S&P 500 Falls Short Of Reaching New High As 2023 Ends And 2024 Begins

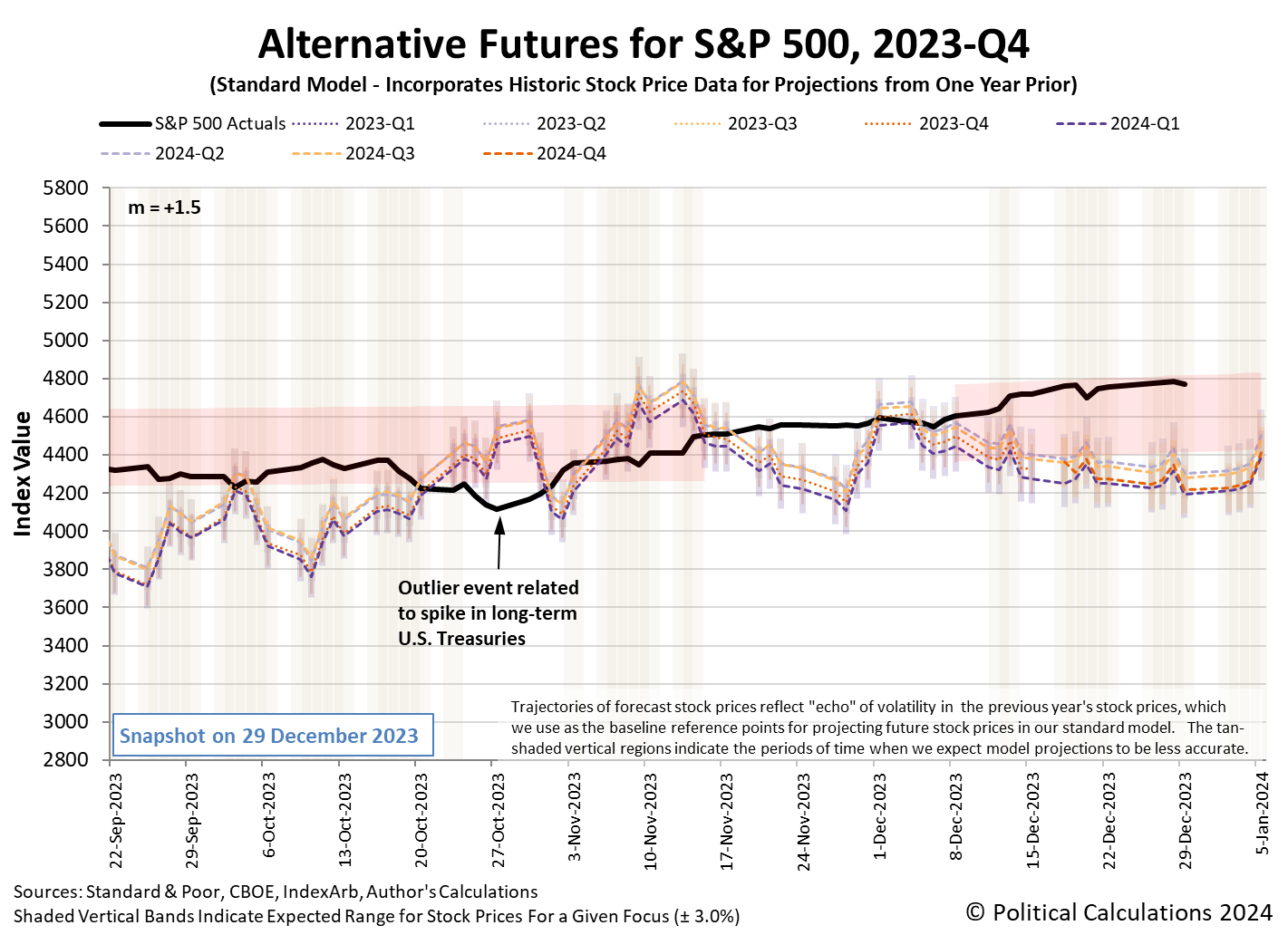

The S&P 500 (Index: SPX) came close to reaching and surpassing its two-year-old record high of 4,796.56 from 3 January 2022 in the final weeks of 2023. Alas, the index fell short and closed out 2023 at 4,769.83, just 0.56% shy of setting a new record.

