S&P 500 Erases Losses And Stages Miraculous Rebound, FOMC & Geopolitical Tensions Eyed

After a substantial early morning sell-off, U.S stocks reversed course and staged a stunning rebound, finishing the day slightly higher as dip-buyers took the opportunity to swoop in to scoop up beaten-down shares ahead of Wednesday's FOMC decision.

At the closing bell, the S&P 500 was up 0.28% to 4,410, recovering from a ~4% decline that briefly plunged the world's most popular equity index into correction territory for the first time since 2020. The Dow Jones, after a 180-degree turnaround, also ended in the green, up 0.29% to 34,364. Elsewhere, the Nasdaq 100, which bore the brunt of the rout during most of the day, miraculously erased a 5% plunge to finish 0.49% higher at 14,509. Last but not least, the Russell 2000 managed to outperform its main Wall Street peers, rallying 2.29% to 2,033, after suffering steep losses during the early trade

Before the late-afternoon rebound, concerns about the path of monetary policy were the main negative catalyst for equities, especially those in the tech and growth universe. Investors appear increasingly worried that the Fed's tightening cycle aimed at curbing inflation may be too aggressive and ultimately trigger a hard landing at a difficult time when the U.S. economy is rapidly losing steam. On the latter point, the deceleration was most evident in the IHS Markit PMI data released this morning. According to the financial intelligence firm, in January U.S. business activity in the services sector slumped to 50.9 from 57.6 in December, hitting an 18-month low and coming within a whisker of recessionary terrain (for refence, any reading below 50 indicates contraction while a figure above that level signals expansion). While the slowdown can be blamed in part on the omicron surge, the recovery is still weakening and bodes ill for corporate earnings.

During most of the session, risk aversion was compounded by rising geopolitical tensions in Eastern Europe, specifically the latent threat of Russia invading Ukraine in the coming days or weeks. The situation is very fluid, but the U.S. ambassador to the United Nations warned allies to prepare for a possible failure of diplomacy, a sign that hope for a last-minute breakthrough is quickly fading. At this point, there are many unknown variables, but Wall Street fears that an invasion could reverberate through global markets and trigger a worldwide recession. If an escalation occurs, the White House is likely to impose drastic economic sanctions on Moscow to deter further aggression in the future, a scenario that can significantly drive-up energy and agricultural commodity prices. Restrictions that curtail Russia’s exports can exacerbate the highinflation trend around the globe and lead to significant demand destruction, but we’ll need to see how the standoff plays out before making general assessments about the outlook.

Turning our attention to other catalyst, the reporting season will remain in the spotlight, but the focus will concentrate on earnings and guidance from the mega caps, as these companies typically have a greater impact on the direction of the broader market. That said, Microsoft, Tesla and Apple are set to announce results in the coming days (Tuesday, Wednesday and Thursday respectively).

Finally, earnings aside, traders should closely follow Wednesday’s FOMC decision, arguably the most important event of the week. While no change in monetary policy is expected, the central may offer insight into the tightening cycle, including the timing of the liftoff and the start of the balance sheet runoff. All things considered, the bank is likely to indicate that the normalization process remains on track, but may issue a less hawkish message to calm investors and stabilize markets. Any sign that policymakers will be patient and not raise borrowing costs as aggressively as traders had discounted in recent days, when they were forecasting four rate hikes for the year, may produce a large relief rally and pave the way for the S&P 500, Dow Jones, and Nasdaq 100 to regain lost ground in 2022.

