Some Reasons NIO And XPeng Could Be Good Buys

The EV industry offers multiple different investment options, from established manufacturers to components suppliers and miners. In China, NIO and XPeng XPEV both look to have high growth potential as the two differentiate themselves from competitors.

The EV frenzy earlier in the year has started to dwindle down, with many established companies and SPACs seeing some hefty valuation crunches. In China, EV adoption and government support remain high, and the consumer market is highly fragmented with heavy competition, leaving room for major and minor players alike to grow. With expected EV sales growth of 40% to 1.8 million units for 2021 (although the chip shortage could impact this) and high expected growth rates through 2025, NIO and XPeng, two of the stronger startups in China, could find impressive runways to growth as the two have worked to separate themselves from the rest through holistic approaches to product offerings and technological advancement.

NIO: Stronger Financials and Improved Product Offerings

NIO is quickly climbing the ladder and establishing itself as a dominant Chinese and potentially global EV manufacturer, finally reaching the 100,000th delivery milestone in April. The company could be set to reach another quarterly delivery record, as Q2’s guidance offers some small upside, +4.7% to +9.7% q/q to 21,000 to 22,000 units. Guidance and growth at this degree would imply continuation of a 7,500-unit production limit incurred by the chip shortage, but still representing strong demand to reach over 40,000 units in 1H.

Q1's financials were strong, as NIO recognized +20.2% revenue growth q/q as deliveries were just +15.6%. Higher ASPs and higher deliveries relative to Q4, stemming from an expanded sales network and a better product mix, aided revenue growth. Revenues from the 100kWh permanent upgrade in BaaS were strong, with over half of vehicles delivered in Q1 electing for one of the BaaS subscriptions. Even so, the stronger pieces of the report surfaced within NIO's margin profile, aided by uptake of BaaS battery upgrades and NIO Pilot. Vehicle margin expanded 400 bp q/q to 21.2%, the highest margin that NIO has reached in its lifetime and the highest between Li and XPeng. Gross margin expanded as well, up 230 bp q/q to 19.5, enhancing operating leverage down the lines: gross profit increased 36.2%, operating loss narrowed 68.2%, and adjusted net loss narrowed 73.3%.

Leverage from continual delivery growth and higher ASPs (whether that remains with high BaaS uptake and related discounts is yet to be seen) should drive NIO to profitability as the margin profile continues to improve. NIO lost only RMB0.23 (US$0.04) per share for Q1 (excl. accretion on non-controllable interests), and keeping a high margin profile of this sort, above 17%, could see NIO reach profitability as early as Q4 this year if chip shortages do not severely impact operations and high seasonal demand in 2H is exhibited.

Aside from an improved financial picture, NIO has a few important positive developments that can pave the way for future success: increasing customer utility and building out a holistic infrastructure and product/service offering.

NIO’s Power segment primarily provides a "power service system with chargeable, swappable, and upgradable batteries," but has expanded its offerings to include home chargers and on-the-road functions. Power Home 2.0 and Plus offer remote charge scheduling, real-time charging status, multi-user ability, FOTA upgrades, and more. The 20kWh Plus charges 100kWh battery from 20% to 90% in 3.5 hours, while the 7kWh takes longer. Although this does not necessarily compare to superchargers, with a 10-hour charging duration for the 7kWh station, the value proposition within Power services and BaaS offset that.

The Power Network, NIO’s charging and swapping infrastructure, continues to grow, with over 200 Power Swap and 142 supercharging Power stations alongside 'destination' stations. The Power Swap 2.0 “could significantly boost the service capacity of each station to maximum 312 times per day” with a swapping time of less than 3 minutes per vehicle. The 'Power North' plan is more infrastructural-focused, and "it will deploy a total of 100 Power Swap stations, 120 Power Mobiles, 500 Power Charger stations with over 2,000 Power Chargers, and over 10,000 destination chargers in eight provinces and autonomous regions" by 2024. Public charging expansion benefits both NIO and non-NIO owners, with more access to enhanced supercharging and destination charging. More Power Swap and Power Swap 2.0 stations can increase adoption of BaaS and lead to growth of monthly revenues streams.

