S&P 500, Nasdaq 100 Week Ahead Forecast: Inflation Could Make Or Break The Market

S&P 500 AND NASDAQ 100 OUTLOOK: SLIGHTLY BEARISH

The S&P 500 and Nasdaq 100 suffered steep losses this week after the Federal Reserve delivered another 75 basis-point hike at its November meeting. However, this decision, which was fully discounted, was not the main bearish catalyst: verbal guidance was. While the central bank signaled that it may downshift the pace of tightening at some point in the future, it also acknowledged that it is too premature to talk about a “pause” and that the ultimate level of interest rates will be higher than expected due to persistently elevated inflation.

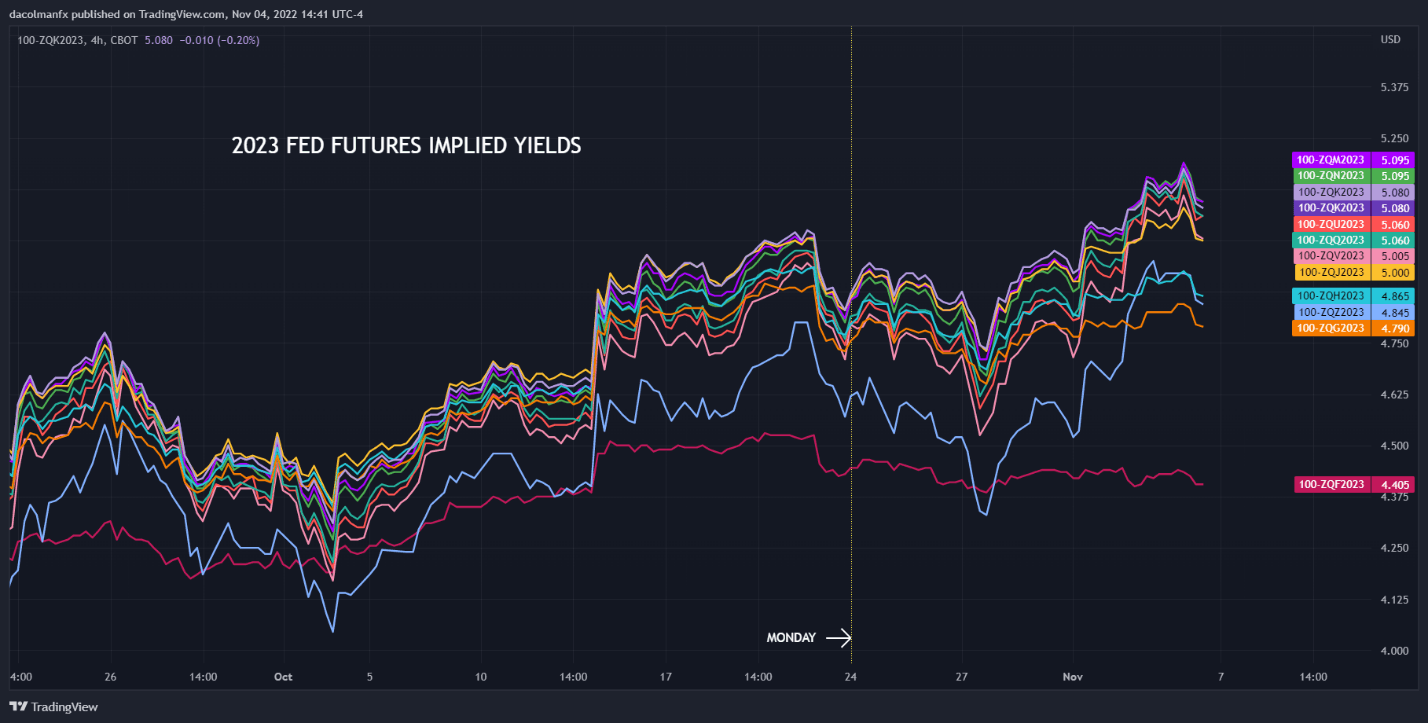

Powell's hawkish message spooked traders, leading them to reprice higher the path of monetary policy, as reflected in the chart below, showing an implied terminal rate on Fed funds futures of around 5.1% by the middle of next year, up from 4.85% on Monday. This aggressive roadmap is likely to reinforce recession risks and undermine equities, even if the FOMC moves to a slower cycle to better assess the cumulative effects of its past actions considering the lag of policy transmission.

IMPLIED YIELD FOR 2023 FED FUTURES

(Click on image to enlarge)

Source: TradingView

The latest U.S. employment report confirmed that policymakers have more work to do to cool the economy in their quest to tame inflation via demand destruction. In October, U.S. employers added 261,000 payrolls versus 200,000 expected, a sign that hiring remains extremely resilient despite numerous headwinds. A tight labor market should bolster household spending while preventing wage pressures from easing materially, a scenario that will complicate the fight to restore price stability.

