Snap IPO Filing A Disaster

After much anticipation, Snap Inc. (Pending:SNAP), the parent company of messaging app Snapchat, has publicly released its IPO filing through the SEC. Snap Inc. is expected to be the biggest technology IPO since Facebook (Nasdaq:FB) in 2012. However, reaction from investors on the deal is mixed. The company hopes to raise $4B through the sale of its shares, which would give the company a valuation of between $25B and $35B and could go public as early as March (an exact date has not yet been determined).

Although most people think of Snap Inc. as a social media app, the company describes itself in its SEC filing as a camera company which believes that "reinventing the camera represents its greatest opportunity." Snap Inc. changed its name from Snapchat last year as it sought to transition away from being just a mobile app and prepared to introduce new products, such as its camera-equipped sunglasses, Spectacles, which were released in September.

The company had filed confidentially last year for its IPO. Under the 2012 Jumpstart Our Business Act, companies with less than $1B in annual revenue can file its IPO with regulators ahead of its release to the public. This gives the company a window of time between the SEC getting the documents to when they are then available to all investors.

Business Overview

Snap Inc., is best known for its Snapchat app, which enables users to send disappearing videos, photos, and messages to one another. The app was first launched in July 2011 and in one year had over 30 million users. In October 2012, the company launched on Android phones which significantly increased its user base. Since its beginning, the company has been adding additional features to its app. In 2013, users were able to send videos messages for the first time. Additional features include: 'stories' which enables users to upload and watch a series of short video clips from friends and group chat for messaging with multiple users.

In September 2016, Snap Inc. began selling camera-equipped sunglasses, called Spectacles in pop-up vending machines and in its retail store in New York. There was much hype surrounding the sunglasses when they were first released, but interest has since waned with their New York store mostly empty. The company says Spectacles have not generated significant revenue for the company and said in its filing that they plan to increase distribution in 2017.

The company is based in Venice, California and as of December 31, 2016 had 1,859 employees. Employees who work at the company describe the culture as highly secretive with little communication between different groups.

Management and Investors

CEO Evan Spiegel and CTO Bobby Murphy co-founded the company when they were studying at Sanford University. Since then it has raised over $2.63 billion in seven rounds of funding. Investors include: Alibaba, Coatue Management, Institutional Venture Partners, Kleiner Perkins Caufield & Byers, Yahoo!, and others.

In the SEC, the two founders, Spiegel and Murphy report selling an aggregate of $16.2 million worth of shares in September 2016, about a month before they first filed its IPO documents. Spiegel's compensation package in 2016 was $2.4 million.

Revenue and User Base

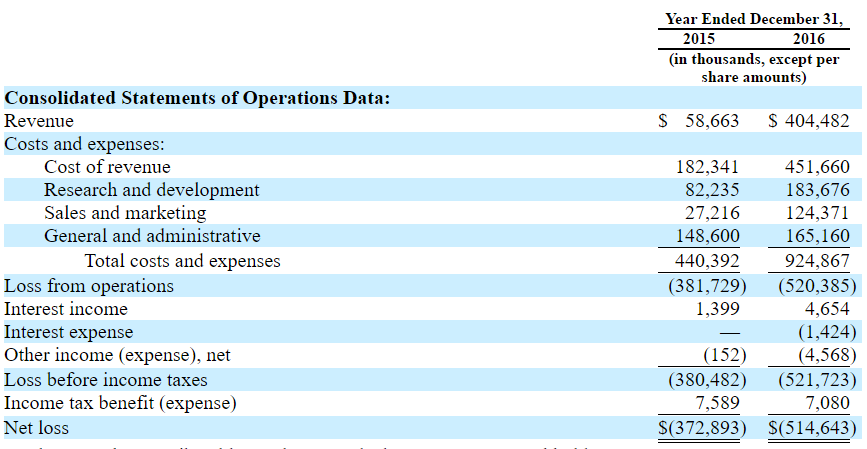

In 2014, the company launched its first ad on the app. Snap Inc., generates the majority of its revenue through ads and has been growing revenue at an impressive rate. The company generated $404.5M in revenue in 2016, more than six times the $58.7M generated in 2015, and it has an expected revenue target of $1B for 2017. The company incurred net losses of $514.6M and $372.9M in 2016 and 2015, respectively. Although net losses are normal for startups, Snap's are quite large, with the cost of revenue being higher than revenue in 2016 (see below).

