S&P 500 Futures Climb To Fresh Highs, Driven By Chipmakers

Image Source: Pexels

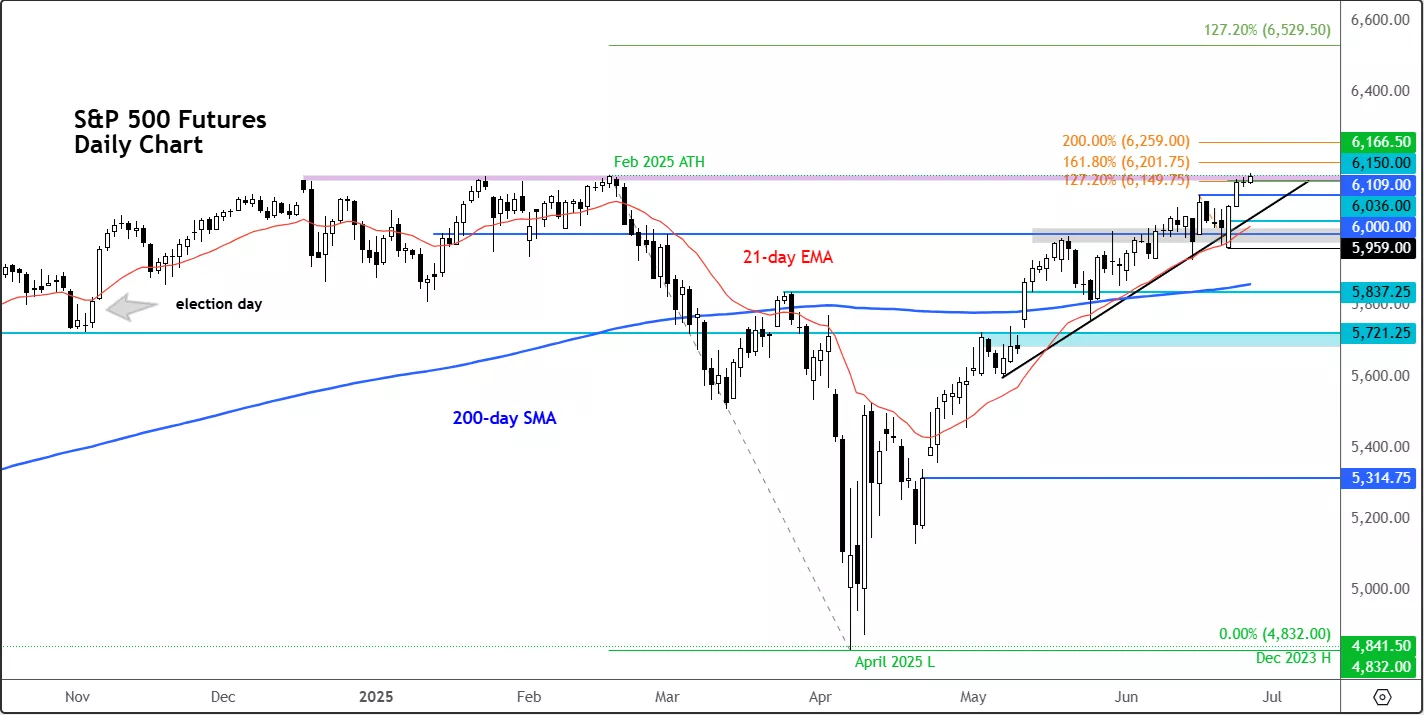

The S&P 500 futures have punched into uncharted territory again, pushing above the February high and topping 6,166. This move is closely following Nasdaq’s lead, with the bigger story being that we have had some geopolitical calm and an AI-fueled tech rally, plus the prospects of a sooner Fed rate cut under a different chairperson.

A surprise de-escalation in the Middle East gave markets a breather earlier this week. The ceasefire between Iran and Israel—brokered by the U.S.—appears to be holding, easing geopolitical tensions that had been simmering for weeks. Investors, for now, are treating that as a green light to buy.

But just as one source of uncertainty fades, another has taken its place. According to the Wall Street Journal, there’s mounting speculation that Donald Trump could replace Federal Reserve Chair Jerome Powell as early as September or October. That possibility has caused the US dollar to fall further and Treasury yields pulled back as traders began pricing in a more dovish Fed under new leadership—even if that leadership remains theoretical for now.

Technical Picture: Bulls Still Have the Ball

From a chart perspective, it’s hard to argue against the trend. The S&P 500 futures have broken cleanly above February’s peak, and the index looks poised to continue grinding higher unless proven otherwise.

(Click on image to enlarge)

Let’s talk levels:

- 6,150 – this marks the 127.2% Fibonacci extension from the mid-June dip and has already flipped from resistance to support.

- 6,109 – the mid-June high could act as a cushion on pullbacks.

- 6,081 – Monday’s high and the launchpad for the latest leg higher.

- 6,036 – an intraday support level tied to this week’s upward momentum.

- 6,000 – the psychological milestone that bulls will need to fiercely defend.

- 5,959 – this is the technical line in the sand. A drop below here would mark the first lower low in this uptrend and force a reassessment of the bullish case.

If the rally keeps its footing, 6,200 is a realistic near-term target, aligning nicely with the 161.8% Fibonacci projection from mid-June’s pullback.

Powell on the Hot Seat? What That Means for Rates

The Powell rumor mill has added a layer of political drama to an already sensitive macro environment. Markets are reading this as a sign that interest rate cuts could not only come sooner—but be deeper. Hence, the Dollar Index has fallen further, breaking recent support at 97.60-97.92 area. Whether Powell stays or goes, the message from investors is clear: the Fed will have to act eventually, especially with inflation pressures appearing more manageable.

However, Powell isn’t folding just yet. The Fed remains cautious, particularly with risks related to tariffs and fiscal policy lingering in the background. The July 9 expiration of the current 90-day reciprocal tariff pause could reintroduce significant volatility. Likewise, Trump’s push to pass a sweeping fiscal bill by July 4 has traders watching Washington just as closely as Wall Street.

Big Tech Still Carrying the Market

Once again, the heavy lifting is being done by tech, and more specifically, chipmakers.

Micron was the standout on Wednesday after offering a bullish revenue forecast. But Nvidia, the undisputed poster child of AI exuberance, continues to steal the show. The stock surged again in pre-market, touching above $156, reaffirming its central role in this rally.

At this stage, it’s clear the market is surfing a wave of AI-driven optimism. But beneath the surface, cracks may soon show again. The S&P 500 is now trading at 22 times forward earnings—well above its long-term average. Elevated valuations haven’t scared off buyers yet, but they remain a potential headwind if macro data starts to disappoint.

Measured Climb or Melt-Up?

So where do we go from here? There’s undeniable momentum, driven by tech strength, fading geopolitical fear, and hopes for easier monetary policy. But the climb may start to slow if valuations bite back or Washington injects fresh uncertainty into the mix.

More By This Author:

EUR/USD Outlook: Dollar Gives Up Oil Driven Gains As Powell Testimony LoomsS&P 500: All About The Middle East Tensions And Oil Prices

GBP/USD In Sharp Focus As Middle East Tensions, Fed, BoE All Come Into Focus