S&P 500 Snapshot: Down 8.52% YTD

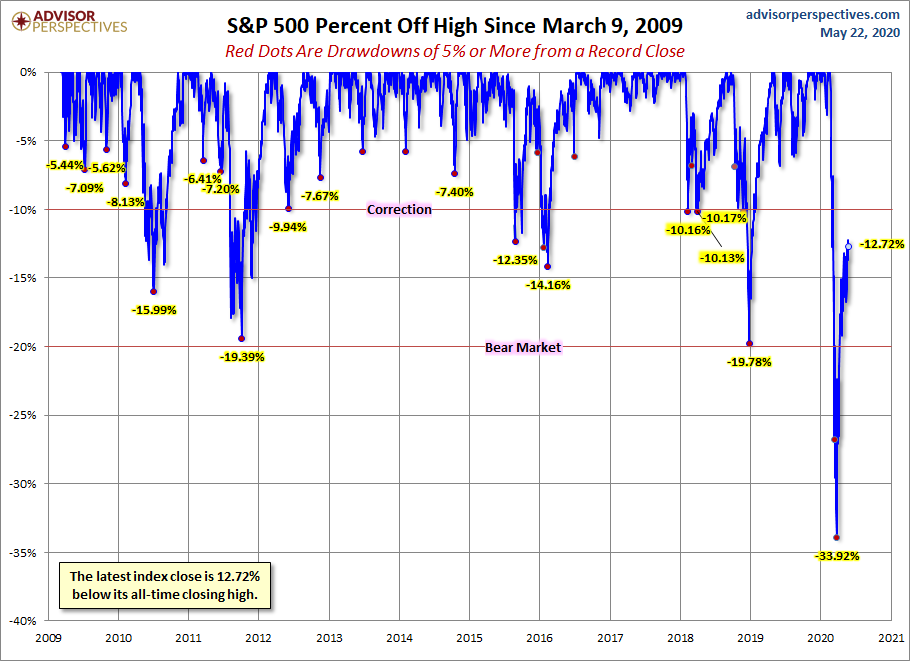

The S&P 500 ended Friday, May 22, up 0.24% from Thursday. The index is down 8.52% YTD and is 12.72% below its record close.

The U.S. Treasury puts the closing yield on the ten-year note, as of May 22, at 0.66%. The two-year note is at 0.17%.

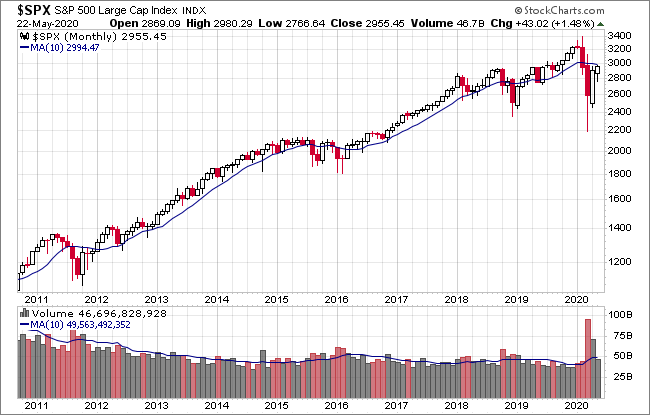

Here's a snapshot of the index going back to 2010.

A Perspective on Drawdowns

Here's a snapshot of record highs and selloffs since the 2009 trough.

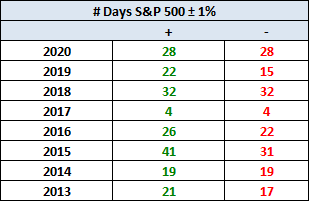

Here's a table with the number of days of a 1% or more change in either direction, and the number of days of corrections (down 10% or more from the record high) going back to 2013.

