S&P 500 Slips From Intraday High As Investors Await Fed Insight

Stocks are lower at midday, as investors look ahead to the conclusion of the Federal Reserve's two-day policy meeting tomorrow, in hopes that it will shed light on potential tapering plans and inflation. Wall Street is also digesting economic data, which showed a worse-than-expected decline in retail sales data, as well as the highest 12-month increase for the producer price index (PPI) ever recorded.

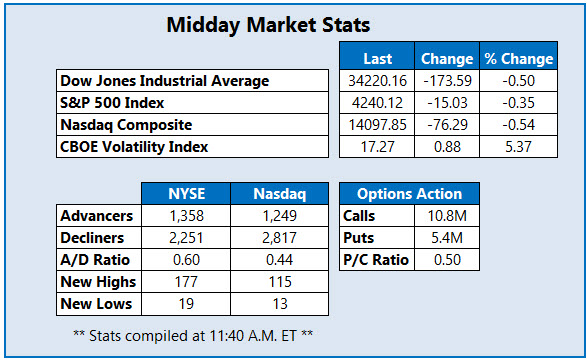

In response, the Dow Jones Industrial Average (DJI) was last seen down 173 points. Meanwhile, S&P 500 Index (SPX) is modestly lower after earlier hitting a fresh intraday high earlier in the session, and the Nasdaq Composite (IXIC) is firmly in the red, also falling from yesterday's record close.

Pet supply retailer Petco Health and Wellness Company Inc (Nasdaq: WOOF) is getting blasted in the options pits today. Shares are down 10% at $25.25 at last check, just a day after Reddit traders helped the security close almost 18% higher. Circling back to the options pits, 57,000 calls and 14,000 puts have already crossed tape, which is 14 times the intraday average. Most popular is the June 30 call, followed by the 25 call in the same series. In other words, options traders are banking on more upside for WOOF by the end of this week, when these contracts expire. Petco stock has been trading mostly sideways after going public once again in January with an initial public offering (IPO) price of $18 per share. Quarter-to-date, WOOF has already added more than 12%.

Near the top of the Nasdaq, today is Alfi Inc (Nasdaq: ALF), last seen up 78% at $6.07, after earlier hitting an all-time high of $6.80. The major bull gap came after the software name announced a deal with All-Niter to fulfill, stage, and ship 10,000 digital tablets for Lyft (LYFT) and Uber (UBER) drivers across the country. Alfi stock went public in May but has remained flat after surging to the $5.60 mark just days after its market debut. Today's pop has ALF eyeing is the highest close yet, while sporting a 108.8% month-to-date lead.

Meanwhile, towards the bottom of the Nasdaq is PDS Biotechnology Corp (Nasdaq: PDSB). The security is down 26.7% at $9.43 this afternoon after it announced a price of $8.50 per share for the underwritten public offering of more than 5 million shares of its common stock, which is roughly a 54% discount to Monday's close. The company has raised $45 million to fund clinical pipeline development and working capital, as well as general purposes. Prior to today's plummet, shares had climbed to a June 4, three-year high of $13.47, but are now slipping below support at the 20-day moving average. Longer-term, PDSB sports a massive 626.9% year-over-year lead.