S&P 500 Intrinsic Value Update - Tuesday, June 30

“Davidson” submits:

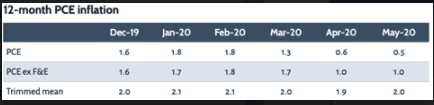

The Value Investor Index is updated with the latest 12mo Trimmed Mean PCE inflation report. The market perception that oil prices are a significant factor for inflation is not supported by recent events. That the recent shifts in oil prices have had no impact on inflation should be a signal that oil prices respond to inflation market psychology rather than a source of inflation. The Value Investor Index is $2,489 and the SP500 at $3,035 sits at a ~21% premium. Speculation in the market is highly skewed in investor’s perceptions towards companies that are believed to benefit from imposition of additional lockdowns due to COVID-19. With valuations ranging from 5x-70x Revenue, parts of the SP500 have an excessive impact on pricing. The remainder of SP500 issues have valuations 0.1x-2x Revenue and deeply discounted with Momentum Investors uniformly chasing identical themes of “ESG” (Environmental, Sustainable, Governance) and COVID-19. Markets are never uniform and one should never chase non-economic themes especially when such themes are skewing the performance of an accepted index.

(Click on image to enlarge)

(Click on image to enlarge)

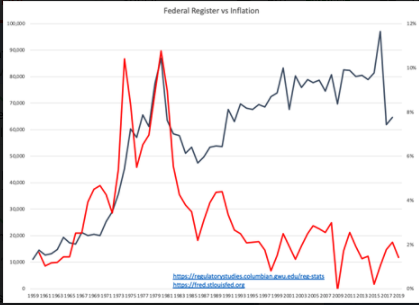

Inflation comes from government acting to debase the basis of currency. This is the direct result of expanding currency without adding value. There are several causal factors. The simplest of these, known since Aristophanes wrote “The Frogs”, ~405 BC, is the oldest known expression of the rule referred to as “Bad money drives out good”. When governments issue currency to expand spending without adding value to society, this is a form of increased taxation, lowers the value of existing currency, and creates inflation. Spending for grand social experiments, war, and infrastructure by the government typically do not add economic value. For public companies, adding value to society amounts to paying off borrowed funds (a temporary increase in currency) by building shareholder equity and replacing debt with equity. When businesses do this successfully, the process involves replacing older consumer offerings with innovative faster, better, and cheaper offerings. To do otherwise insures corporate failure in a competitive marketplace.

Government spending does not do this. Government spending often contains inflated costs to benefit political supporters. This adds to inflation. Government debt does not carry equity replacement and is inherently inflationary. Business competitiveness is inherently deflationary. It is not the increase in Money Supply which has long thought to be believed inflationary, but how politically motivated the government’s expansion of money is spent that matters. The Money Supply this time is simply credit lines to businesses who will be frugal to ensure they survive this shutdown and not overly inflationary. A more subtle but little recognized source of inflation is government regulation to effect social engineering outcomes.

(Click on image to enlarge)

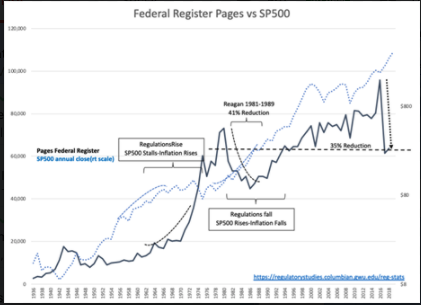

The Federal Register page count published annually has the strongest correlation to inflation of any other factor. Complying with regulations are a business expense that must be passed to consumers so that businesses survive as innovated and profitable entities. When regulations do not add economic value to society they are inflationary. That the rise in the page count 2009-2017 was not inflationary as the late 1970s is due to the “Sequestration” imposed on government spending to counter-regulatory activity.

The current administration has lowered regulations by more than 30% and indicates more reductions are yet to come. The evidence from when Pres. Reagan lowered regulation by ~40% in the early 1980s is plain to see. Economic activity soared as regulation expenses fell, employment rose and inflation fell. The SP500 soared in response. The impact lasted more than 5yrs. The US economy has yet to receive the full impact of the recent regulation reductions. More is yet to come.

Current conditions favor low inflation and decent economic expansion coming out of the COVID-19 shutdown. Buy equities where corporate insider buying is most active!

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

moreComments

No Thumbs up yet!

No Thumbs up yet!