So Much For A Quite Pre-Holiday

Image Source: Unsplash

President Trump’s double whammy of threats against Apple (AAPL) and the European Union was an unexpected blast to global markets. Opening more fronts on the trade war were exactly what traders hoping for a quiet end to a pre-holiday weekend did not need, and it clearly caught most off guard. I’m sure that plans of many in the US to try to leave work early were dashed. It’s not clear what prompted these statements, but they are emblematic of the type of volatility that we should always be prepared for.

For those who missed the news, the following blasts arrived on Truth Social between 7 and 8AM EDT. The first set was directed squarely at AAPL, threatening a 25% tariff on iPhones that are not made in the US:

“I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else,” he wrote on Truth Social.

“If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.,” the president wrote.

Then, less than an hour later, the President suggested that all goods from the EU would be subject to a 50% tariff as early as June 1st, less than two weeks away:

“Their powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 a year, a number which is totally unacceptable,” he wrote in a Truth Social post Friday morning.

“Our discussions with them are going nowhere!” Trump wrote.

“Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025.”

This is the type of news that causes market inertia to be disrupted.While market momentum is not the same as physical momentum, I’ve often asserted that Newton’s First Law of Motion broadly applies to markets as well:

An object at rest remains at rest, and object in motion remains at a constant speed and in a straight line unless acted upon by an unbalanced force

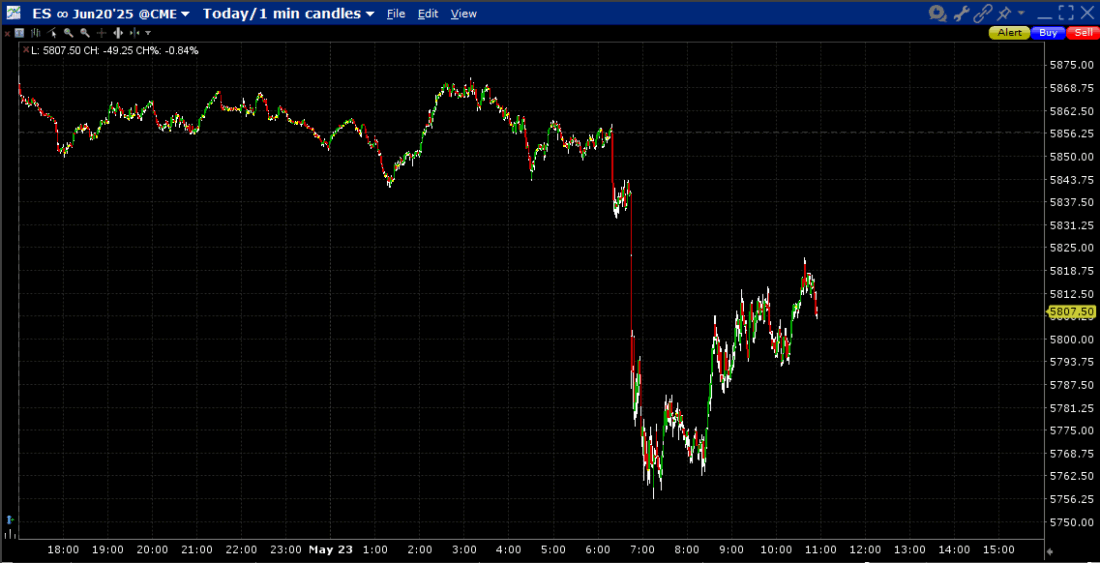

We’ve already seen that tariff pronouncements disrupt the market’s momentum on various occasions.And we’ve also seen the market shrug off most of the perceived effects of them.As I type this, we are seeing traders doing their best to rally stocks off their lows.The chart below shows how pre-market ES futures meandered overnight, then plunged twice in the pre-open (the second rather precipitously), then bounced just ahead of the open.Since then, we have generally tried to grind higher, though there is still some ground to cover:

ES June Futures, 1-Day, 1-Minute Candles

(Click on image to enlarge)

Source: Interactive Brokers

Perhaps traders are keeping yesterday’s late action in mind.We saw the S&P 500 (SPX) grind higher all afternoon before giving back all its gains shortly before the close.It appears that traders were not eager to go home with long positions – something that worked well for the sellers today:

SPX 2-Days, 2-Minute Candles

(Click on image to enlarge)

Source: Interactive Brokers

Although there was plenty of market moving news this morning, it appears that there are some traders who will try to exploit the light volume to seek trading opportunities from the long side.“Don’t short a dull tape” is a popular adage for a reason.Remember though, that while this afternoon might seem a bit dull after this morning’s fireworks, as we noted recently, there is no shortage of economic data and earnings reports coming our way in the coming short week.If you’re in the US, enjoy the peace and quiet of the Memorial Day weekend, and take some time to reflect upon the sacrifices that brought us that holiday.

More By This Author:

It’s All About Bonds For Now

“Sell in May” Or “Dull Tape”?

Talking Fed Heads Tap The Brakes

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more