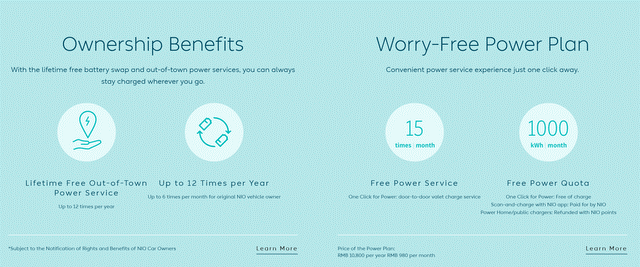

NIO is developing Power Mobile, a new charging solution where owners request a charge whenever needed, with a charging van sent directly to them. NIO is marketing this as "a flexible and convenient portable power bank to your car," with one of the 300+ charging vans dispatched to the vehicle's location (similar to hailing a rideshare) to charge 100km range in 10 min. Other manufacturers do not provide a charging solution of this sort, and access to flexible charging solutions and BaaS provides a competitive advantage. In addition, NIO's worry-free power plan includes 15 times/month of Power valet (pick-up, charge, return vehicle), and normal ownership benefits include lifetime free power service and battery swapping, once per month.

(Click on image to enlarge)

Graphic from NIO

The monthly subscriptions and related discounts offered under BaaS make NIO’s models more affordable upfront, and allow it to compete with cheaper, top selling models like Tesla’s Model 3. BaaS was included in over half of new orders in Q1, suggesting strong demand for the service off the bat; the 70kWh BaaS offers a RMB70,000 discount for a monthly RMB980 fee, and the 100kWh BaaS offers a RMB128,000 discount for a monthly RMB1,480 fee. Buyers are still eligible for purchase tax exemption and government subsidies. The discounts create a significant value proposition for prospective buyers, and should be a major tailwind for future deliveries opting in to BaaS – it gives approximately 72 to 86 months of savings under retail price, depending on what battery is selected.

NIO offers similar ownership benefits for vehicle services. Original owners are given lifetime free warranty and roadside assistance, with no time or mileage limits, and lifetime in-car connectivity, up to 8GB cellular data monthly. A door-to-door valet service, like the Power valet, and an annual RMB11,600 worry-free service plan complete the service offerings.

One other long-term positive for NIO to cement its status as one of the leading domestic manufacturers is capacity expansion. NIO has "kicked off the planning and building of a new plant in Xinqiao Industrial Park in Hefei" as part of NeoPark, a 16,950 acre industry park that will become home to multiple companies, 10,000 R&D workers, 40,000 technical workers, and a total annual production capacity of 1 million vehicles among all occupants. NIO is a major partner in creating NeoPark, investing RMB10 billion. Capacity expansion is necessary for NIO to execute its global expansion plans - the company is finally reaching the European market through Norway. NIO will be providing a more detailed look at the 'NIO Norway' launch on May 6, and expansion to other European countries and North American sometime in the upcoming years are possible.

XPeng: Aiming to Lead The Autonomous Race

Even though XPeng's cumulative deliveries are much lower than NIO's, from a later time to market, the company is quickly emerging as a strong competitor and is pushing into a leading position within technological advancement. Rapid production ability, seen within the 160 day completion of the 10,000 units of the P7, combined with future capacity expansion should see deliveries and revenues rise rapidly in the upcoming years due to this superiority. Deliveries for April came in slightly higher m/m, unlike NIO, as XPeng delivered 5,147 units as demand for existing products remains strong with the launch of the P7 Wing and G3 LFP-battery during the month and the P7 LFP in the near future.

XPeng is building one of the best, if not the best, autonomous driving and lidar systems to complement a 700+km maximum range - the company teased a snippet of its new lidar on Twitter, showing a high definition 3D generated field of view. Autonomous capabilities have already reached level 3, backed by the most powerful computing system, as XPeng continues to advance XPILOT and NGP (Navigation Guided Pilot).

XPILOT 3.0, the most recent OTA upgrade, has found a high uptake in deliveries, as approximately one-fifth of P7s elected to use the software just three months after its release late in January. XPILOT 3.5 and 4.0 are under development, and these would allow vehicles to "perform full-scenario highway autonomous driving." Such advancements can put the capabilities of the P7 above competitors' vehicles, and development of the full autonomy software in-house provides seamless update ability, enhancing a push to becoming the leader in autonomy.

(Click on image to enlarge)

Graphic from XPeng

The P7 claimed the longest autonomous drive in China, with benchmarks like interventions surpassing the Model 3. Human interventions were just ~0.71 per 100km on the 3,600km test drive which included nearly 3,000km of highway driving. Tesla's intervention rate was slightly higher at ~1.03 per 100km, and lane changing and tunnel driving were not as successful, at 81.3% and 41.8%. A separate test drive on a 2,000km route saw the P7 log 19 interventions, compared to 22 for the Model 3, while having a higher success rate in heavy rain and tunnels, like from integration with Amap.