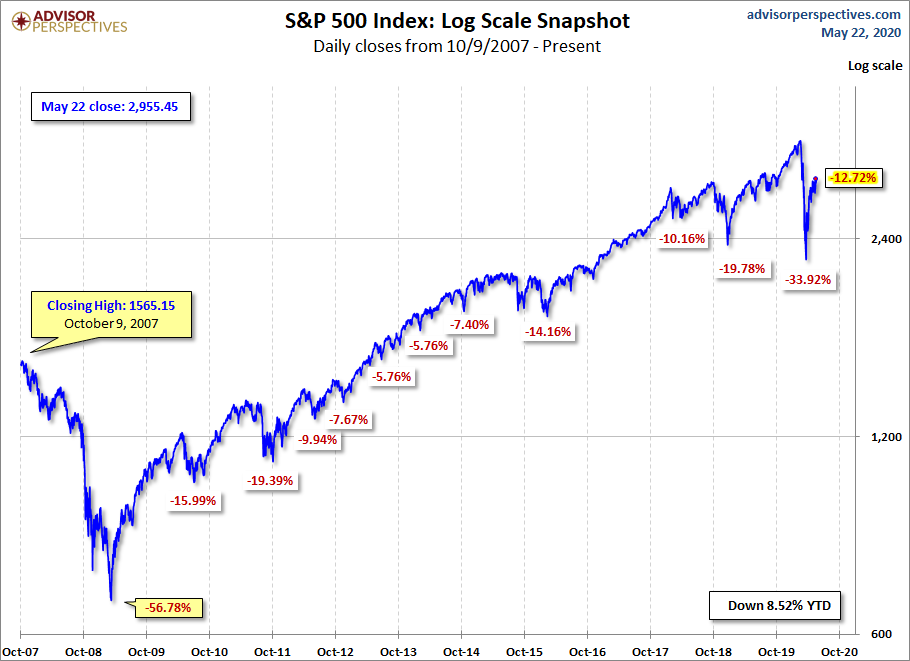

Here is a more conventional log-scale chart with drawdowns highlighted.

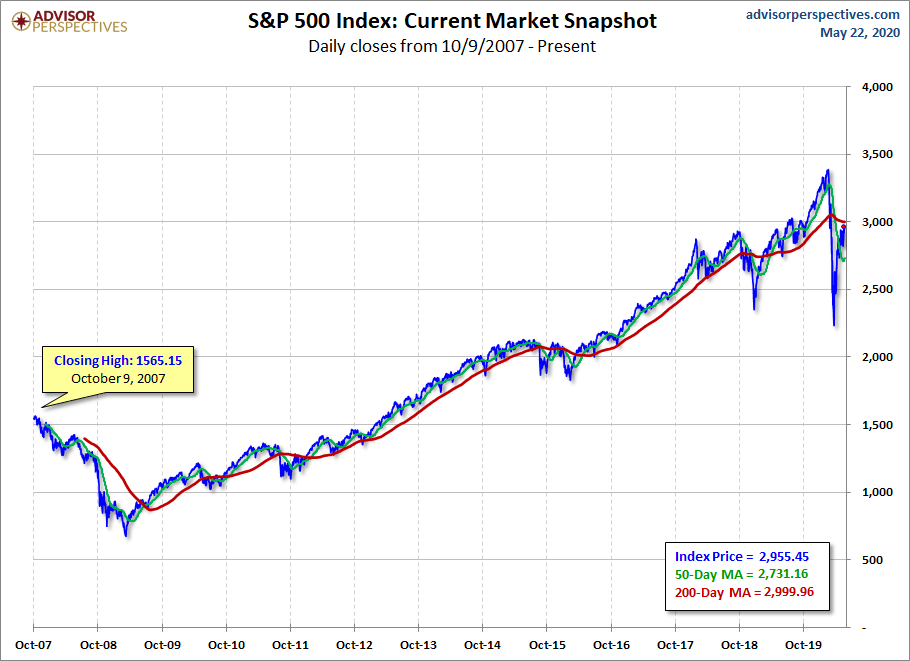

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

A Perspective on Volatility

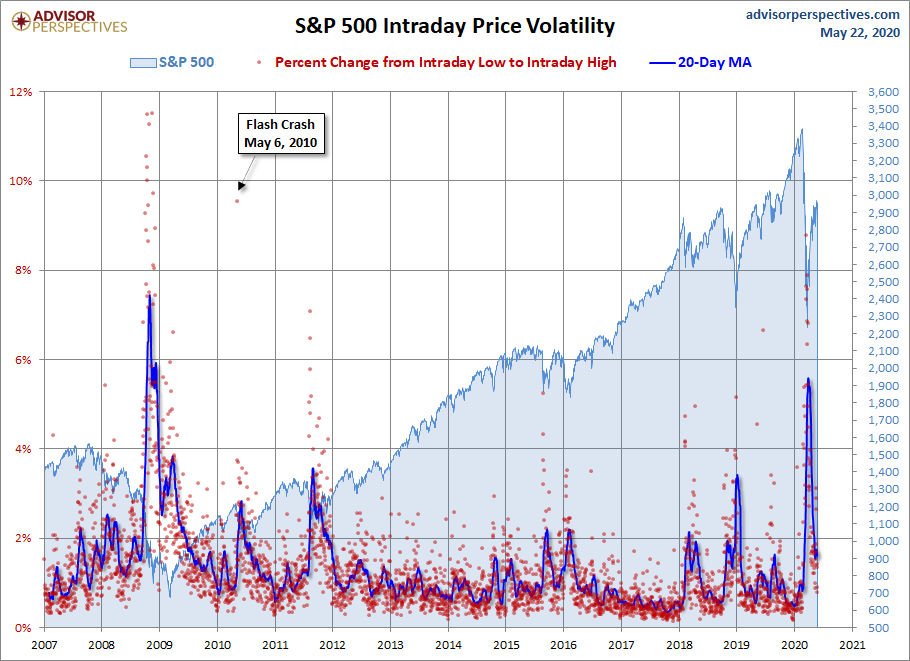

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

Many thanks Jill. Well said. James