Smartwatch Vs. Fitness Tracker: Fitbit Dives Deeper Into Smartwatches As Sales Decline

Fitness tracker or a smartwatch? Well, that’s a question that was asked a couple of years ago, but plainly put to rest over the last 2 years. Utility and price point have been the two determining factors when it comes to wearable adoption. Fitness trackers have outsold smartwatches by more than 3:1 over the last couple of years and since the wearable market took shape in the mainstream consumer market.

Fitness trackers are simpler to use than smartwatches and can stand alone with code, logic, sensors and relays within their encasements. Smartwatches are quite cumbersome, lacking for battery life, require a host operating system (OS), attempt and fail at duplicating the major utility of a smartphone and at a great expense to the consumer. With all of these shortcomings on the part of the smartwatch, it is easy to argue in favor of fitness trackers and that is even without recognizing the evolution-fitness trackers have undertaken in recent quarters.

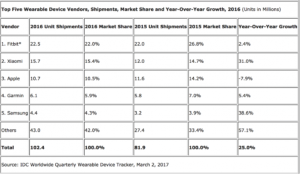

Fitbit (FIT ) is the leading global wearable company with roughly 26.8% market share. A distant second and third to Fitbit in terms of market share are the Chinese conglomerate Xiaomi at 14.7% and Apple Inc. (AAPL) at 14.2 percent. Apple’s decision to focus only on the smartwatch segment of the wearables market has impacted their ability to increase their market share. Moreover, the company relies on its user base to account for nearly all of its smartwatch sales, as the Apple Watch products are only compatible with iOS and require an operating iPhone unit. These issues have also plagued Samsung regarding its market share and sales of its smartwatch, the Gear and iterations of the Gear. Samsung has only a 3.9% global market share of the wearables market. Having said that, Samsung grew its global smartwatch shipments by over 38% in the 2017 period. The difference in market share versus shipments demonstrates that smartwatches are literally sitting on retail shelves and consumers simply aren’t buying them to any significant degree and certainly no where near the rate they are purchasing fitness trackers. It’s been rather easy for smartwatch manufactures to sell their product to retailers, but extremely difficult for the retailers to sell them to consumers. It’s also why smartwatches continue to be discounted even after the holiday shopping season. I offered such commentary as it pertained to Apple’s over-hyped smartwatch sales during the most recent Q4 2016 Holiday sales period in an article titled Fitbit Retrenches: The Bottoming Phase For A Hardware Company.

For all intended purposes, the smartwatch has been a colossal failure as sales in the category have fallen precipitously YOY. In fact, the only time smartwatches, as a category, grow sales is when a new product launches in conjunction with a previous product shipment. For example: Apple (AAPL) has touted the Q4 2016 period as having shown its greatest sales for the Apple Watch. Mind you, the company has made absolutely no mention of the profitability of the Apple Watch, the average selling price (ASP) or sell-through statistics…and why would they? Here is what really happened with the Apple Watch Series 1 and 2 during the holiday period. In 2015, Apple only had one Apple Watch for which sales were so poor the company reduced the price nearly a year before the company released a new iteration. This hasn’t happened with an Apple product since the company launched the iPod product line. In Q4 2016, the company had two versions of the Apple Watch it sold-in to retailers, a sky increase of 100 percent. Apple only reports sell-in metrics per SEC regulations, like Fitbit. So as one can see, the sku count for the Apple Watch increased 100% YOY, thus boosting sales for the Apple Watch. But the sell-through, meaning from the retailer to the consumer, has been paltry. It’s why the consumer could find door buster deals on the Apple Watch Series 1 for $199 on Black Friday. Truth be told, that door buster became the ASP for the Apple Watch throughout the December period. Truth be told, that sale price is still being offered at various retailers every month since. Truth be told again, that’s why Apple’s CEO, Tim Cook, won’t discuss the ASP or the sell-through of the Apple Watch. Hard not to grow sales for the Watch when you are offering two Apple Watches in 2016; a 100% increase in sku count YOY.

Even with the sku increase and hopeful retailers abound to inventory Apple Watch Series 1 and Apple Watch Series 2 during the Holiday sales season, Apple found it's watching shipments fall. In 2016, as reported by IDC, Apple Watch shipments fell by 7.9% year-over-year. In fact, Apple was the only major vendor tracked by IDC that witnessed shipments decline in 2016.

But of course, this is the reality that Apple doesn’t desire investors to focus on! In short, the smartwatch has been an exercise in futility whereby no matter what manufacturers do to improve upon the device, the consumer simply doesn’t appreciate the lack of utility and high price point.

For all the smartwatch hoped to be it has found itself to be anything but a transition away from the smartphone. Some of the hoped upon utility was that a smartwatch could duplicate the photography application of the smartphone. That failed rather quickly with Samsung’s Gear smartwatch and hasn’t been heard of since. Gamification has also failed on the smartwatch due to the size of the screen and physiological conflict with the human body, also a problem for photography. And then of course there is the art of conversation that begs for privacy when attempting to have a conversation through a tethered smartwatch. You pretty much have to give up privacy with the smartwatch akin to the issues that plagued earpieces that utilized blue tooth. The smartwatch has proven to be anything but smart according to consumer adoption rates and when compared to their counterpart, fitness trackers.