As XPeng challenges Tesla and NIO among others, autonomous superiority on top of a competitive price point can help the company scale deliveries and command more market share in the future. Manufacturing expansion should aid the market share growth picture, as XPeng continues to expand its production capacity. Current maximum annual capacity at the Zhaoqing plant is approximately 100,000 units, with a second factory in Guangzhou slated to complete by late 2022 and enter production/deliveries during 2023. Guangdong's provincial government did invest USD$76.8 million to accelerate the factory's construction, which could advance that timeline slightly. XPeng is building a third manufacturing plant in Wuhan, which has a projected capacity of 100,000 units; however, the company has not mentioned a date for completion. Final capacity after all three are operational at maximum scale looks to be approximately 450,000 units annually, paving the way for a high trajectory of delivery growth from the projected 57,500 units in 2021. Expanded product portfolio - the P7 and multiple versions like the Wing, G3 and the upcoming P5 sedan expected in Q4 - also point to positive growth potential.

XPeng also has international expansion plans, with its first shipment of vehicles to Norway occurring late in 2020, beating NIO to the market. Such capacity expansion can allow the manufacturer to hit high domestic demand while still leaving units to be shipped internationally to other target markets. XPeng's technological prowess and pricing at a base US$34,000 are quite attractive for customers and could allow it to steal market share in more mature markets like Norway and Holland.

Risks to Watch

There are a few main risks to watch, including some delivery headwinds from chips, the duration of the chip shortage and sourcing ability, and potential needs for capital.

For NIO, production has not resumed at max, 10,000+ units per month, which can adversely impact the level of deliveries moving forward, such as that seen with Q2’s small upside guidance. Expectations about the chip shortage duration, and for it to clear by the latter half of the year could keep deliveries lower during periods of high seasonal demand, thus affecting high-end revenue growth. Although NIO did say that it expects to have enough chips to navigate through the shortage, the backlog of chips across the industry could make it harder or more expensive to source chips later in the year or in 2022, which could impacts revenues, deliveries, costs and margins.

Also, capital has been and will be a necessity to continue expanding and innovating and to occupy a leading position in China and even the world. NIO unveiled its concept autonomous car, EVE, and potential plans to expansion further in Europe and North America (on top of NeoPark) will be capital-intensive. During Q1, NIO's cash and cash equivalents decreased to RMB28.6 billion, down just over 25% (RMB9.8 billion), from Q4. If more cash is needed, NIO could sell a portion of its RMB18.6 billion in short-term investments, or offer convertible notes or equity, which would incur further dilution. For a discussion of other risks, delivery and revenue projections, and valuation, refer to "NIO: Remaining Bullish After Strong March Deliveries” on SeekingAlpha.

For XPeng, most of its risks arise from a longer timeline to profitability coupled with a valuation at the high end of its peer group. The company already has hefty expenditures in R&D with over 40% of staff in the department and is planning to significantly increase R&D headcount to advance autonomous capabilities and continue innovating. Headcount expansion will increase wages and costs, and impact bottom line growth as operating expenses grow at similar pace to revenues, thus likely keeping its margin profile thinner and prolonging time to profitability as deliveries and revenues scale. XPeng is also developing its own chips in-house for autonomous capabilities, working in both the US and China, to mitigate impacts of the chip shortage; this is likely to increase costs as well.

Overall

EV growth and adoption with government support in China provides much room for the multiple players leading the sector to grow, and NIO and XPeng have quickly established themselves as leading startups. NIO's delivery and financial picture has strengthened, and its holistic approach to infrastructure, product offerings, and customer utility can serve as a positive catalyst for deliveries and revenues, with higher uptakes of BaaS and high discounts mitigating premium pricing. XPeng is catching up quickly on deliveries, and has huge planned capacity after its factories complete, while its goal of leading in autonomy while providing affordable, quality vehicles could see it capture more market share in the future. Risks such as the chip shortage and chip sourcing ability are important to watch, while capital could also be necessary to promote more expansion plans. Even so, NIO and XPeng both look to have positive long-term potential in terms of deliveries and revenues in China and beyond.

Disclosure: I am long XPEV. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this ...

more

Thanks for the share, a worthwhile read.

Interesting. I am wary of safety in the EV market in China. We have seen accidents with EVs in the US which were discussed and companies put on notice. I don't see this happening in China. Safety first. This is still a risky market. But one supposes there is money to be made here, just as their is money to be made trading Dogecoin.

EVs are the future!

Good read, thanks.