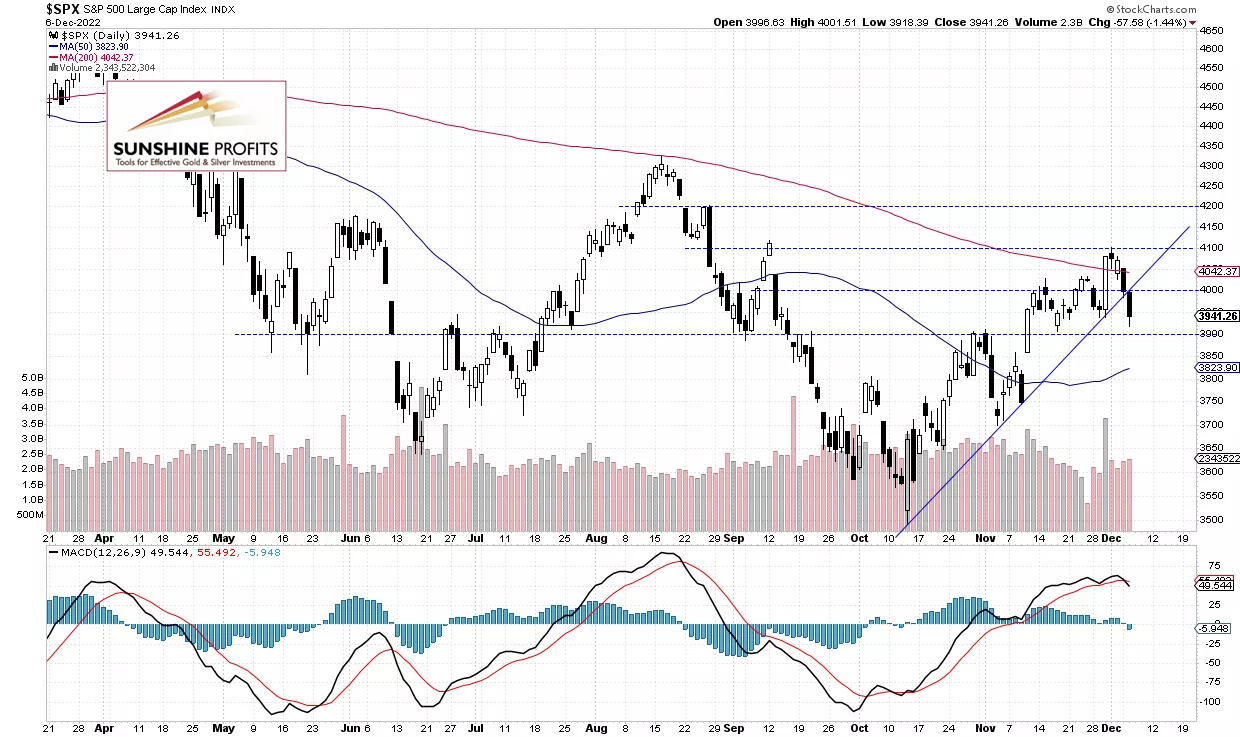

The S&P 500 index lost 1.44% on Tuesday, as the broad stock market continued its Monday’s 1.8% sell-off. It reacted to Monday’s better-than-expected ISM Services PMI release. On Thursday the S&P 500 reached a new local high of 4,100.51, and yesterday it went closer to the 3,900 level.

This morning the S&P 500 is expected to open 0.3% lower after an overnight decline of more than 1%. We may see a short-term rebound following the recent declines. It still looks like a consolidation within an uptrend. However, the index broke below its two-month-long upward trend line yesterday, as we can see on the daily chart:

(Click on image to enlarge)

Futures Contract Goes Sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below the slight upward trend line. The support level is at around 3,900.

(Click on image to enlarge)

Conclusion

The S&P 500 index extended its Monday decline yesterday to the ongoing recession and inflation worries. The market retraced its recent advances, but we may see a short-term or intraday upward correction at some point. Investors will be waiting for Friday’s PPI release, the next week’s Tuesday’s CPI release, and Wednesday’s FOMC release.

Here’s the breakdown:

- S&P 500 index broke below the 4,000 level and extended its Monday decline yesterday.

- We may see a rebound today, but the market reversed its short-term uptrend.

More By This Author:

S&P 500 Trades Sideways Since Powell’s Speech – Is It Bullish?

Jobs Data May Send Stock Prices Lower, But The Trend Is Still Up

S&P 500 Below 4,000 Again – Time to Be Bearish?

Disclaimer: All essays, research, and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a ...

more