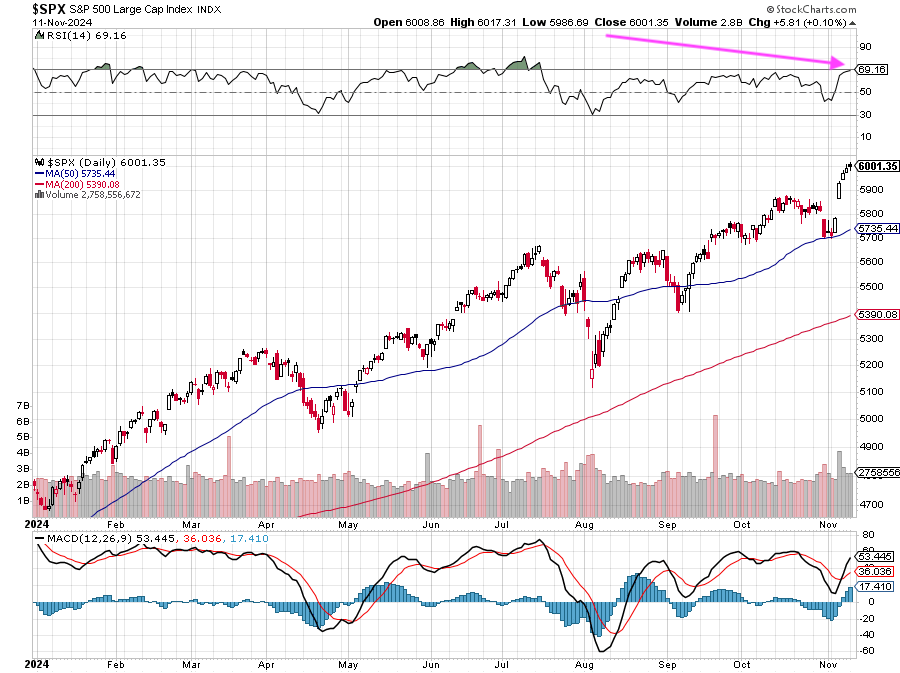

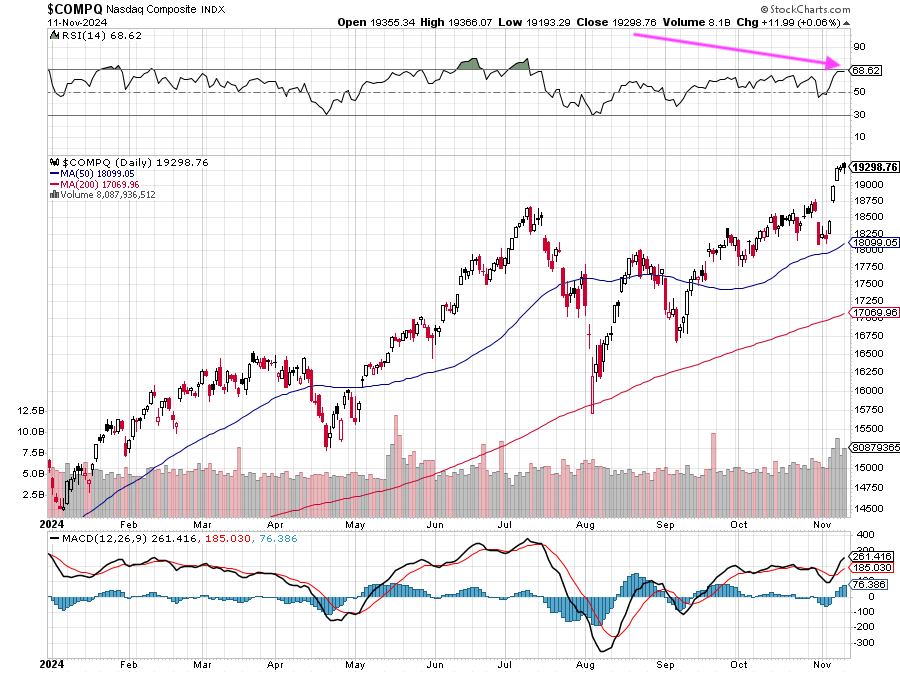

S&P 500 Nears Overbought, Fed Heads & Inflation On Deck

Equity futures point to a down market open later this morning, but we’ll want to revisit futures as quarterly results from Home Depot (HD), Mosaic (MOS), Tyson Foods (TSN), and a few dozen other companies are reported. Because of the strong moves in both the S&P 500 and the Nasdaq Composite since the 2024 presidential election outcome, we would not be surprised to see traders and investors with short time horizons be profit takes especially as the Relative Strength Index (RSI) levels for both are bumping up against overbought levels.

While we wait for the October CPI and PPI reports to be published tomorrow and Thursday morning respectively, in addition to the October NFIB Small Business Optimism Index this morning brings two Fed speakers after the market open. Coming off last week’s Fed policy meeting and the lack of fresh data, odds are they will largely reiterate Fed Chair Powell’s comments. The same is likely true when Philly Fed President Patrick Harker speaks at 5 PM ET today.

In our view comments from the Fed speakers starting tomorrow through the end of the week will be far more constructive about what’s next for Fed rate cuts. We say this because the October inflation data will be published as will the October Retail Sales and Industrial Production data. The core inflation figures will tell us if the upward trend seen in recent data has abated; if not, that data would suggest the Fed may have some serious thinking about its December policy meeting.

The market has dialed back expectations for rate cuts over the coming quarters, now seeing four 25-basis point rate cuts being delivered by the end of 2025, down from that many by mid-2025. What’s in play, however, is whether the Fed will cut interest rates again in December after delivering 75-basis points in cuts between its September and November policy meetings. As of now, the CME FedWatch Tool shows the market pricing in a 69% chance the Fed will deliver yet another rate cut, but even that percentage has slipped over the last few weeks. We’ll be keeping an eye on 10-year Treasury yields as that data is published and Fed speakers make the rounds.

As we put more distance from Election Day and President-elect Donald Trump appoints cabinet positions, investors will start to focus on Trump’s economic policies and what they could mean for inflation and Fed monetary policy. Reports point to Trump nominating China hawks Senator Marco Rubio and Congressman Mike Waltz for secretary of state and national security advisor. Candidate Trump pledged to aggressively use tariffs, but whether those campaign trail promises are negotiating tools or become enacted policy will be determined in the coming months. This could inject a fresh wave of uncertainty into the market, something it and investors are not fond of.

More By This Author:

Will The Fed Kill The Trump Trade?Election Day Today, Then The Fed - How We See It

Big Tech Digestion, Prepping For The October Employment Report

Disclosure: None.