S&P 500: Bulls Are Coming Back?

Stocks retraced some more of their recent declines on Tuesday. Will the market continue higher following today’s consumer inflation data?

The S&P 500 index gained 0.92% yesterday, as it got back above the 4,700 level. The broad stock market’s gauge extended its advance following Monday’s upward reversal from the local low of 4,582.24. It was a dip-buying opportunity, however, the short-term advance still looks like an upward correction within a new downtrend. The broad stock market continues to trade within an over two-month-long consolidation. Late December – early January consolidation along the 4,800 level was a topping pattern and the index fell to its previous trading range.

On Dec. 3 the index fell to the local low of 4,495.12 and it was 5.24% below the previous record high. So it was a pretty mild downward correction or just a consolidation following last year’s advances.

The nearest important resistance level is at 4,700-4,720 and the next resistance level is at around 4,750. On the other hand, the support level is at 4,650. And the important support level is now at 4,580-4,600, marked by Monday’s daily low. The S&P 500 is close to its November-December local highs again, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

(Click on image to enlarge)

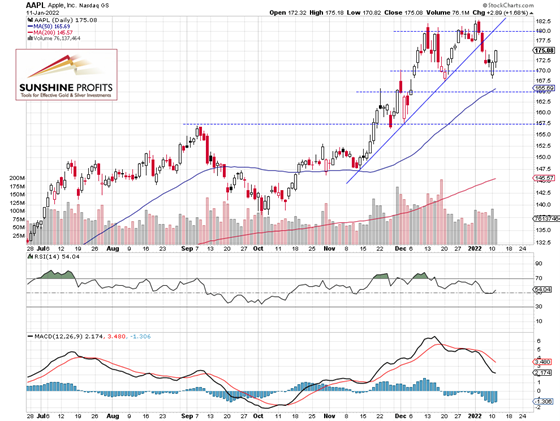

Apple Bounced From the $170 Price Level

Last week, Apple stock broke below its two-month-long upward trend line after reaching the new record high of $182.94 on Tuesday. So far, it looks like a downward correction and the nearest important support level is at $165-170, marked by the previous highs and lows. The stock trades within an over month-long consolidation of around $170-180.

Is this a medium-term topping pattern? It’s getting very hard to fundamentally justify Apple’s current market capitalization of around $3 trillion.

(Click on image to enlarge)

Conclusion

The S&P 500 index is expected to open 0.4% higher this morning following the Consumer Price Index release which was slightly higher than expected at +0.5% m/m. So the broad stock market will retrace more of the recent declines. However, we may see a profit taking action later in the day.

Here’s the breakdown:

- The S&P 500 extended its short-term uptrend yesterday. It may be still a correction within a downtrend or some further consolidation along the 4,700 level.

- In our opinion, no positions are currently justified from the risk/reward point of view.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a ...

more