S&P 500 Nears Fresh Highs As Stocks Crawl Higher

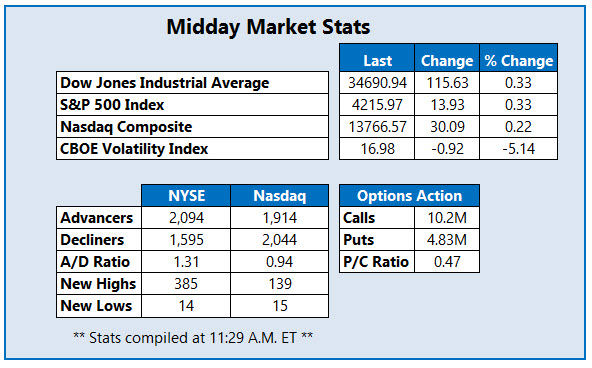

The major benchmarks are inching higher at midday, as Wall Street attempts to brush off inflation fears after a muted start to June. The Dow Jones Industrial Average (DJI) is up 115 points this afternoon, while the S&P 500 Index (SPX) is sitting firmly in the black, once again grasping at its early May record highs. The Nasdaq Composite (IXIC) is also higher, with reopening plays taking a breather.

Elsewhere, investors are keeping a close eye on Reddit darling AMC Entertainment (AMC), after the equity hit a fresh all-time high following a stock sale that raised $230.5 million. Zoom (ZM) is also on Wall Street's radar. The stay-at-home staple is trading lower this afternoon, as many look past an impressive first-quarter earnings report.

One stock seeing a surge in options activity today is Romeo Power Inc (NYSE: RMO), which is up 2.9% at $8.88. So far, 28,000 calls have crossed the tape, which is eight times what is typically seen at this point. Most popular is the weekly 6/4 10-strike call, followed by the 6/11 10-strike call, with positions being sold to open at the former. Today's surge came after the tech name announced a collaboration with Nuvve (NVVE) to accelerate vehicle-to-grid integration for battery-electric commercial vehicles. Prior to that, RMO had been trending lower on the charts, after a major bull gap pushed it to a Dec. 28 record of $38.89. The stock's 50-day moving average has kept a lid on several rally attempts, but today's pop has RMO poised to close above the area for the first time since January. Year-over-year, though, Romeo Power stock is still down more than 10%.

Biotechnology concern Briacell Therapeutics Corp (Nasdaq: BCTX) is one of the best-performing stocks on the Nasdaq today. The security is up 162.3% at $8.34 after it reported advanced breast cancer patients treated with its leading candidate Bria-IMT as monotherapy in combination with checkpoint inhibitors showed a more robust chance of survival. Today's massive bull gap has the security trading at its highest level since late July. Over the past week alone, the equity has added a whopping 168.8%.

One of the worst stocks on the Nasdaq is Orbital Energy Group (Nasdaq: OEG). The equity is down 23.3% at $5.86 at last check, cooling after yesterday's news of a 700-mile construction project across Mississippi made it one of the top performers. The shares nearly touched the $8 level during yesterday's trading, finding footing at the 80-day moving average. The security still sits well above the trendline today and is up over 1,115% year-over-year.