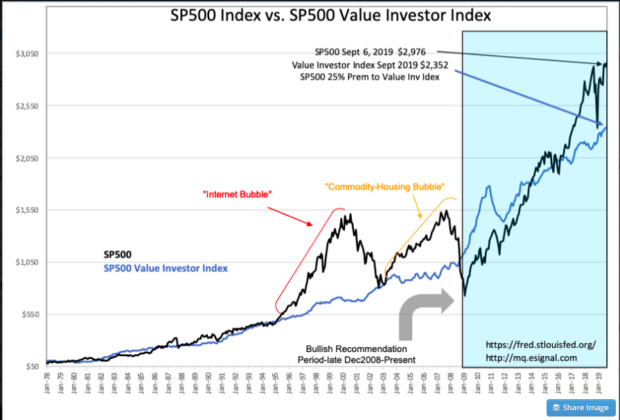

S&P 500 Intrinsic Value Index Update - Friday, Sept. 27

“Davidson” submits:

It is useful to note that the Value Investor Index does not adjust w/rates. It is based on long-term SP500 EPS and the Natural Rate (based on long-term economic fundamentals). The Natural Rate is based on the long-term Real Private GDP trend and a 12mo inflation measure. Many are using the 10yr Treas rate as a capitalization rate which comes from Greenspan’s Fed Model of years ago, but this would have the SP500 priced closer to ~$7,000 -$10,000 with rates 1.65% and a higher level of current earnings as opposed to the 4.94% of the Natural Rate using the historical long-term SP500 EPS median. The basis of the Value Investor Index is that it takes market psychology which has driven 10yr rates towards record lows out of the calculation.

(Click on image to enlarge)

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

moreComments

No Thumbs up yet!

No Thumbs up yet!