(Click on image to enlarge)

(S-1/A Filing)

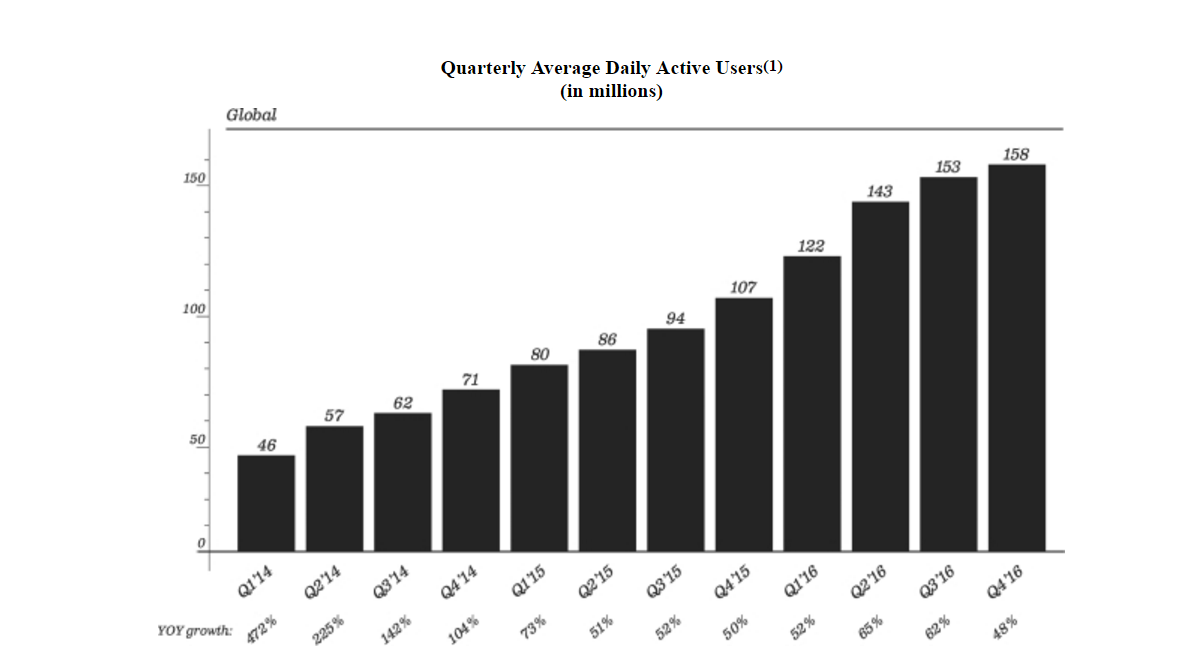

The company has also been quickly growing its daily active user base, although a slowdown in growth rate raises concern. For the last quarter ended December 31, 2016, Snap Inc. had 158M active users on its app. This was a 3.2% increase from Q32016 whereas daily active users grew by 7% from Q2106 to Q32016 (see chart below). On a positive note, users are very active of the app. The average user opens Snapchat 18 times a day and uses it for 25 to 30 minutes.

The slowdown in growth rate for Snap Inc., comes as its competitor Facebook (Nasdaq:FB) and Instagram are launching products, which mimic Snapchat. Additionally, the majority of Snap's users are between 18-34 years old, which is a demographic that tends to be less brand loyal and more likely to switch from trend to trend.

(Click on image to enlarge)

(S-1/A Filing)

An additional concern is the continued control the two founders will have post-IPO. Together they hold approximately 89 percent of voting shares, and the company is issuing non-voting shares in its IPO; a move that is unprecedented in a U.S. initial public offering and has made some investors wary.

Conclusion

There has been much hype surrounding Snap's IPO but also concern about the huge net losses and slowing growth rate of users. Investors are unsure whether Snap will become the next Facebook or Twitter (NYSE: TWTR) and whether its current valuation is justified.

Activity in the IPO market has picked up somewhat in 2017; however, with AppDynamics (Pending: APPD)'s and Mauser Group (Pending: MSR)'s pre-IPO acquisitions, deal flow is still a bit scattered.

Snap's IPO performance will serve as a strong signal to other startups, like Airbnb and Uber, on whether to go public.

At its current estimate valuation we are very cautious on this IPO, but look forward to watching the deal develop.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

more

I believe that $SNAP is over-valued, however, this is understandable considering it's impact on social media as well as #SNAP's integration into other media and marketing platforms. 158 million daily users does not happen by chance. Post-#IPO shares issued to the public will probably not do much for the SNAP's organizational structure. Since the founders retained 89% voting rights, it looks like they are sticking to a plan and vision and would like to execute without compromise.

Good insight @[@[Abdullah](user:14530) Jouejati](user:32712). Have you been following #Snap's #IPO since? $SNAP