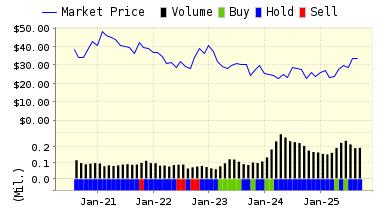

Snow Removal Equipment Company Douglas Dynamics (PLOW) Is Upgraded

Douglas Dynamics, Inc. (PLOW) designs, manufactures and sells snow and ice control equipment for light trucks, which is comprised of snowplows and sand and salt spreaders, and related parts and accessories. The Company sells its products under the WESTERN, FISHER and BLIZZARD brands through a distributor network, primarily consisting of truck equipment distributors located throughout the Midwest, East and Northeast regions of the United States as well as all provinces of Canada. It sells its products primarily to professional snowplowers who are contracted to remove snow and ice from commercial, municipal and residential areas. Douglas Dynamics, Inc. is headquartered in Milwaukee, Wisconsin.

When we sort today's database for upgrades with the best one-year forecast figures--which will always return the top forecasts for newly upgraded STRONG BUYS--Douglas Dynamics comes up. This may seem like a strange result given the fact that winter is finally over, but the company manages its production exceedingly well to avoid boom and bust cycles.

Douglas Dynamics currently has a market share in excess of 50%, so they are doing quite well--insert mandatory warning about global climate-change threats to the long-term bottom line here, of course. However, some analysts note that PLOW's major competition was recently acquired by Toro (TTC), so they will have to stay agile.

Our models like the company for its strong momentum and P/E Ratio. The company also has a good dividend yield. It recently reported a great increase in revenues year-over-year, but profits were down due to the costs related to the acquisition of Iowa-based snow and ice control equipment manufacturer Henderson Products. Keep in mind that their big earnings are seasonal--so picking it up in the down periods when there is no snow may be the best move for establishing a good, value-based position.

ValuEngine updated its recommendation from BUY to STRONG BUY for DOUGLAS DYNAMICS on 2015-05-05. Based on the information we have gathered and our resulting research, we feel that DOUGLAS DYNAMICS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Momentum.

Below is today's data on PLOW :

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

21.53 | 1.11% |

|

3-Month |

21.54 | 1.16% |

|

6-Month |

21.99 | 3.30% |

|

1-Year |

24.14 | 13.37% |

|

2-Year |

21.91 | 2.91% |

|

3-Year |

16.31 | -23.37% |

|

Valuation & Rankings |

|||

|

Valuation |

3.12% undervalued |

Valuation Rank |

|

|

1-M Forecast Return |

1.11% |

1-M Forecast Return Rank |

|

|

12-M Return |

25.83% |

Momentum Rank |

|

|

Sharpe Ratio |

0.49 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

12.35% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

25.31% |

Volatility Rank |

|

|

Expected EPS Growth |

-27.76% |

EPS Growth Rank |

|

|

Market Cap (billions) |

0.47 |

Size Rank |

|

|

Trailing P/E Ratio |

12.14 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

16.81 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

n/a |

PEG Ratio Rank |

|

|

Price/Sales |

1.56 |

Price/Sales Rank |

|

|

Market/Book |

2.74 |

Market/Book Rank |

|

|

Beta |

1.27 |

Beta Rank |

|

|

Alpha |

0.13 |

Alpha Rank |

|

VALUATION WATCH: Overvalued stocks now make up 59.47% of our stocks assigned a valuation and 21.79% of those equities are calculated to be overvalued by 20% or more. Fifteen sectors are calculated to be overvalued--with six at or near double digits.

Disclosure: None

ValuEngine subscribers can easily check out all of our top-rated STRONG BUY stocks with our "5-Engine ...

more

I am long PLOW and TTC, also Compass Minerals is big in the salt biz as is Dow Chemical..being from Buffalo (I am)must be why I have an affinity to the plows that kept that city running. Cheers! And next time tell us what the overvalued sectors are right now..