S&P 500, Nasdaq Nab Records On Upbeat Tech Earnings

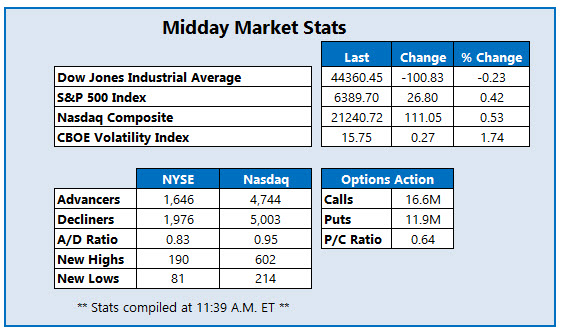

The Nasdaq Composite (IXIC) is enjoying a triple-digit lead this afternoon, earlier scoring another record high alongside the S&P 500 Index (SPX), as investors digest upbeat results from Microsoft (MSFT) and Meta Platforms (META). The Dow Jones Industrial Average (DJI) is down triple digits, but much like the SPX remains on track for its third-straight monthly gain, while the IXIC is on track for its fourth.

Hotter-than-expected inflation for June and modest jobs data remain in focus, while U.S. Treasury Secretary Scott Bessent noted trade negotiations between the U.S. and China are approaching the finish line. Further, President Donald Trump extended Mexico’s 25% tariffs for 90 days amid ongoing talks.

Applied Digital Corp (Nasdaq: APLD) is among the most heavily traded stocks in the options pits today, with 252,000 calls and 63,000 puts exchanged so far, which is 6 times the volume typically seen at this point. Most active is the weekly 8/1 14-strike call, where new positions are being opened. APLD is up 36.9% to trade at $13.74 at last check, after the company beat revenue expectations for the fiscal fourth quarter. The shares attracted a price-target hike from Needham to $16 from $12 in response, and are looking to snap a four-day losing streak with their biggest single-day percentage gain since June 2. So far in 2025, APLD has added 80%.

Leading the SPX today is eBay Inc (Nasdaq: EBAY) stock, last seen up 18.5% to trade at a record high of $92.30, after the e-commerce concern surpassed top- and bottom-line estimates for the second quarter and issued an upbeat current-quarter outlook. EBAY is pacing for its first gain in five sessions, as well as its best day since 2005, as it bounces off long-term support at the 40-day moving average. The shares now sport a 48.2% year-to-date lead.

Baxter International Inc (NYSE: BAX) stock is near the bottom of the SPX today, last seen down 22.3% to trade at $21.80, after the healthcare company reported a second-quarter revenue miss and issued a lackluster outlook for the current quarter. The equity is extending its 25% deficit for 2025 and earlier fell to a 19-year low of $21.60, after several failed attempts to conquer the 100-day moving average since May. BAX is also now eyeing its worst day since March 2003.

More By This Author:

Dow, S&P 500 Retreat As Fed Fatigue Sets InStocks Mixed As GDP Data, Interest Rates Take Focus

S&P 500 Snaps 6-Day Win Streak As Rally Loses Steam