SoftBank Unloads $14 Billion In Tech Stocks After Nasdaq Gamma Squeeze

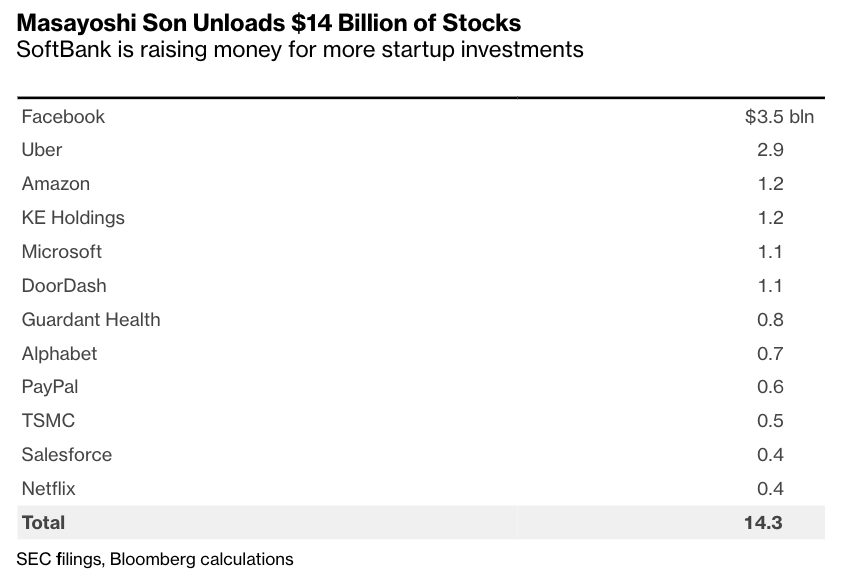

SoftBank Group Corp. was the "Nasdaq whale" that bought billions of dollars in call options of US equity derivatives and unleashed a massive gamma squeeze over the last year that pushed tech stocks to nosebleed valuations. The reason behind the move is becoming more evident as the Japanese investment bank has dumped $14 billion worth of US-listed stocks in the last quarter, nearly triple the amount in the quarter before last. Cash generated from the sales is expected to fund new investments in technology startups.

Bloomberg data estimates SoftBank sold $6 billion worth of Facebook Inc., Microsoft Corp., Alphabet Inc., Salesforce.com Inc., and Netflix Inc. in the second quarter. Another $4 billion came from sales of Uber Technologies Inc. and DoorDash Inc. In total, around $14 billion in stocks were sold to invest in startup investments for its Vision Fund.

"The last three quarters have largely been defined by the potential for Vision Fund portfolio companies to go public, but a new theme is emerging as SoftBank starts to take money off the table," Kirk Boodry, an analyst at Redex Research in Tokyo, told clients in a note after SoftBank's earnings announcement on Aug. 10. "That theme probably picks up steam as the quarter goes on."

SB Northstar, a unit set up to trade public stocks and derivatives, where SoftBank founder and CEO Masayoshi Sont holds a 33% stake, also sold 2.4 million shares of PayPal Holdings Inc., 4.4 million shares of Taiwan Semiconductor Manufacturing Co., and about 367,000 shares of Amazon.com Inc. The sales generated about $2.37 billion.

SB Northstar appears to be reducing exposure to mega-cap technology companies. Its portfolio declined to $13.6 billion as of June, from $22 billion at the end of 2020.

Sont told investors he isn't ready to sell stakes in startups that have already gone public in a recent call with investors. He said the cash generated from the sales is used to finance Vision Fund deals.

Bloomberg notes, "the company doesn't make public the exact asset sales figures. It booked a total of $4.3 billion in realized gains between SB Northstar and its two Vision Fund entities last quarter."

So the artificial gamma squeeze that helped the NASDAQ double off its March 2020 lows appears to be a ploy by Son so his funds could dump big tech names to fund Vision Fund deals.

In March, it was revealed that Son was being investigated by the SEC for triggering the melt-up in tech stocks.

With the news, Son is exiting big-tech stocks - it could be disastrous if other market participants began dumping as liquidity problems could cascade into panic selling.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more