S&P 500 Looking To Gain Footing Near Record High

The S&P 500 (Index: SPX) dipped during the first full trading week of March 2024. The index closed out the week at 5,123.69, a little less than 0.3% below where it ended the previous week.

Nevertheless, the index did manage to eke out a new record high close of 5,157.36 on Thursday, 7 March 2024. That high came in response to strong signals from Fed officials that they will indeed act to cut interest rates later in 2024. Investors currently expect the Fed to begin cutting interest rates in the U.S. in June 2024 to address a slowing economy. In that action, the Fed will be lagging behind the example of the European Central Bank, which is expected to begin cutting its interest rates to address the weak Eurozone economy as early as later this month.

The Fed's confirmation followed last week's hint from Fed officials that they plan to implement a new kind of quantitative easing-style program to provide some relief from elevated interest rates, which had pushed the index up to its previous record high close on Friday, 1 March 2024.

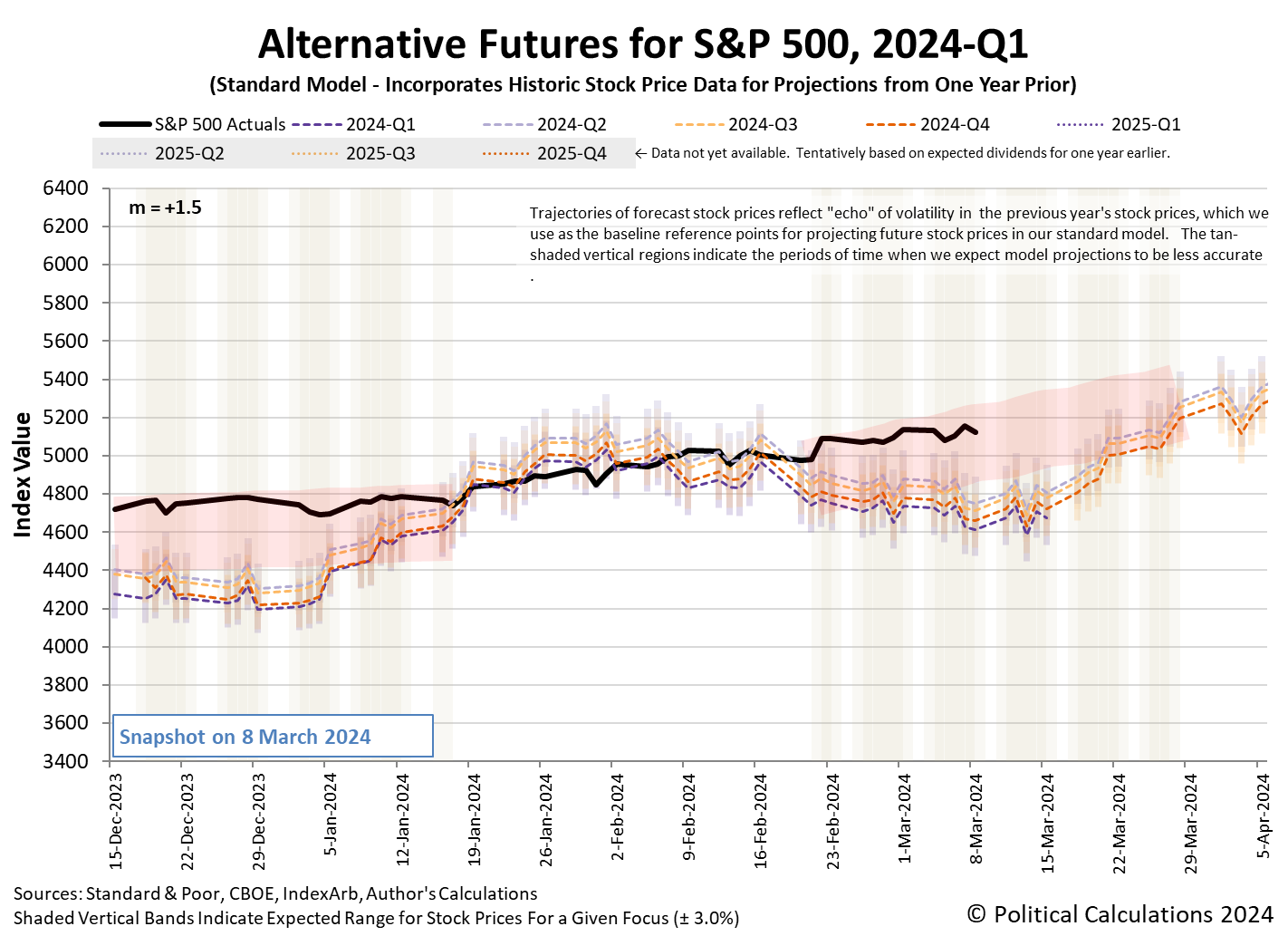

In the latest update to the alternative futures chart, we find the trajectory of the S&P 500 is still running in the upper half of the latest redzone forecast range.

That forecast range assumes investors will remain closely focused on 2024-Q2 in setting the level of the index, which aligns with investor expectations of the Fed's interest rate cuts starting in June 2024.

Monday, 4 March 2024

- Signs and portents for the U.S. economy:

- Fed minions says in no hurry to cut rates:

- Bigger trouble developing in China:

- JapanGov minions thinking it's time to admit years of deflation are over:

- Dow, S&P, and Nasdaq ended lower while yields bumped up

Tuesday, 5 March 2024

- Signs and portents for the U.S. economy:

- Bigger stimulus developing in China:

- BOJ minions get more data saying they should end never-ending stimulus, face reckoning with the zombies it created:

- Wall Street's bull run falters as Nasdaq, S&P, Dow notch worst day since mid-February

Wednesday, 6 March 2024

- Signs and portents for the U.S. economy:

- Fed minions say rate cuts are coming, but probably fewer:

- Bigger stimulus developing in China:

- Bigger trouble developing in China:

- Data likely to push BOJ minions into ending never-ending stimulus soon:

- Nasdaq, S&P, Dow end higher after Fed chair Powell's testimony yields no surprises

Thursday, 7 March 2024

- Signs and portents for the U.S. economy:

- Fed minion claims Fed "not far" from rate cuts, but note "remotely close" to digital currency:

- Global growth signs developing in China:

- Bigger stimulus developing in China:

- BOJ minions inching closer to ending never-ending stimulus:

- ECB minions signal rate cuts coming to Eurozone in June 2024:

- S&P closes at new record high while Nasdaq, Dow also rise ahead of jobs report

Friday, 8 March 2024

- Signs and portents for the U.S. economy:

- Fed minion says interest rates aren't affecting economy:

- Mixed economic signs developing in China:

- BOJ minions getting excited to end never-ending stimulus later this month:

- ECB minions getting excited to cut Eurozone interest rates:

- Wall Street slips from records with Nasdaq leading declines

The CME Group's FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2), unchanged from last week. The Fed is expected to begin a series of quarter point rate cuts starting on that date, continuing into mid-2025 at six-to-twelve week intervals.

Meanwhile, the Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) bumped up to +2.5% after last week's +2.1% projection.

More By This Author:

Visualizing The Volatility Of The S&P 5002024 Starts With New Home Prices Out Of Reach For Typical American Household

Dividends By The Numbers In February 2024

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more