SolarEdge: Growth, Momentum, And Valuation

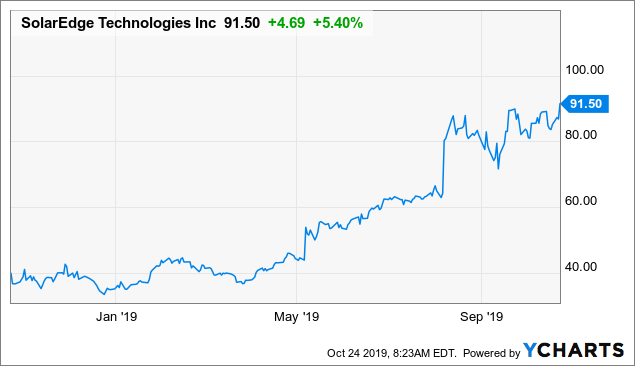

SolarEdge's (SEDG) stock is on fire, gaining over 125% in the past year and trading at all-time highs as of the time of this writing. Past performance does not guarantee future returns, and high expectations can be hard to beat. However, when considering the company's growth rates, fundamental momentum, and valuation, SolarEdge looks like a winning bet.

Data by YCharts

A High-Growth Business

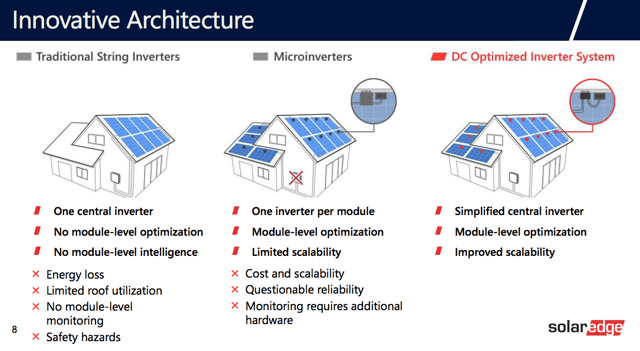

Inverters are a key component in solar panels, and SolarEdge is an innovative leader in such a market. The company uses optimizers on every panel, so the panels can operate independently, but still employ a central inverter. This architecture allows for superior performance, and it also reduces expenses, because it does not require duplication of inverters.

Source: SolarEdge

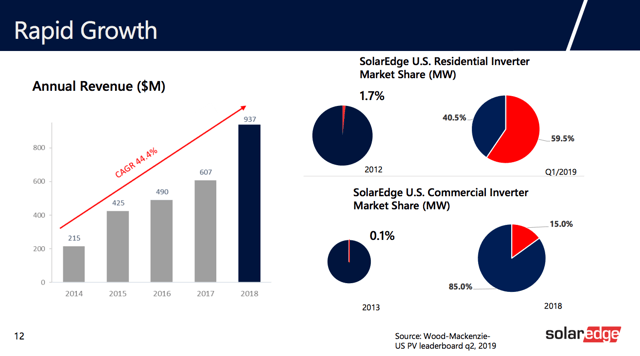

A superior technological solution has allowed SolarEdge to consolidate a leadership position in the market and a large global reach. In the process, the company has delivered an annual compounded growth rate in revenue of 44% annually since 2014.

Source: SolarEdge

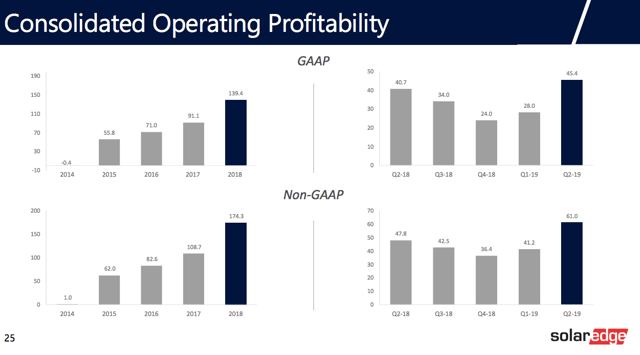

The company is growing rapidly, and it has demanding reinvestment needs. For this reason, profit margins can be volatile and hard to predict on a quarterly basis. But profitability metrics are clearly moving in the right direction over time.

Source: SolarEdge

Financial Performance for the second quarter of 2019 was more than strong. SolarEdge reported $325 million in revenue, growing by 20% versus the prior quarter and increasing by 43% versus the same quarter in the prior year. Revenue from the solar business came in at $306.7 million, up 21% from the prior quarter and growing 35% from the same quarter last year.

GAAP gross margin was 34.1%, up from 31.7% in the prior quarter and down from 36.1% year over year. Margins were negatively impacted by the increase in US tariffs on China-made products during the period.

Management is quite optimistic about the company's prospects over the middle term. From the conference call:

Our solar business continues to be very strong, and the rapid growth in sales requires increasing our production capacity at an even faster pace than what we had anticipated at the end beginning of the year. Sales in Europe have picked up significantly and we have added meaningful sales in Brazil along with steady growth in Asia Pacific.

In the United Stated, despite the tariff increase on made in China products, sales are on the rise and we have significant backlog for the third and fourth quarters that is rising our very strong outlook.