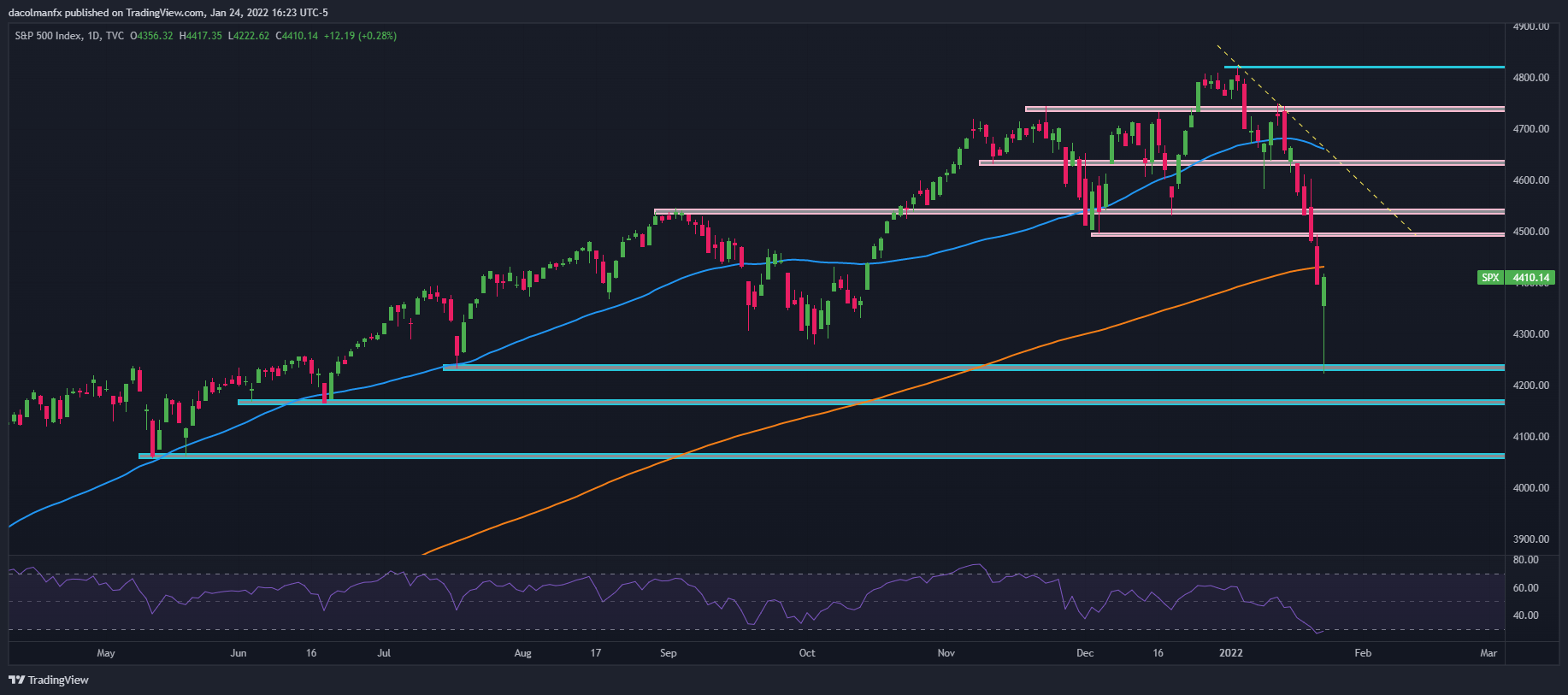

S&P 500 TECHNICAL ANALYSIS

At its worst point of the day, the S&P 500 plunged roughly 4%, but selling pressure abated as the hours went by as dip buyers stepped in to blunt the sell off. On that note, the daily chart shows that price bounced off a key support in the 4,230 area (July 2021 low), but was unable to reclaim its 200-day simple moving average.

Having said that, the near-term bias remains bearish after the extensive technical damage caused by the recent pullback, however, the index outlook could turn slightly more constructive should price overtake the 200-day SMA. If that scenario plays out, we could see a move towards 4,495/4,500, followed by a possible test of the 4,540 area.

On the flip side, if strong downside momentum picks up pace, support can be seen in the 4,230-region. If bears manage to push the index below this floor, the corrective phase could accelerate and trigger a move towards the June 2021 low at 4,165.

S&P 500 TECHNICAL CHART

(Click on image to enlarge)

Disclaimer: See the full disclosure for DailyFX here.

But why did it stage a rebound? Pure perception, 0 fundamentals.

Zero fundamentals? You bears need to stop hoping for the world to end. Many time frames show this is near the bottom for now

Who said anything about the world ending? The only thing that is changing is the free money. It will be back though and that's when the game will be on. The game that the fed is playing the that they can somehow return to normal interest rate someday.