That's close enough for the S&P 500 to reach a new high on absolutely no news with little more than typical day-to-day volatility. Then again, that's all it took for the 505 component stocks that make up the S&P 500 to top out at its old record on the first trading day of 2022 before beginning its descent into a prolonged bear market on the prospects of rising interest rates.

Stock prices have since nearly recovered to their old record high on the strength of a rally that began in late October 2023 after investors determined the Federal Reserve had reached the end of the series of rate hikes it began in March 2022. Now, the CME Group's FedWatch Tool indicates investors are not anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 20 March 2023 (2024-Q1), when the Fed is expected to start a series of quarter-point rate cuts at six-to-twelve-week intervals through the end of 2024.

These strengthening future expectations were enough to deliver an old-fashioned Santa Claus rally at the end of 2023, which more or less ran out of steam in the final days of the year. The latest update of the alternative futures chart shows the whole rally through the final trading day of 2023.

There was very little new information for investors to absorb during the final trading weeks of 2023. Here is what passes for the market-moving news headlines during that time.

Monday, 18 December 2023

- Signs and portents for the U.S. economy:

- Fed minions admit they're confused, will be cutting rates in 2024:

- Bigger stimulus developing in China:

- ECB minions thinking about cutting rates in June 2024:

- Nasdaq, S&P extend seven-week bull run, Dow ends flat as year-end comes into view

Tuesday, 19 December 2023

- Signs and portents for the U.S. economy:

- Fed minions claim they are "nicely positioned" for inflation, claim no urgent need to cut rates:

- BOJ minions keep never-ending stimulus alive, for now:

- Wall Street ends higher as rate-cut fever lingers

Wednesday, 20 December 2023

- Signs and portents for the U.S. economy:

- Fed minions try playing coy over coming interest rate cuts:

- Wall Street tumbles to sharply lower close as abrupt sell-off snaps rally

Thursday, 21 December 2023

- Signs and portents for the U.S. economy:

- Speculations about what Fed minions will do in 2024:

- BOJ minions get reason to keep never-ending stimulus alive a little longer:

- Wall St ends sharply higher, rebounding with a boost from chips

Friday, 22 December 2023

- Signs and portents for the U.S. economy:

- Fed rate cuts firmly in view for 2024, even as rate-setters shift

- S&P 500 posts best weekly win streak in over six years as Wall Street rally powers on

Tuesday, 26 December 2023

- Signs and portents for the U.S. economy:

- BOJ minions creep closer to ending never-ending stimulus, dissent over messaging:

- Nasdaq, S&P, Dow kick-off final week of 2023 with gains, as Wall Street eyes record close

Wednesday, 27 December 2023

- Signs and portents for the U.S. economy:

- Bigger stimulus developing in China:

- Signs of stimulus gaining traction in China:

- BOJ minions want to think more about ending never-ending stimulus:

- Wall St ekes out modest gains as S&P 500 hovers near all-time closing high

Thursday, 28 December 2023

- Signs and portents for the U.S. economy:

- Bigger trouble, stimulus developing in China:

- BOJ minions get reason to keep never-ending stimulus alive:

- ECB minions claim they may not cut rates in 2024:

- S&P 500 ekes out meager gains, flirts with bull market confirmation

Friday, 29 December 2023

- Signs and portents for the U.S. economy:

- 2023 is in the books as the Dow, S&P, and Nasdaq slide on the last trading day of the year

Starting from a projected +2.6% annualized growth rate on 15 December 2023, the Atlanta Fed's GDPNow tool's estimate of real GDP growth for the current quarter of 2023-Q4 dipped to +2.3%, where it held throughout the Christmas-through-New Year’s holidays. The Atlanta Fed's projections for GDP growth in the final quarter of 2023 will continue until they are replaced by the BEA's initial estimate of that growth at the end of January 2024.

In the next edition of the S&P 500 chaos series, we'll roll the alternative futures chart forward to provide a glimpse of what to expect for stock prices throughout the first quarter of 2024.

More By This Author:

Your Paycheck In 2024What's Your U.S. Income Percentile?

Lifetime Income Trajectories By Education Level

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more