Small Losses Keep Rein On Markets

Markets still haven't pushed on since recovering from the losses in early July. Where we had the Russell 2000 struggling, now we have the Nasdaq looking weak. The S&P also took a little knock after a positive Thursday.

In reality, we are probably looking at trading ranges and not any imminent collapse, and with (Covid curtailed) holidays in full swing it's hard to see where the demand buying is going to come from.

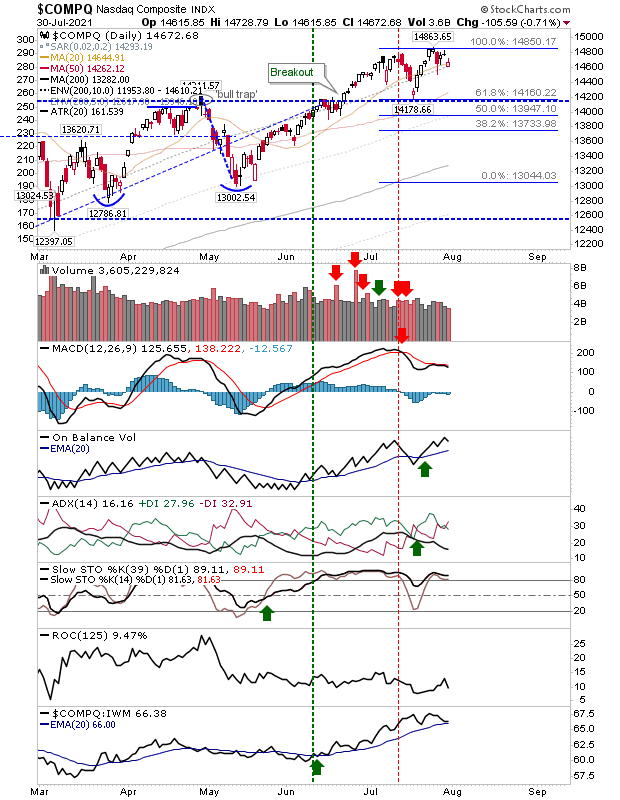

At least with the Nasdaq there was support of the 20-day MA to lean on, although it didn't offer much support earlier in the month. The MACD is still on a 'sell' trigger as other technicals stayed positive.

The S&P has been holding above 20-day and 50-day MAs with supporting technicals net bullish, although Friday's selling did rank as distribution.

The Russell 2000 has been singing the same tune for a while, and Friday's action did little to dispel that. There was a MACD trigger 'buy', but it's the only positive supporting technical indicator. Friday's action registered as distribution with the 50-day MA currently playing as resistance, but given the trading range I would be less concerned about the moving averages here. What's needed is a push to trading range resistance around $233 in $IWM.

We don't have a lot of change. Neither do we have any clear guidance as to what may happen next. The Russell 2000 has been lagging for most of 2021 and this is a problem for secular bull watchers. The S&P and Nasdaq can only carry the can for so long, but my expectation is that they will drift into sideways trading ranges.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more