Slow Down On Buy Button

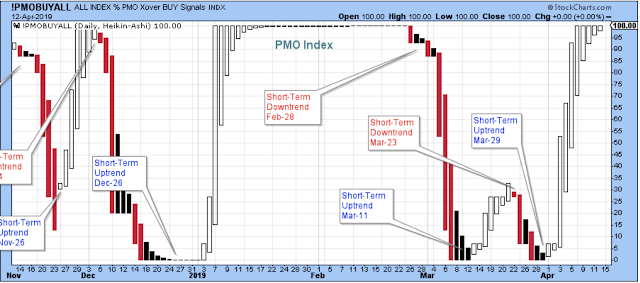

This short-term trend is at the top of the range so it is time to slow down on the buy button.

The SPX equal-weight is up against resistance.

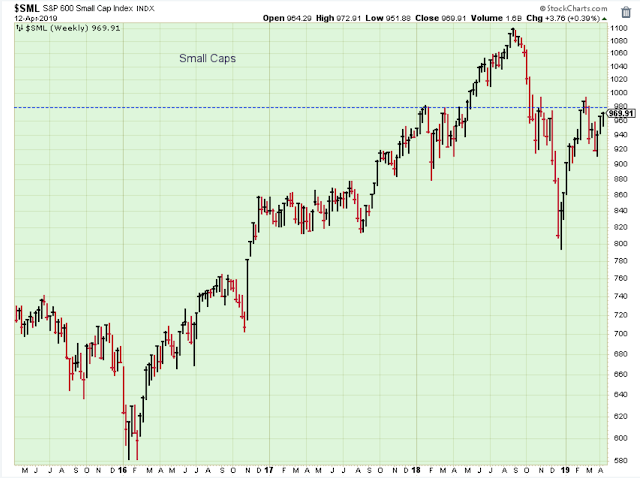

I think the small caps might be the next group to participate.

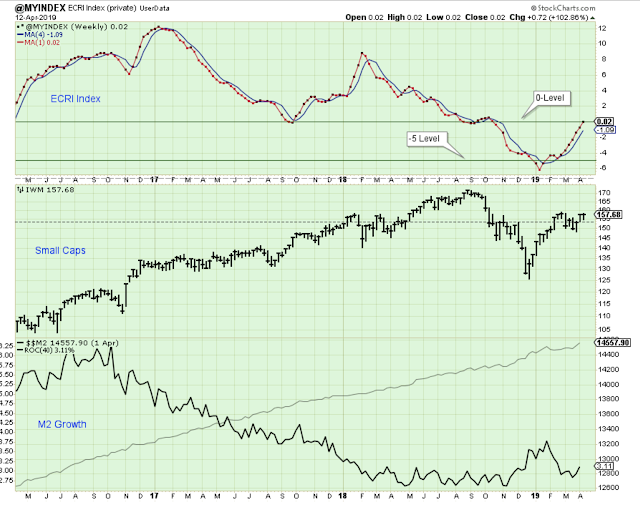

The ECRI Index just poked up above the zero-level, so I think the longer-term outlook has flipped to positive... although with the usual backdrop of a choppy, muddling economy.

Outlook Summary

The long-term outlook is positive as of April 12.

The medium-term trend is up as of January 4.

The short-term trend is up as of March 29.

The medium-term trend for bond prices is up as of November 16 (prices higher yields lower).Likely to be downgraded to negative soon.

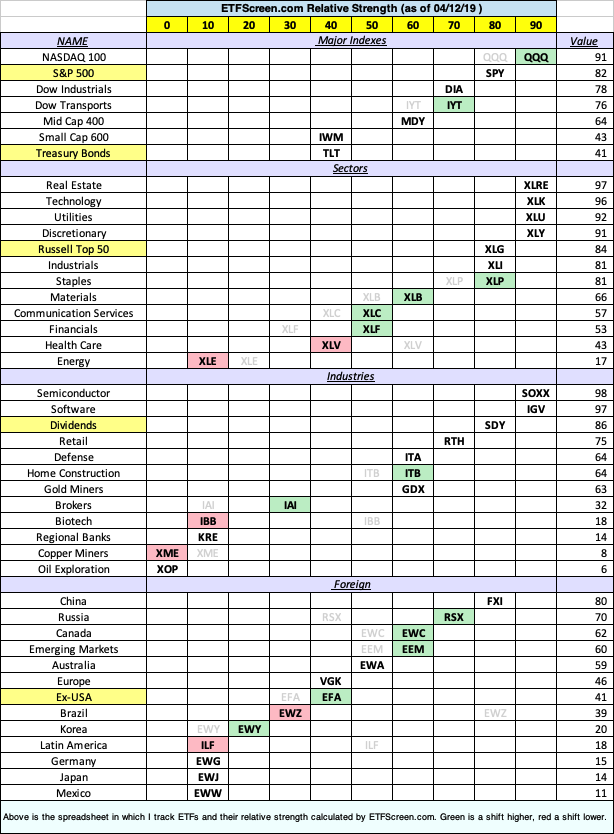

Investing Themes:

Large-Caps, Mid-Caps, Transports, Dividend-Payers

Technology, Consumer, Industrials

Semiconductors, Software, Retail

China, Russia

Strategy During a Bull Market:

- Buy large cap stocks and ETFs at the lows of the medium or short-term market trends.

- Buy small cap growth stocks on breaks to new highs in the early stages of market trends.

- Reduce buying when the market trend is at the top of the range.

- Take partial profits when the market uptrend starts to struggle at the highs.

- The cardinal rule is never invest based on personal politics. The stock market can do well regardless of which political party is in control.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more