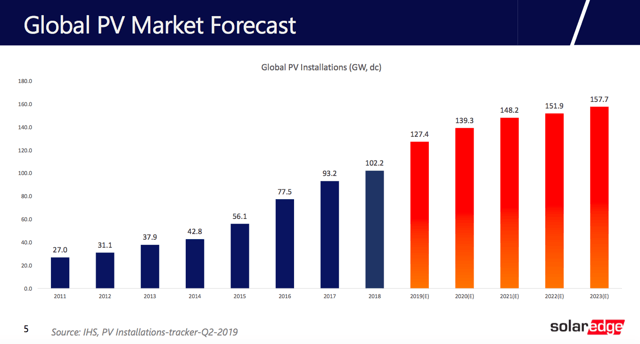

The industry can be cyclical and competitive, but long-term growth opportunities in solar energy are clearly exciting. If management plays its cards well and capitalizes on these opportunities, SolarEdge should have plenty of room for sustained expansion in the years ahead.

Source: SolarEdge

Surpassing Expectations

As opposed to value stocks, which are more predictable and tend to revert to the mean over time, growth stocks tend to move in big trends. In value stocks, you can buy when the business is temporarily weak and the stock is down since prices tend to revert up and down. In growth stocks, however, uptrends and downtrends are stronger and more durable, so it can be better to buy when the business is doing well and surpassing expectations.

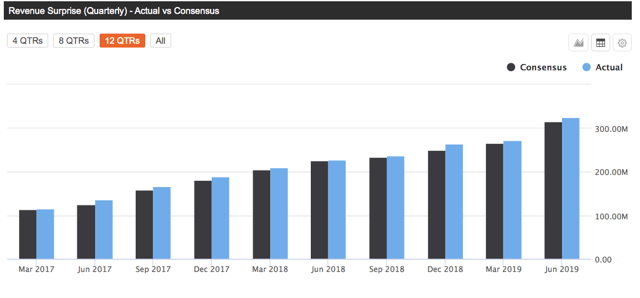

The chart below shows revenue estimates and the actual reported number for SolarEdge over the past 12 quarters, and the company has beaten expectations in each of those quarters. Quite an impressive track record of consistency for a business operating in a cyclical industry.

Source: Seeking Alpha Essential

Wall Street analysts keep running from behind and increasing their revenue estimates for SolarEdge. Stock prices are reflecting certain expectations about the fundamental metrics of the business. When those expectations increase, the stock price tends to move in the same direction.

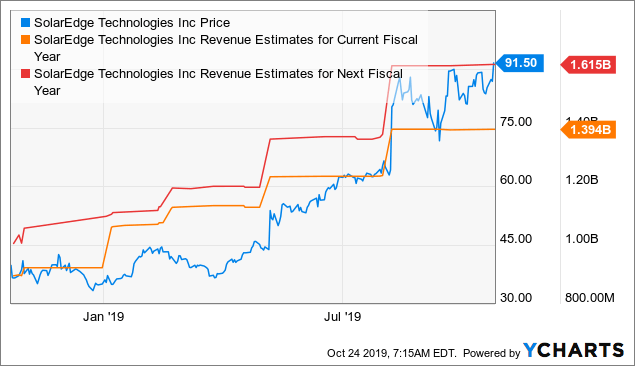

We can see in the chart below how revenue estimates for SolarEdge in both the current year and next fiscal year have consistently increased, and this is pushing the stock price higher.

Data by YCharts

As long as this trend remains in place, solid fundamental momentum and better-than-expected financial performance should provide a tailwind for SolarEdge stock.

The Valuation

The market is expecting vigorous growth rates from SolarEdge, and this is reflected in valuation to a good degree. However, the stock is not overvalued if the company keeps delivering in line or above expectations.

Wall Street analysts are on average expecting $3.72 in earnings per share during 2019 and $4.39 in 2019. Based on these assumptions, SolarEdge stock is trading at price-to-earnings ratios of 24.6 and 20.9 respectively. Revenues are estimated to be $1.39 billion in 2019 and $1.61 billion in 2020. This puts the price-to-sales ratio at 3.15 and 2.72.

Being SolarEdge, such a strong growth business that is also outperforming expectations, valuations are not too excessive at all at current prices.

Valuation needs to be analyzed in the context of other return drivers. A company producing strong growth rates and consistently delivering above expectations deserves a higher valuation than a business producing mediocre financial performance and underperforming expectations.

But sometimes it can be challenging to incorporate multiple factors into the analysis in order to see the complete picture from a quantitative perspective. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this has bullish implications for SolarEdge.

The company has a PowerFactors ranking of 99.87 as of the time of this writing, meaning that SolarEdge is comfortably in the best 1% of companies in the US stock market based on financial quality, valuation, fundamental momentum, and relative strength combined.

Risk And Reward

SolarEdge operates in a very dynamic and competitive industry, and technological change can be a double-edged sword. Just like the company is materially benefiting from superior solutions nowadays, it needs to permanently invest in R&D to stay at the forefront of industry trends.

In addition to this, demand for all kinds of energy is highly cyclical and dependent on macroeconomic conditions, and the trade war with China could have a considerable impact on margins, for better or for worse, in the middle term.

Those risks being acknowledged, SolarEdge has a smart business model, and the company is delivering vigorous growth and outperforming expectations. The stock is no bargain, but it is not overvalued either if the company continues on the right track. For these reasons, SolarEdge looks well-positioned for solid returns going forward.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more