The smartwatch reminds me very much of the Keurig Kold by Keurig Green Mountain. Keurig believed there was a market for single-serve cold beverages from a brewing machine. I’ve written extensively about Keurig Kold prior to its launch, leading up to its launch and post its discontinuation from the marketplace. My initial critique regarding the developing Keurig Kold was very simple, WHY? Why does the consumer need a cold beverage small brewing appliance? We already have ready-to-drink cold beverages and a storage for these cold beverages called a refrigerator. In other words, why do we all of a sudden need two refrigerators in our kitchen, one to store and one to pour? It just didn’t make any sense whatsoever from the very beginning of the Keurig Kold. The Keurig Kold simply didn’t address any meaningful consumer pain point. With coffee, Keurig managed to address the consumer pain points of choice and convenience. No longer did a consumer need to visit a drive-through for their morning coffee run or wait for an entire pot of coffee to brew. In 60-seconds or less a Keurig brewer could deliver one of over 250 coffee flavor choices into your cup, mug or travel mug. But with cold beverages, these pain points that occur with hot beverages don’t exist. It’s just too easy to open the refrigerator and pour a cold beverage or pop a can open. With coffee, I have to have a brewing system as I can’t reach into my refrigerator and retrieve a hot cup of coffee. It was a major problem that Keurig simply ignored throughout their 4-year development cycle of the Keurig Kold.

When the Keurig Kold finally did come to the market, it did so with a variety of flavor choices that included Coca-Cola, Diet Coke, Dr. Pepper, and several private label, better-for-you cold beverage choices. Unfortunately, the products fell on deaf ears as the brewing system cost $299-$369 and the flavor pods carried an average retail price of $1.14 for the dispensing of an 8oz cold beverage. The math simply didn’t add up to the benefit of the consumer and cost carries the greatest weight for mass adoption. The Keurig Kold was on the market for roughly 10 months before Keurig Green Mountain discontinued the product and offered refunds to consumers of the device. Keurig Kold will go down as one of the most disastrous consumer products in history, especially as Keurig Green Mountain spent over $1.5bn to develop and launch the product. The smartwatch is trending toward this sentiment with each passing year and as mass adoption has yet to be found.

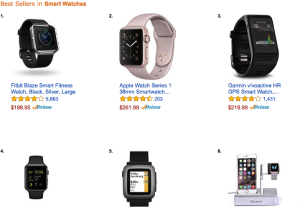

What has and will continue to be disconcerting about Fitbit, the leading fitness tracker and wearable brand, is that the company is gearing up for a late 2017 smartwatch launch. It’s former Blaze smart fitness watch comes in at the lower price range of the overall smartwatch category at $199 as it lacks 3rd party applications as well as other features. Again validating that price matters, even without the advanced functionality of the Apple Watch or Samsung Gear, the Fitbit Blaze dominates the wearables sales sub-category as demonstrated by its ranking on amazon.com (AMZN).

In fact, since the first week it launched, the Blaze has outsold and overtaken the Apple Watch as the #1 smartwatch sold on amazon.com. What is even more transparent from the amazon.com ratings is that the Apple Watch 2 has been every bit the disaster Apple Watch 1 was, before the vendor lowered its price to move units. Again, price very, very much matters.

So given the evidence presented within this narrative, why is Fitbit heading down the smartwatch path? I believe the company is making an attempt to solidify a position in the smartwatch category simply based on sales relevancy. The company understands higher price points enable it to move fewer units, but at higher dollars per unit. So with regards to revenues, the smartwatch facilitates the company’s revenues in the future, even as its total product line will exhibit unit shipment declines in 2017. In short, Fitbit can sell one smartwatch at $299 and offset 2 fewer units sold of its Alta fitness tracker. At the same time, Fitbit plants its flag in the smartwatch category while extracting would be competitor sales and market share given that retailers will likely give the companies first official smartwatch a chance. Encroaching on its competitors’ smartwatch territory can also force the competition to take further action in the future. What that further action might be remains to be seen.

Either way, Fitbit’s foray deeper into smartwatches won’t be altogether beneficial for the company, as smartwatches have decisively lower gross profit margins than do fitness trackers. The component cost and production costs on smaller batch production cycles is a headwind or obstacle for the entire category. The slotting fees are also higher, which is never discussed by manufacturers, as they don’t include this in product gross profit margins, but rather cost of sales. It’s a little trick these vendors/manufacturers use when talking to analysts and investors that could aim to persuade these groups to believe they have decent profit margins on the product when the reality is to the contrary.

Fitbit’s smartwatch will be of little relevance to the company’s future or its return to growth in the future. The consumer simply isn’t fooled by the product’s high cost and low utility or whatever brand name coincides with the smartwatch. What will be interesting to see, however, is what happens come the fall when Apple, Samsung, Garmin (GRMN) and Fitbit all attempt to launch a new smartwatch iteration. Given that consumers haven’t take to the devices in each of the previous iterations, retailers will likely scrutinize each product more carefully and inventory fewer brands and fewer quantities.

The Final Word

Fitbit’s smartwatch acquisitions of failed and on the verge of bankruptcy companies like Pebble and Vector are emblematic of the going concerns for the company. Fitbit aims to create an app store and smartwatch from these assets where the entities themselves have never found success. The bold attempt by Fitbit to create a competitive app store will likely prove meaningless, as it has virtually no sound probability of competing with the likes of iOS and Android. Many have come before Fitbit with the exact same game plan, a bigger brand and failed mightily i.e. Blackberry (BBRY), Pebble and more. What many will come to find is that Fitbit’s smartwatch venture will reap fewer rewards than the bottoming of sales and profits and prior to their cyclical return to growth. The majority of Fitbit’s sales will always come from its lower-end price point products, those from $149.99-$79.99. And again, for validation of this point, Amazon’s Best Seller rankings, for the whole of its fitness tracker category is the Charge 2. Additionally, the Charge 2 is the only fitness product ranking in the top 100 for Health & Personal Care items sold on Amazon.com. Sorry smartwatches, sorry Apple Watch, Samsung Gear and all the rest, the consumer has spoken. But whoever figures out the music component, well…then you may have something!

Disclosure: I am long TGT, COST, FB, INTC, MSFT. I am short UVXY and VXX