Someone Must Be Confident

This morning, we received the latest in a string of downbeat sentiment readings.The latest came from the Conference Board, whose release was entitled, “US Consumer Confidence Plunged Again in April.”Meanwhile, other surveys of investor sentiment show a preponderance of bearish sentiment.Despite that, stocks are continuing their advance.

Consumer Confidence for April fell to 86.0, down from a revised 93.9 last month, and below the 88.0 consensus.Worse, the Expectations Index fell to 54.4 from a revised 66.9.Here is how the Conference Board explains the findings:

“Consumer confidence declined for a fifth consecutive month in April, falling to levels not seen since the onset of the COVID pandemic,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The decline was largely driven by consumers’ expectations. The three expectation components—business conditions, employment prospects, and future income—all deteriorated sharply, reflecting pervasive pessimism about the future. Notably, the share of consumers expecting fewer jobs in the next six months (32.1%) was nearly as high as in April 2009, in the middle of the Great Recession. In addition, expectations about future income prospects turned clearly negative for the first time in five years, suggesting that concerns about the economy have now spread to consumers worrying about their own personal situations. However, consumers’ views of the present have held up, containing the overall decline in the Index.”

And for those who are understandably wondering if the drop had a political bias or failed to affect more affluent households:

April’s fall in confidence was broad-based across all age groups and most income groups. The decline was sharpest among consumers between 35 and 55 years old, and consumers in households earning more than $125,000 a year. The decline in confidence was shared across all political affiliations.

We can see from the following long-term chart that while sentiment is down sharply, it is far from historically terrible.The same can’t be said for expectations, though:

Conference Board Sentiment (white) and Expectations (blue), quarterly data since 1966

(Click on image to enlarge)

Source: Bloomberg

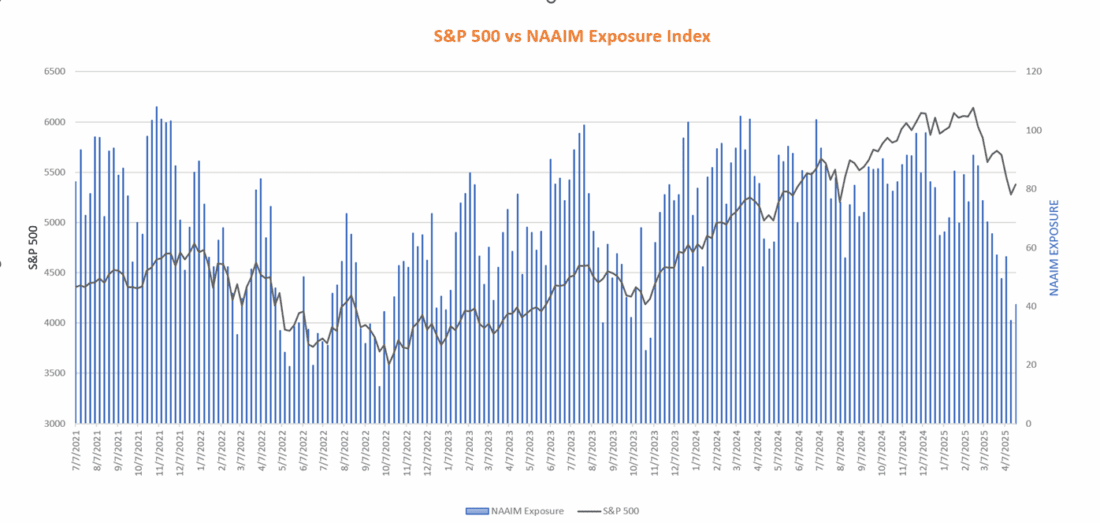

Meanwhile, sentiment among institutional investors is not particularly great either.The National Association of Active Investment Managers (NAAIM) has created an Exposure Index, which they describe as:

The NAAIM Exposure Index represents the average exposure to US Equity markets reported by our members.

We can see in the chart below that the Exposure Index is near, but not quite at, four-year lows:

(Click on image to enlarge)

Sources: NAAIM, Interactive Brokers

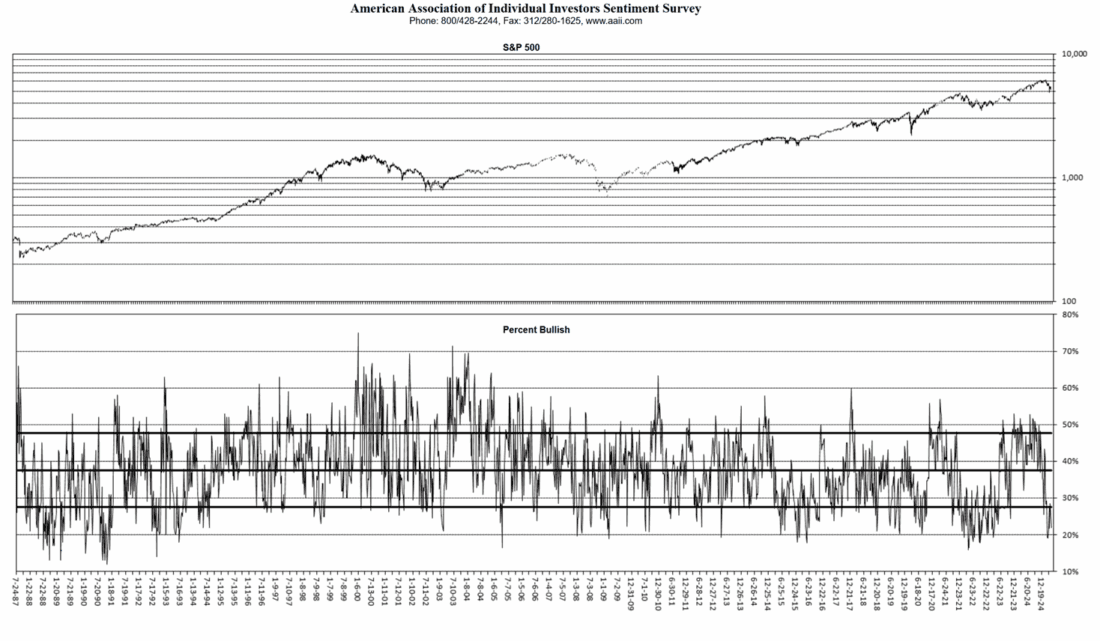

Yesterday, we explored the idea that institutions were the primary sellers in the recent downturn and that individuals were the ones who bought through the declines and were instrumental in turning the market higher.Yet the survey data from the American Association of Individual Investors (AAII) shows bullish readings near their own long-term lows:

(Click on image to enlarge)

Source: AAII

Yet someone has been willing to bid up for equity exposure.We wouldn’t have seen a bounce, nor would we be in the midst of a week-long up streak otherwise.

(An important aside: I HATE when people say there are more buyers than sellers or vice versa when the market moves.There is always, ALWAYS, equal amounts of shares being bought and sold.Prices move because one cadre of investors is more aggressive than the other.Prices go up when the buyers are more aggressive, and down when the sellers are more aggressive.)

The answer lies in the standard caveat when looking at survey data: watch what people DO, not what they SAY.Actions speak louder than words.That said, I am loath to completely dismiss the negative sentiments.We know that it is often a good time to be contrarian when market-related sentiment gets extreme.That worked extremely well earlier this month.But from an economic sense, sentiment can become self-fulfilling.If too many consumers pull back on their spending and investment, that can cause a contraction, or even a recession, simply on its own.And since sentiment is down, but not at true long-term lows, that bears watching.

More By This Author:

Who Is The “Smart Money”?

Whither The Rally?

The Word Of The Week: “Uncertain”

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more