S&P 500 Drops As Outlook For Banks, China Get Worse

There were two sets of news headlines that combined to impact the U.S. stock market during the trading week ending Friday, 18 August 2023.

Domestically, Fitch Rating's threatened downgrade of a dozen banks in the U.S., including JP Morgan Chase (NYSE: JPM) underscored the growing risks on their balance sheets from the Federal Reserve's series of rate hikes. The rate hikes have resulted in the rapid accumulation of unrealized losses for banks with large holdings of U.S. Treasuries, putting them at risk of failing as Silicon Valley Bank and other smaller banks did earlier in the year.

Internationally, the biggest economic story in the world continues to be China's sputtering economy. The Chinese government's action to terminate the reporting of its youth employment statistics revealing its developing troubles indicates those building problems are bigger than it wants to admit. At the same time, the government's official economic statistics agency is attempting to minimize the perceived risk to China's economy from the heavy debts of its real estate sector and the country's local governments.

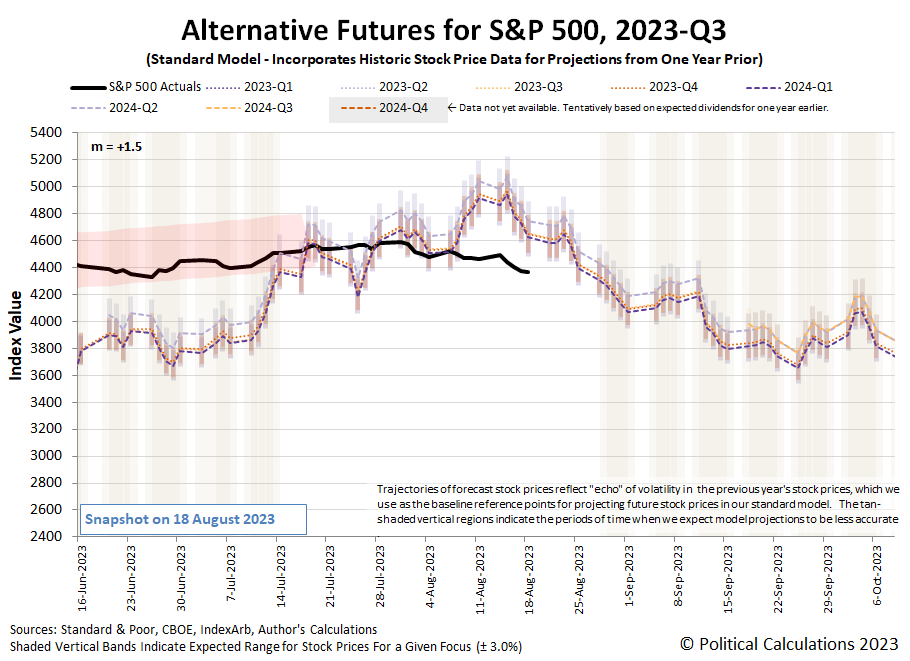

For the S&P 500 (Index: SPX), the looming potential downgrades of U.S. banks carried more weight, leading the index to fall to 4369.71, a 2.1% decline from the previous week’s close. Here's the latest update to the alternative futures chart for the third quarter of 2023:

We've refrained from adding a redzone forecast chart to account for the deviation from the dividend futures-based model's projections over the last couple weeks for two reasons. First, the current deviation from the model's echo effect will be short-lived, as we expect the trajectory of the index to rejoin the model's projections on Friday, 25 August 2023. That will coincide with Jerome Powell's address at the Federal Reserve's Jackson Hole annual summer get-a-way.

Second, we'll be using that date as the starting anchor point for a much longer redzone forecast range that will last into mid-November 2023. We'll be adding that new redzone forecast range to the chart in the next edition of the S&P 500 chaos series.

But, that doesn't mean you can't sketch your own redzone forecast range on the chart for this short period! All you need to do is connect the dots for where the S&P 500 was on Monday, 7 August 2023 with where the dividend futures-based model projects it will be on Friday, 25 August 2023.

That raises the question of "which projection?", but that's easily answered. Investors are currently focused on 2023-Q4 in setting current day stock prices, so you would use the projection associated with that future quarter. It's not your imagination. It really is that easy, and the S&P 500 is already about two-thirds of the way there!

Here is our summary of the past week's market moving headlines:

Monday, 14 August 2023

- Signs and portents for the U.S. economy:

- Fed minions counting on slowing rents to beat inflation down to 2% target:

- Bigger trouble developing in China:

- S&P 500, Nasdaq end up as Nvidia surge leads megacap higher

Tuesday, 15 August 2023

- Signs and portents for the U.S. economy:

- Fed minions claim they're not done with rate hikes yet:

- Strange things going on with official Chinese stats:

- Bigger trouble developing in China:

- Suddenly much bigger stimulus developing in China:

- Bigger fiscal stimulus developing in Eurozone:

- Broad Market Selloff Sends S&P 500 Below Its 50 Day Moving Average

Wednesday, 16 August 2023

- Signs and portents for the U.S. economy:

- Fed minions divided in July over need for more rate hikes, minutes show

- Bigger trouble developing in China:

- BOJ minions thinking about intervention to keep yen from falling:

- Stocks, oil slide as Fed mulls rates and China struggles

Thursday, 17 August 2023

- Signs and portents for the U.S. economy:

- U.S. 10-year Treasury yield hits highest since October, drags on shares

- Oil edges up as China seeks to calm economic fears

- US weekly jobless claims fall as labor market remains tight

- US 30-year fixed mortgage rate jumps to near 21-1/2-year high

- U.S. Mid-Atlantic manufacturing sky-rockets to 16-month high

- Fed minions set date for their biggest event of the summer:

- Bigger trouble developing in China as investors bet on bailout:

- Chinese central bank issues warnings while promising stimulus:

- Bigger trouble developing in the Eurozone:

- Wall Street ends lower on healthcare losses, interest rate jitters

Friday, 18 August 2023

- Signs and portents for the U.S. economy:

- "Slim" majority of economists say Fed minions done with rate hikes:

- Bigger trouble developing in China:

- Other signs of China's trouble spreading in Asia:

- Bigger stimulus developing in China:

- BOJ minions see justification to keep never-ending stimulus alive:

- ECB minions thinking about declaring victory over inflation despite sluggish economy in Germany, want to keep Eurozone banks from new taxes in EU countries:

- Nasdaq, S&P 500 and Dow finish relatively unchanged as yields cool a bit

The CME Group's FedWatch Tool developed an interesting quirk this week. While it continues to show no rate hike in September (2023-Q3), it is now giving a greater than 50% probability the Fed will hike rates by a quarter point when it meets on 1 November (2023-Q4). But only for six weeks, because it also shows the Fed reversing to cut rates by a quarter point just six weeks later in December (2023-Q4). After that, it anticipates no other rate changes through May 2024, followed by a series of quarter point rate cuts will begin as early as 12 June (2024-Q2) and continue at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool strapped its estimate of real GDP growth in 2023-Q3 onto a rocket in the last week. It is now predicting annualized real growth of +5.8%, which is up a lot from the previous week's estimate of +4.1%. It's also much higher than the top end of the projected range for the so-called "Blue Chip Consensus" for the quarter. We'll find out which set of forecasters is more right a little over two months from now.

More By This Author:

Clearing The Danger ZoneConnecting FFO To DPS For REITs

How Much Fossil Fuel CO2 Is in the Air?

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more