In any case, we'll know more about inflation next week, after the U.S. Bureau of Labor Statistics releases last month's data on Thursday morning. That said, headline CPI is forecast to have risen 0.7% on a seasonally adjusted basis, with the annual rate seen easing to 8.0% from 8.2% in September. For its part, the core gauge is expected to clock in at 0.4% m-o-m and 6.5% y-o-y.

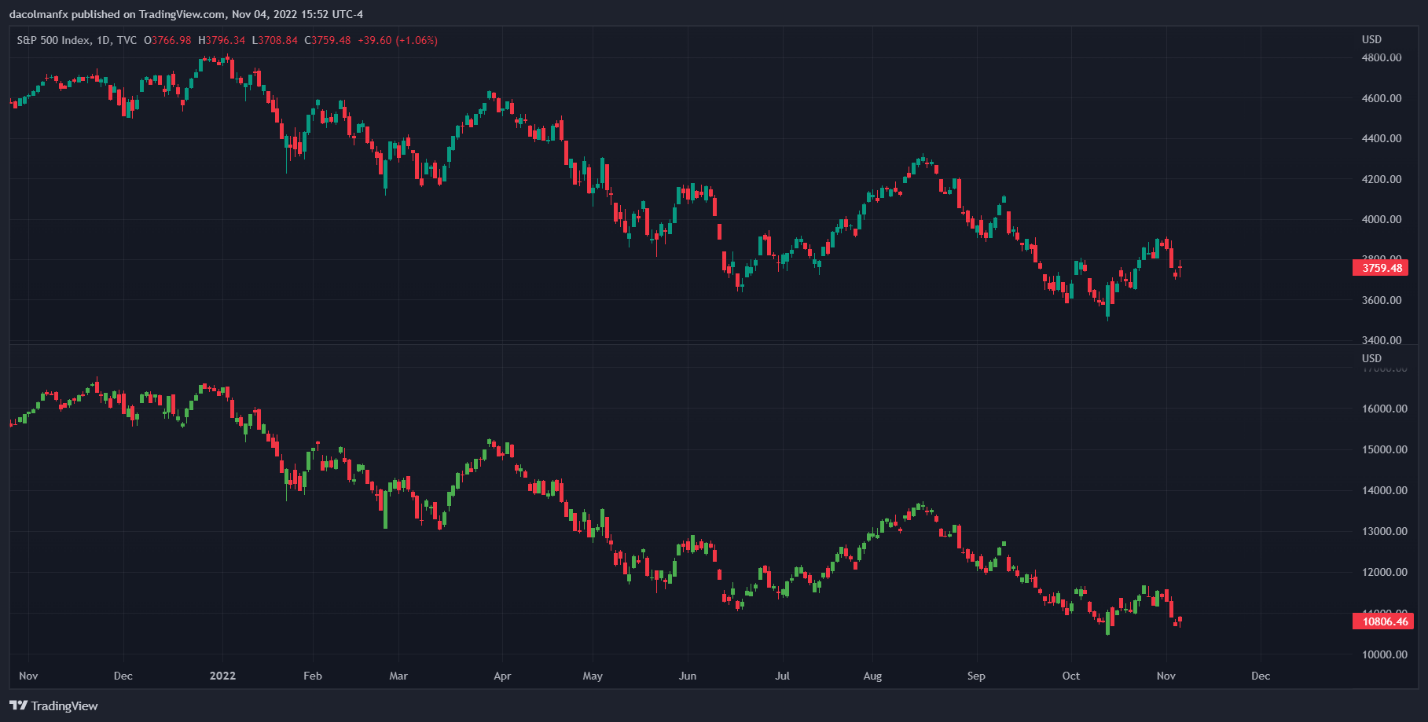

For the mood to improve and for buyers to return, the CPI outturn must surprise to the downside in a material way. Results that are in-line with or above estimates should keep sentiment depressed, paving the way for more losses for both the S&P 500 and Nasdaq 100. In this sense, the very near-term outlook for stocks hinges on the inflation report, but over a medium-term horizon, the underlying bias is still negative.

S&P 500 and Nasdaq 100 Daily Chart

(Click on image to enlarge)

S&P 500 Chart Prepared Using TradingView

More By This Author:

S&P 500 Extends Losses As Yields Charge Higher Ahead Of Key Fed Decision. Now What?US Economy Grows By 2.6% In Third Quarter, But GDP Data May Overstate Strength

S&P 500 Stages Big Turnaround Despite Microsoft & Alphabet Carnage, US GDP Eyed

Disclosure: See the full disclosure for DailyFX here.