S&P 500 Forecast: Looks For Reasons To Break Higher

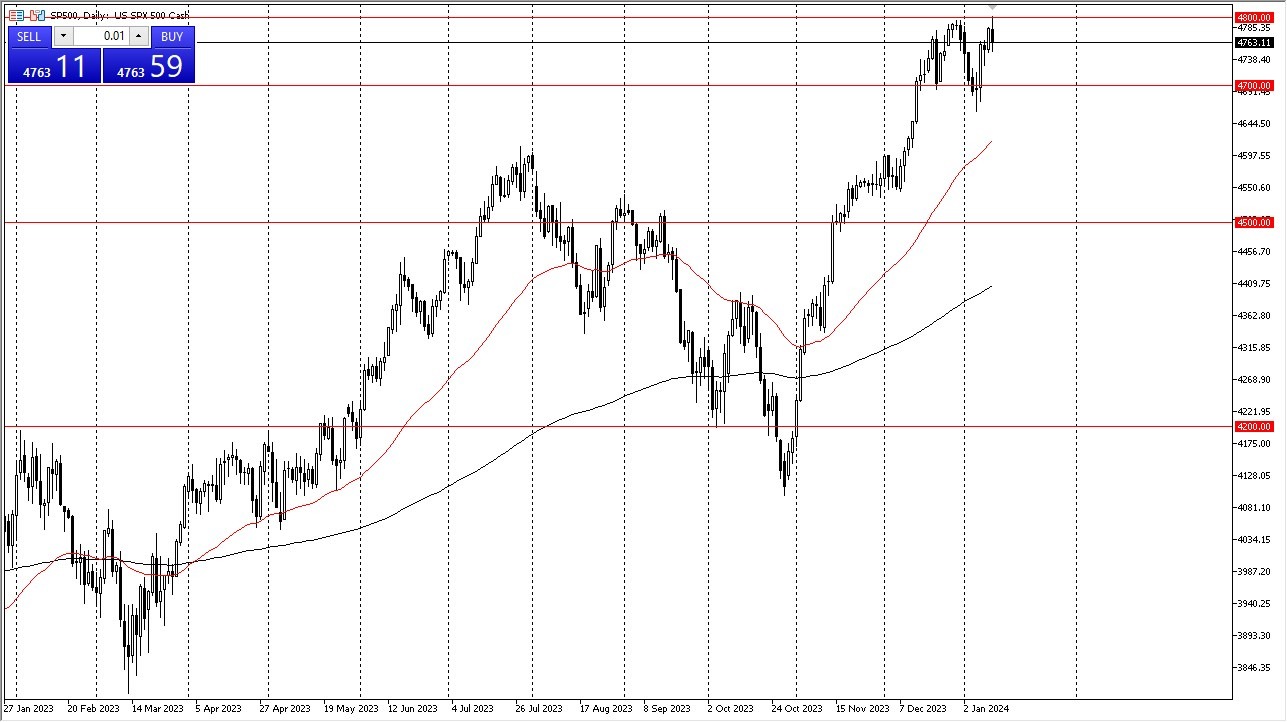

Ultimately, the S&P 500 has experienced significant volatility in response to the CPI data, with a resistance barrier at 4,800. Support at 4,700 is crucial, and a consolidation phase may ensue.

- The S&P 500 exhibited notable volatility during Thursday's trading session, prompted by the release of the Consumer Price Index (CPI) data, which registered slightly higher than Wall Street's preference.

- Presently, the index faces a significant resistance barrier at the 4800 level, which was a previous high.

- This is an area where a lot of noise will be a factor.

(Click on image to enlarge)

As we look at the S&P 500's performance, it's evident that it has been struggling at the 4800 level, a zone that has historically posed formidable resistance. A break above this level would provide the market with the potential to extend its gains. However, the current landscape portrays a market grappling with indecision. Consequently, it is crucial to acknowledge the importance of the 4,700-support level. It is entirely plausible that the market may experience a period of consolidation.

The Technical

The market previously witnessed a substantial rally, and, logically, a period of correction or consolidation is necessary to offset those gains. A breach below the 50-day Exponential Moving Average could open the door to a descent towards the 4,500 level. This, as always, hinges on the prevailing sentiment surrounding interest rate expectations in the United States. Favorable signals suggesting potential rate cuts by the Federal Reserve tend to be well-received by Wall Street.

As we look at the S&P 500's performance, it's evident that it has been struggling at the 4800 level, a zone that has historically posed formidable resistance. A break above this level would provide the market with the potential to extend its gains. However, the current landscape portrays a market grappling with indecision. Consequently, it is crucial to acknowledge the importance of the 4,700-support level. It is entirely plausible that the market may experience a period of consolidation.

The Technical

The market previously witnessed a substantial rally, and, logically, a period of correction or consolidation is necessary to offset those gains. A breach below the 50-day Exponential Moving Average could open the door to a descent towards the 4,500 level. This, as always, hinges on the prevailing sentiment surrounding interest rate expectations in the United States. Favorable signals suggesting potential rate cuts by the Federal Reserve tend to be well-received by Wall Street.

More By This Author:

Natural Gas Forecast: Sees Noisy ActionBTC/USD Forecast: Presses Higher On Thursday

S&P 500 Forecast: Looks To CPI And PPI

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more